The stock market’s recovery rally that began in July was fueled by massive short covering as investors realized their excessive pessimism was overdone. Now a new extreme—excessive optimism—is showing up in several measures of investor sentiment, and it begs the question of whether we’ve entered a new bull market or are just in the midst of a bear market rally.

This major sentiment reversal has occurred at a pivotal point for the market’s recovery, and as I’ll argue here, what happens in the next couple of weeks will likely determine if what we’ve witnessed since July was a temporary bear market rally or the start of a new bull market.

[text_ad]

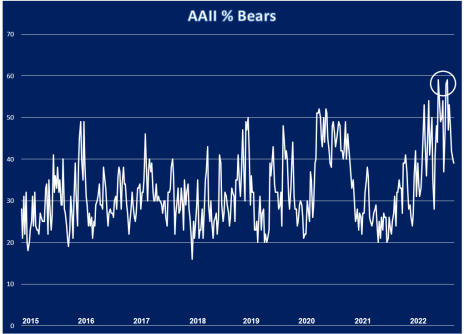

When the benchmark S&P 500 index (SPX) hit bottom in June, investor sentiment—by several measures—was as pessimistic as it has been since the credit crash some 14 years ago. According to the weekly survey published by the American Association of Individual Investors (AAII), bearish sentiment was nearly 60% the week of June 21, a level of pessimism rarely seen in that particular poll. (For perspective, the last time the AAII bearish percentage was higher than that was at the credit crash low in March 2009.)

Other markets have also rebounded from massively “oversold” conditions and have enjoyed short-covering rallies in recent weeks. For instance, according to the latest Commitments of Traders (COT) published each week by the Commodity Futures Trading Commission (CFTC), commercial hedgers—the so-called “smart money”—have been significantly reducing their short positions in several major metals, particularly gold and silver. They’ve also recently reached their lowest short interest levels since 2018 (when the last major gold bull market began).

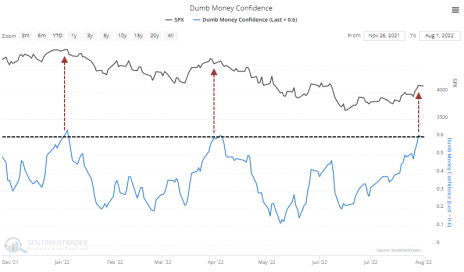

“Dumb Money” Confidence

In just the last few days, however, sentiment among retail traders in both stocks and commodities has made a startling comeback from the depths of despair to an excess of exuberance. Data provided by Jason Goepfert of SentimenTrader reveals that “dumb money” confidence (i.e. small traders) has just ended one of the longest streaks of sub-60% confidence since 1998! By contrast, small trader confidence in the stock market’s rally has just hit a level of extreme optimism at 60%, which is typically seen around market tops.

Other measures of sentiment among retail traders and investors have also hit similar levels of optimism suggesting that market psychology may have gone “too far, too fast.” In other words, a pivotal point in the relief rally since the June low is likely upon us—one that will likely determine whether the July-to-August rally is the start of a new bull market … or just a bear market rally.

Indeed, technical evidence is mounting that the market is on the verge of such a pivotal juncture. Consider, for instance, that several major indexes—including the Nasdaq Composite and the SPX—are approaching a widely-watched and psychologically significant trend line, namely the 200-day moving average. It’s not uncommon for rallies to be turned back (at least temporarily) at this key trend line.

In favor of the bulls, however, is the fact that the S&P 500 has already recovered more than 40% of its decline from the January peak. Such an impressive retracement suggests the rally is less likely to fail based on the amount of buying power required to push stocks to such heights in such a short period.

Also worth considering is the 60/40 Percent Rule made famous by the legendary commodities trader Amos Hostetter in the book, A Successful Speculator’s Approach to Commodities Trading. This rule proposes that a greater than 40% recovery from a major market low in stocks or commodities signifies the likely continuation of the recovery to higher levels (although the rally could take several months to completely unfold). To date, the SPX has recovered close to 50% of the January-to-June decline, which further argues for a bullish interpretation.

Returning to sentiment, whenever the market has reached an extreme level of retail investor pessimism after a big decline, it’s not uncommon for sentiment to quickly snap back to extreme optimism. Such an extreme reversal, in fact, often accompanies major buy signals—especially if it involves heavy upside/downside trading volume on the NYSE (i.e. greater than 10-to-1). As it turns out, we saw precisely this signal on August 10.

Does the above evidence mean that a new bull market has been born and the bear has already returned to hibernation? Possibly, though some additional confirmation is required before we can definitively say this is anything more than a bear market rally. Arguably the strongest proof that the bull is back would be for the daily new 52-week lows on both the NYSE and the Nasdaq to shrink below 40 for a couple of weeks, while new highs consistently outpace new lows by at least a 3-to-1 margin. We’re still waiting for that to happen.

I’m focusing on areas of relative strength in the metals market that I believe will outperform in the coming weeks. Among these areas are stocks and ETFs in the lithium and copper industries (i.e. battery metals). As for the broad market outlook, we’ll likely know soon enough whether the bull is back to stay. The preliminary evidence, however, is decidedly sanguine.

So, bear market rally or new bull? What’s your opinion?

[author_ad]