My wife and I are watching this television show called “Twin Peaks: The Return,” a revival of the oddball classic created by director David Lynch more than 25 years ago. Like most Lynch creations, the show is good in a weird, offbeat kind of way, but it takes its sweet time getting to a point—entire episodes go by without anything of real significance to the central plot happening. It reminds me of the boring stock market that’s currently in our midst.

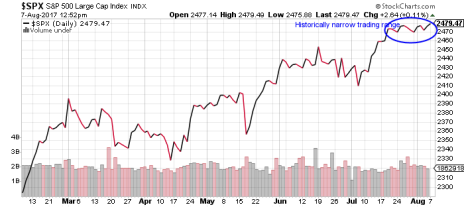

How boring and uneventful has this stock market been? Historically so.

[text_ad]

Last Friday, the S&P 500 closed its 12th straight session with a move of 0.3% or less—its longest streak of inaction on record. Jacob Mintz, our options trading expert, noted in email to his subscribers on Monday that the benchmark U.S. index has been stuck in a seven-point range (high of 2,477, low of 2,470) for 13 trading days, dating back to July 19. Even by mid-summer standards, that’s a boring stock market.

When will the stasis end? Perhaps not until Wall Street returns from its usual August vacation, sometime around Labor Day. Given the alternative—August is traditionally one of the worst months for stocks, and a double-digit market crash in August 2015 is likely still fresh in investors’ minds—boring is okay this time of year. But an eventual breakout is inevitable. And with valuations at decade-highs and certain companies getting slammed on earnings misses in the past month, there’s a very real chance the breakout could be to the downside.

That said, as I mentioned in an article I wrote yesterday about buying stocks at all-time highs, most of our analysts remain bullish, albeit cautiously. Bull markets don’t simply die of old age, and the earnings growth has been great. More than 80% of companies in the S&P have reported second-quarter results, and the average year-over-year EPS growth rate is 10.1%, which if it holds, would mark the first back-to-back quarters of double-digit earnings growth since 2011.

So while valuations are high, with stocks stuck in neutral for three solid weeks, the reality is that earnings growth is outpacing share price growth. Perhaps the boring stock market and the incredibly low volatility is the calm before the storm. But we’ve heard similar ominous warnings during this bull market and they’ve all been wrong.

It’s possible that the market is merely catching its breath before another push higher, starting in the fall. In light of the run-up since Donald Trump’s election last November, that’s probably a good thing. Meanwhile, there’s plenty of opportunity for stock picking, especially in the financial sector—bank stocks gained nearly 2% last week.

If you want some help identifying those opportunities, click here. Just because the market is boring doesn’t mean you can’t profit.

[author_ad]