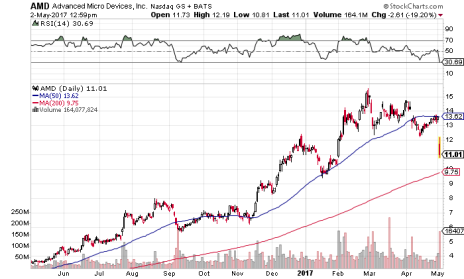

Advanced Micro Devices (AMD) has been one of the best stocks in the market over the last year. From last May to this February, AMD stock roughly quintupled, from 3 to 15. It has since gone through a predictable correction phase, but no serious damage was done.

Until yesterday.

20% Drop for AMD Stock

On Tuesday, AMD stock plummeted right from the opening bell, falling more than 20% at one point. Ostensibly, earnings were the culprit. While the chipmaker’s sales improved 18.3% and earnings per share ticked down at a slower rate (-$0.04) than they did a year ago, a lackluster gross margin forecast convinced investors to start selling AMD in droves.

The company expects second-quarter gross margins to decline to 33%. If that doesn’t sound like a huge deal, you’re right, especially when you consider that first-quarter margins were a mere percentage point higher at 34%. But when it comes to earnings season, it’s all about expectations, and analysts were anticipating higher gross margins in the current quarter. Sales and earnings were also in line with analyst estimates, which for a stock like AMD is almost akin to a miss.

[text_ad]

Really, AMD stock is a victim of its own success. When a stock rises really far really fast—particularly a mid-cap stock like AMD—investors start looking for reasons to knock it down a peg or two. Evidently, lower-than-expected gross margin guidance and in-line sales and earnings were enough of a reason for AMD stock to be punished severely.

Granted, AMD does seem overvalued considering it hasn’t turned a profit since 2011, sales weren’t even growing until the last 12 months and the company has more debt than cash. It’s the all-at-once nature of the AMD stock selloff that seems a bit jarring.

Here’s the thing, though: The earnings sell-off may end up being good for AMD. When Wall Street punishes a stock in one fell swoop like this, it tends to over-punish. In the coming days, cooler heads will prevail, and many investors will realize that they may have overreacted. Plus, value buyers may swoop in at the sight of one of the market’s great growth stocks suddenly morphing into a bargain stock.

Of course, now that AMD stock has broken well below three-month support at 12, it could also continue to trickle lower in the coming weeks. If you were fortunate enough to buy Advanced Micro Devices stock at any point in the last couple of years (it’s actually up 376% in the last two years), then this technical breakdown would be plenty reason to sell and preserve most of your profits. If you don’t own AMD, it’s probably best to wait and see which direction the stock heads before blindly buying off such a massive dip.

Limit Your Losses

My point isn’t to say whether AMD is a good stock or a bad stock after yesterday’s fall. Rather, it’s to highlight the fickle nature of investing, and why it always makes sense to take partial profits when a stock is on the way up, and to set loss limits in case of a sudden drop. When Wall Street collectively turns on a stock, it can be damaging if you don’t limit your losses.

And at one point or another, Wall Street always turns on a stock. Sometimes in one trading session.

[author_ad]