The market’s best six months initially kicked off with a bang, with the S&P 500 jumping 8.4% from the beginning of November through the beginning of February. For those who believe in the “best six months strategy,” the timing could not have been more perfect. Unfortunately, the market’s subsequent action pared those gains as the S&P started the month of May up only 8.1% from the beginning of November.

If you haven’t heard of the best six months strategy, it’s quite simple: You buy stocks from November-April—statistically their best six months—and then take your foot off the gas from May-October, the market’s so-called “Sell in May and Go Away” period.

[text_ad]

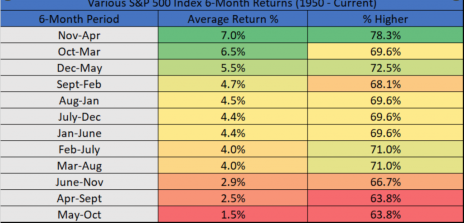

The numbers support the strategy. Since 1950, the S&P 500 has posted an average gain of 7% from November through April, the best performance of any six-month stretch, outpacing October-March (+6.5%) by a half-percent. In the past 10 years, the November-April period has seen stocks advance nine times, by an average of 8.8%.

Meanwhile, the worst six months are May through October, when the S&P advances a mere 1.5%, on average.

Check out this table, courtesy of Ryan Detrick of LPL Financial:

Seven decades of data is pretty convincing! And certainly, seasonal investing in general has its merits, as our Nancy Zambell has written. However, there are market timing indicators that are more precise than just blindly following the calendar.

After all, if you had followed the best six months strategy in late 2018/early 2019 and started buying stocks in November, you’d have jumped in as the market was in free fall during a brutal 20% market correction in the fourth quarter of 2018. And the best six months didn’t go great the next year either - that’s when Covid-19 arrived and sent U.S. markets spiraling down more than 30% in February and March of 2020. Although to be fair to the strategy, buying in November of 2020 and holding until April of 2021 would have netted you 28% gains. The next year, however, would have had you buying at the top of the bull market and into the beginning of the bear, a period in which the S&P lost 10%. A strategy that’s been right two of the last five years doesn’t make the most compelling case.

So you’re better off following the advice of our market expert, Mike Cintolo.

Mike created two stock market timing indicators that have proven quite useful: Cabot Trend Lines and Cabot Tides.

Here’s how each of those indicators works, in Mike’s words.

2 Alternatives to the Best Six Months Strategy

Cabot Trend Lines

The Cabot Trend Lines are our unique way of determining the long-term trend of the stock market. As long as both the S&P 500 and the Nasdaq Composite fluctuate above their respective trend lines, we consider the market to be bullish. If both indexes are below their trend lines, we are in a bear market.

Basically, if both indexes close two straight weeks above their respective 35-week lines, it’s a buy signal; if both close two straight weeks below them, it’s a sell signal. Using such a long-term moving average won’t result in pinpoint signals, but that’s the point—it keeps you on the right side of the major trend.

Looking at the 2000 to 2012 period, if you simply bought the Nasdaq Composite during buy signals and sold the Nasdaq short when the Trend Lines turned negative, you would have made 130%, compared to a loss of 15% for the Nasdaq as a whole. Going back further, to 1991, if you owned the Nasdaq during bullish periods and simply held cash during bearish periods, you’d be up 10-fold, versus less than seven-fold for the market as a whole.

Cabot Tides

The Cabot Tides is made up of five different market indexes to help us determine the overall intermediate-term direction of the stock market. They are: S&P 500, NYSE Composite, Nasdaq Composite, S&P 600 Small Cap and the S&P MidCap 400.

The market is considered to be advancing on an intermediate-term basis if at least three of these five indexes are advancing. Contrarily, the market is deemed to be declining if at least three of these five are declining.

To derive intermediate-term signals, we compare each index to its own 25-day and 50-day moving averages. If the index is standing above the lower of these two moving averages, and that lower moving average is itself advancing, then this index is bullish. Otherwise, it’s safe to assume the intermediate-term trend for this index is down.

Probably the most important advantage of using this moving average approach in timing the market is that you are guaranteed to catch every major market advance while avoiding every major market decline. This is the nature of a moving average. But there is a cost. It’s the opportunity lost in the first few weeks of a new advance. And it’s the small penalty you must pay for getting out of the market quickly when the market changes its mind soon after a new buy signal is given. For example, a new buy signal could quickly turn into a sell signal if the market turned weak enough to drop the index below its lower moving average. If that happens you should quickly turn defensive again and start thinking about the preservation of your capital instead of trying to make big gains in a falling market.

Where Does the Market Stand Now?

So, where does the market currently stand in relation to these two Mike-created indicators? From a top-down perspective, the evidence has definitely taken a turn for the positive with both the Cabot Trend Lines and Cabot Tides heading in the right direction.

If you’re looking for something to watch, it would be the broader indexes, which are positive but not powerful, and financial stocks, which are still lackluster and have a history of pushing and pulling the market.

We don’t know how the rest of this year will play out for investors, despite the best six months strategy returning near the 8.8% average of the last decade. But sometimes that strategy is wrong, as it was in three of the last five years. Mike’s market timing indicators rarely fail. It’s how he’s helped subscribers to his Cabot Growth Investor advisory avoid bear markets while being heavily invested in bull markets, thus helping longtime readers double their money many times over.

To learn more about Cabot Growth Investor, click here.

[author_ad]

*This post has been updated from an original version, published in 2019.