“Can’t Miss” investment stories are everywhere in the investment world, especially in a bull market, and most especially when someone wants to sell you something. (I’m thinking especially about the targeted ads that talk about “a little company in [your town name here] that’s disrupting a $10 billion industry.”)

Stories of a new product or a scarce commodity or innovative service that’s guaranteed to go through the roof are really tempting, so tempting that we’re willing to give up time and money to read more. And sometimes we even lay out money to invest in a stock or ETF or buy a report to act on our enthusiasm!

Time to simmer down and think about things a little! The best growth stocks always feature a combination of a great story with strong numbers (revenue and earnings growth, profit margins, etc.) and a stock chart that shows evidence that investors are growing more positive over time. (I call this Story, Numbers and Chart requirement the SNaC Approach, and you can read more about it here.

Here are three stories about investments that looked like slam-dunk winners that didn’t turn out so well.

[text_ad]

“Can’t Miss” Sector #1: Solar Energy

Solar energy—cheap, renewable photovoltaic electricity from the sun—has been the energy source of the future at least since the 1960s. The logic of this story was irresistible: Fossil fuels either pollute (coal) or are going to get scarcer (oil), so solar is the only way to go (except for wind, of course, but people can’t install windmills on their houses).

Solar stocks looked especially good back when “peak oil”—the idea that fossil fuel production was only going to decrease as diminishing reserves made oil more and more expensive to find—was a viable concept. There were a lot of things wrong with the peak oil idea, chief among them the completely unpredicted fracking revolution that increased the availability of previously uneconomic oil and gas reserves in the U.S.

Here’s a long-term (monthly) chart of the progress of the solar ETF dating back to 2008. You can see that, if you didn’t happen to invest during 2013 or 2017, your investment in the solar industry wasn’t going to buy your kids an Xbox, much less put them through Harvard. This is the Invesco Solar ETF (TAN).

So what went wrong with solar? Well, that story isn’t over, and solar continues to make slow progress. But a quick look at the price of oil suggests an answer. This is the Light Crude Oil chart ($WTIC on StockCharts.com), which tracks the price of crude oil. You’ll see the similarity in the general trend; cheap oil knocks the halo off solar power. (I’m leaving off the possible effects of oil industry money on the regulatory environment because I don’t want to cause a fight. But there it is.)

The other problems with solar were more interesting. There were few barriers to entry and only a few companies—like First Solar (FSLR), with its thin-film technology—had any intellectual capital. And the Great Recession of 2008–2009 knocked out the subsidy programs that had previously supported both home and industrial installations in Germany and the U.S.

Solar power keeps growing, but its growth is tied to incremental improvements in efficiency and economies of scale that are bringing the cost of photovoltaic electricity down to parity with fossil fuel generating plants. Economics and idealism together are better support for solar than idealism alone.

“Can’t Miss” Sector #2: 3-D Printing

Back in 2012, you couldn’t get more than a click or two into a financial site without running into an ad or article about the transformative, disruptive, revolutionary power of 3-D printing. The technology was versatile and looked great on video, the applications seemed endless and a few small companies were leading the charge!

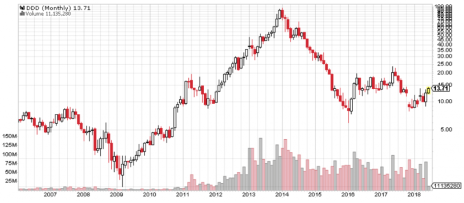

Just to illustrate, here’s a monthly chart of one of those leaders, 3D Systems (DDD), which came out of a very low base and fought its way into double figures in early 2011 before building a launching pad for the rest of that year. But 2012 and 2013 were huge breakout years for DDD, and it soared from 10 as 2013 began to 95 at the end of 2013. During that time, DDD made seven appearances in Cabot Top Ten Trader, which is the best certification I know of for the strength of a growth stock. (To learn more, click here.)

Here’s the monthly chart. Note the rising trading volume in 2012 and 2013 as investors bought into this attractive and easy-to-understand concept.

You can see a similar pattern in other 3-D pioneers like Stratasys (SSYS) and ExOne (XONE).

So what went wrong with the 3-D printing revolution? Actually, nothing at all. But the three stocks I mentioned made enormous runs and made a lot of money for nimble investors and then fell back to earth.

3-D printing remains a hugely valuable technology, but corporate giants came to dominate its industrial uses, leaving the home and hobbyist markets to smaller competitors. DDD, which made a nice run in early 2016, hit the skids in the second half of 2017, falling from 24 in May to 8 in November. It’s trading back near 14 these days, courtesy of a high-volume rally on May 9 following the announcement of a contract with Huntington Ingalls Industries to provide printers to make replacement metal parts on U.S. Navy vessels.

A stock that trades up on good contract news is great, but it’s not the revolutionary story that investors bought back in 2012 and 2013.

That’s two stories of can’t miss sectors that showed how they could miss after all. On Friday, I’ll have a follow-up on a more recent trading fad that faces the same challenges. And I’ll also have my own candidate for a “can’t miss” investment that I think may have real legs. Stay tuned.

[author_ad]