I started my career at Eaton Vance, a large, Boston-based, asset management firm, working in the equity research group, and it taught me the importance of finding an investing niche.

It was a great place to start my career. I got to work with insanely smart people, many of whom had the Chartered Financial Designation and MBAs from some of the best graduate schools in the world (Harvard, Chicago, Northwestern, etc.).

What was even better was the firm had a great culture. Everyone was incredibly friendly and welcoming. Also, the department was fairly small relative to the assets under management. As a result, even as an entry level research associate, I had the opportunity to interview senior management teams.

Shortly after I started my career, the senior pharma analyst under whom I worked left for another job, and I was the only “pharma expert” left.

[text_ad]

Before they hired another senior analyst, I was tasked with interviewing the management teams that visited our offices when conducting the Boston portion of their periodic roadshows.

I still distinctly remember interviewing Johnson and Johnson Chairman and CEO Bill Weldon, who must have been quite surprised to be sitting across from a 22-year-old recent college graduate.

While my time at Eaton Vance was wonderful, my experience there seared one key lesson into my mind: to outperform the market, you need to find an investing niche.

Let me explain.

Lots of Competition in Large-Cap Stocks

At Eaton Vance, the primary focus was on managing portfolios of large-cap stocks.

As a result, the senior analysts and portfolio managers worked incredibly hard to find an edge that would give them insights as to which large-cap stocks were poised to outperform.

Why?

Because the slightest edge that enabled the firm’s large-cap funds to outperform their index and peers would drive billions of dollars of equity inflows.

Every billion dollars of new assets under management would generate an additional ~$7.5 million of high-margin, sticky revenue. At the time, the firm managed more than $100 billion.

To gain an edge, the firm’s portfolio managers, analysts and lowly associates (me!) pored over financial results, traveled around the world attending industry conferences, and spent countless hours performing due diligence while the firm paid millions of dollars for specialized research and access to data.

All of this work was done to create an edge. The financial stakes were enormous.

At the same time, there were hundreds of other portfolio managers and senior analysts in Boston trying to do the same thing. Many were backed by firms (like Wellington Management, Fidelity Investments or Putnam Investments) that had even greater financial resources than Eaton Vance.

On a global basis, there were tens of thousands of portfolio managers and senior analysts trying to do the same thing.

Competition was fierce because the stakes were so high.

As a result, nobody really won.

Eaton Vance funds were not able to consistently outperform their benchmarks despite the best efforts of its incredibly talented team.

This was not unique to Eaton Vance.

S&P Global consistently finds that the overwhelming majority of large-cap funds underperformed their benchmarks across most timeframes (although 2022 was mostly a coin toss).

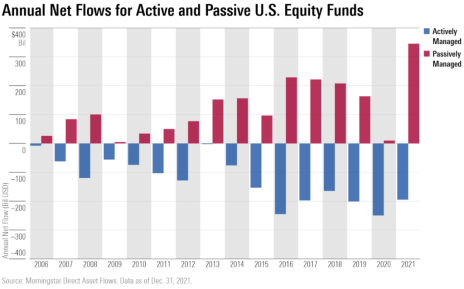

As a result, the outflows from active equity funds into passive funds have been unrelenting, totaling nearly $1 trillion in 2022 alone. And that’s on top of years of prior outflows.

Now let’s get back to the key lesson that was seared into my mind: to outperform the market, you need to find an investing niche.

Sure, you can outperform and make money buying large-cap stocks; just ask the 11% of large-cap funds that actually managed to do it in the last 10 years.

But it’s a really hard game to win consistently because there are so many intelligent and highly trained analysts trying to do the same thing. The financial incentives are massive.

Finding an investing niche reduces the competition, and limits your focus.

Micro-Cap Stocks are My Investing Niche

My favorite niche? Micro-cap stocks.

Historically, micro-caps have generated 17.5% compound annual returns, crushing their larger-cap competition.

Better yet, the cheapest micro-caps have generated even better annual returns: 28.2%.

In the U.S. alone there are over 5,000 different micro-cap stocks. There is virtually no analyst coverage. So, competition is not something you have to worry about.

The only downside is the stocks are small and illiquid so you have to be patient when you buy or sell them.

But the “downside” is actually a structural advantage. Most micro-cap professional investors who are good will attract more assets and “graduate” out of the micro-cap arena, leaving less competition for us. For me personally, sticking with micro-cap stocks has been a profitable venture - and one that has helped my subscribers beat the market in my Cabot Micro-Cap Insider advisory.

To learn how to become a Cabot Micro-Cap Insider subscriber, click here.

Micro-caps may not be for you. That is fine.

But you have to find an investing niche.

Otherwise, the competition will eat you alive.

[author_ad]

*This post has been updated from an original version, published in 2020.