We’re not necessarily stock breakout players—yes, sometimes we’ll buy soon after a stock lifts to new highs if it shows great power, but oftentimes we’re looking for other setups like early-stage pullbacks or some tight action. Even so, monitoring how growth stocks act when they attempt to break free of a multi-month consolidation is useful. Jesse Livermore used to call it the “Pivotal Point,” and how a stock acted as it tried to push through it told him a lot about the stock’s health—and in turn, the market’s.

Granted, it’s hard to quantify the action in an exact manner; there’s no simple indicator that can tell you how attempted stock breakouts are faring. But if you keep your eye on enough high-quality growth names, you will get a feel for whether buyers are eagerly lifting things past resistance, or whether big investors are using such moves as an opportunity to sell.

2 Failed Stock Breakout Examples

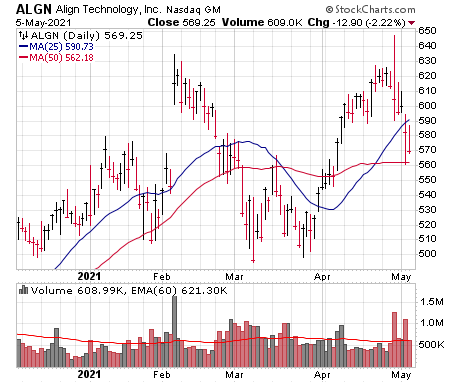

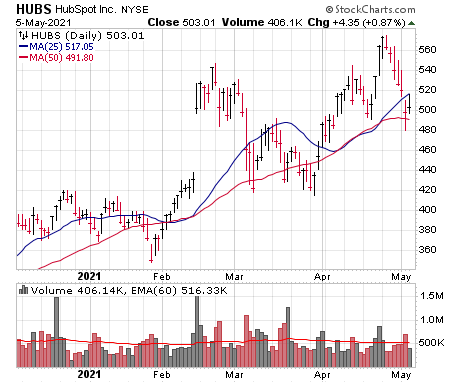

The bad news: Even before last week’s implosion, it was clear that institutions were unloading on (or soon after) any move to new highs. The examples were endless but take a look at Align Technology (ALGN) and HubSpot (HUBS), which tell you what’s been going on.

ALGN had etched a nice, early-stage base (original breakout just back in October), saw some decent upside trading volume in early April and initially gapped up on earnings (sales up 62%, earnings up 241%; analysts still see a near-doubling of earnings this year) before reversing hard.

[text_ad]

Then there’s HUBS, which gapped up on earnings in February before building a base with the growth sector over a couple of months. The breakout attempt again had solid volume, but you can see what big investors did after that move, with shares cascading back into their base.

Now, all of this is descriptive and not necessarily predictive—a ton of growth stocks are reporting earnings this week, and if we see a rash of big, positive upmoves (and there’s not immediate selling afterwards), then it’s certainly possible big investors will have changed their minds. It’s not hard to find halfway decent setups despite the recent selling; Inari Medical (NARI) is a good example of a stock reporting this week (Tuesday, May 11) that’s set up nicely.

But you have to see it to believe it, and so far, seeing so many low-energy, failing breakouts is a sign of an unhealthy environment.

Nothing Abnormal with the Big Picture

As the failed stock breakouts suggest, it’s been a crummy two and a half months for growth stocks, and it’s possible the rest of the market could be losing steam, too. But we wanted to write a bit about the bigger picture—specifically, that what’s gone on so far hasn’t changed anything with the overall bullish outlook. In fact, even with growth stocks, the choppy, challenging action of late isn’t unusual following a huge up year like 2020.

A good example was the huge rebound in 2009, which 2020 mirrored very closely. The year after (2010) ended up being a good one (stocks in our Cabot Growth Investor advisory were up 27%), but almost all of that occurred from September on, with names like Priceline, Las Vegas Sands and Chipotle going bananas—before that, the Nasdaq had a tough four-month, 18%-ish correction.

Before that was the 2003 bear market recovery, which led to some serious chop in 2004 before a late-year rally that launched some serious winners (like Google and Apple’s initial run). The correction was longer (nearly seven months) and also pulled back 18% or so.

And further back was 1995, which was a very smooth year in general and led to some great performance in early 1996. But the correction after that was sharp (20% on the Nasdaq) though it lasted just three months before the buyers really returned.

To be clear, we wouldn’t take these comparisons too literally—i.e., we’re not forecasting an 18% to 20% Nasdaq decline that will last three to seven months. Every situation is different, and besides, the Nasdaq has already had one 12%-plus downturn this year.

But the larger point is that, even if we do spill into a correction (and that’s not guaranteed at all), it wouldn’t represent anything abnormal—the market often has some rough spots and tough trading after a huge up year, which isn’t surprising as many stocks need to digest their gains.

Whether it starts in a couple of weeks or a couple of months, there’s every reason to believe there will be another major blastoff or two coming down the road.

Editor’s Note: This post was partially excerpted from the latest issue of Cabot Growth Investor.

[author_ad]