The global base metals market is in full-on recovery mode after a rough few years, led by a rebound in the automotive and construction industries. Rising demand, a reopening China, and tightening supplies for the materials used in these (and other) industries have boosted the year-ahead outlook, with metals like copper, aluminum, nickel, and lithium poised to benefit. Here we’ll examine some top base metal ETFs.

One of the hottest trends is the resurgence of the global market for industries that are heavy consumers of metals, particularly the electric vehicle (EV) market.

According to Wedbush Securities analyst Dan Ives, there’s currently a “major inflection” in the worldwide demand for EVs, with vehicle makers like BYD (BYDDY), Li Auto (LI) and Tesla (TSLA) vying for the top spot. Ives believes China will likely see tremendous EV demand in 2023 and beyond, with BYD, Li and XPeng (XPEV) all poised to benefit, while Tesla’s Shanghai-based Gigafactory 3 (which does final assembly for the Model 3) enjoys a competitive edge.

[text_ad]

Among the metals most commonly used in EV production are copper, lithium, nickel, and steel. The latter is the starting point for EV manufacturing and is increasingly used instead of aluminum for the production of the vehicle’s body and chassis (though aluminum remains a key material for battery production due to its lower weight).

Indeed, steel production is on the upswing again after mill closures caused by COVID-related shutdowns. According to the Wall Street Journal, “Steelmakers [were] straining to keep up with resurgent orders from U.S. manufacturers, just months after preparing for a long, pandemic-driven slump in steel demand.” And automakers are a big reason for the increased demand, which has pushed steel prices significantly higher.

Base Metal ETF #1: VanEck Vectors Steel ETF (SLX)

To give you some idea of just how much higher prices are, the price for benchmark hot-rolled steel reached as much as $1,500/ton over the summer last year. Prices have cooled off since then but remain above $800/ton, more than 50% higher than the pre-pandemic level of $570 in March 2020 before the nationwide shutdowns began. One way to participate in the steel bull market is through the VanEck Vectors Steel ETF (SLX), which seeks to replicate the price and yield performance of the NYSE Arca Steel Index (STEEL)—and which in turn is intended to track the performance of companies involved in the steel sector.

A vast majority (86%) of steel buyers were polled last November by an industry source expecting another round of price increases from steel mills, and the likelihood is that prices will continue to rise, which should bode well for SLX.

Base Metal ETF #2: United States Copper Index Fund (CPER)

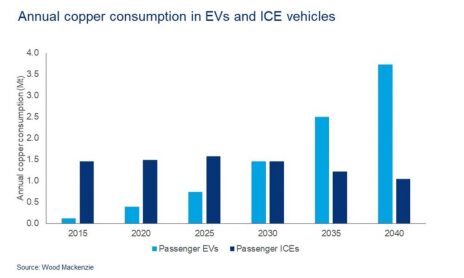

Along with steel, EVs also need lots of copper and can utilize up to three-and-a-half times as much of the red metal compared to a traditional gas-powered passenger car. And while conventional cars use around 18-to-49 pounds of copper, EVs typically contain around 85 pounds.

It’s also worth mentioning that copper was one of the best-performing commodities over the last few years and stands to benefit from continued strong demand in the coming months and years—both from China’s resurgent industrial economy as well as from recovering automobile sales.

Along these lines, the research consultancy Wood Mackenzie has noted that copper “is a cornerstone of the EV revolution” and is heavily used in charging stations and other EV applications due to its high electrical conductivity, durability and malleability. Consequently, consumption of the red metal for passenger EVs is projected to increase by nearly 700% over the next two decades.

One of the best investment vehicles for participating in the copper boom, aside from investing in individual copper mining stocks, is the United States Copper Index Fund (CPER). This ETF is designed to track the performance of the SummerHaven Copper Index Total Return, and is a convenient, less expensive method for participants to access the returns of a portfolio of copper futures contracts.

Base Metal ETF #3: Global X Lithium & Battery Tech ETF (LIT)

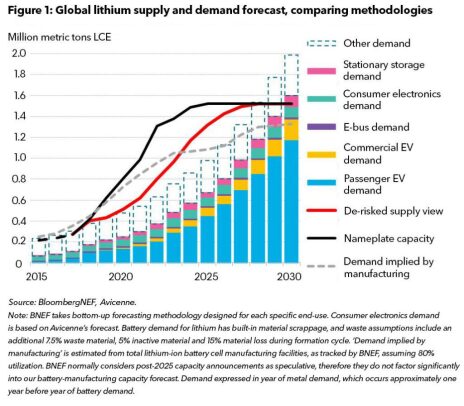

Along with copper, lithium is a key commodity used in EV batteries. Lithium demand is expected to double by 2024, thanks to EV market growth. Moreover, BloombergNEF estimates that by 2030, lithium demand for passenger EV production will rise by nearly 500%.

A key to this bullish demand forecast is China, which was ranked #1 in the world among countries most heavily involved in the lithium-ion battery supply chain. And with lithium consumption accelerating this year, the companies that produce lithium and lithium-ion batteries are outperforming.

An excellent way to capture this anticipated growth is via the Global X Lithium & Battery Tech ETF (LIT). LIT invests in the full lithium cycle, from mining and refining the metal to battery production. According to the fund’s prospectus, it “seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index.”

LIT is up about 9% year to date after spending most of 2022 rangebound near all-time highs.

Base Metal ETF #4: iPath Series B Bloomberg Nickel Subindex Total Return (JJN)

A final base metal worth discussing is nickel. Analysts expect nickel prices to to increase on the back of rapidly growing demand from EV battery manufacturing. Nickel, which is also used in steel manufacturing, rose 45% in 2022 before retreating to year-end 2021 levels this year. However, the need for battery-grade nickel continues to grow, with experts forecasting a 10% demand bump this year (which is likely to prove too conservative).

While nickel-related ETFs are in short supply, one of the best ways to grab a piece of a potential nickel bull run is via the iPath Series B Bloomberg Nickel Subindex Total Return (JJN). This is actually an exchange-traded note (ETN), not an ETF. Liquidity is an issue due to the extremely low daily trading volume average, so there’s more leverage risk involved. But with nickel prices in the early stages of what looks to be a fundamentally induced rising trend, having a small position in JJN is probably a good idea if you want full exposure to the anticipated base metals boom.

Do you invest in base metal ETFs? Why or why not?

[author_ad]

*This post has been updated from an original version, published in 2020.