The presidential elections in France have been getting plenty of headlines in the U.S., but coverage has focused mostly on the curious figure of Marine Le Pen, the National Front candidate. Le Pen, who has now stepped down as head of National Front, is the French manifestation of the global current of dissatisfaction with globalization.

Reduced to its simplest form, globalization is the idea that it’s a good idea to allow money, jobs and people to flow where they want to without regard for national borders. It’s the theory that has allowed corporations to send jobs overseas to China and elsewhere and supported the lowering of trade barriers among nations.

[text_ad]

But where globalization finally hit the wall is with the idea that people should be allowed to go where they want. Immigration is the great hot-button issue of the wave of national elections that have brought nationalist politicians like Duterte to power in the Philippines and Trump to power in the U.S.

Economic migration, like the constant flow of people from Central and South America to the U.S., has always been a fact of life. It has happened in Europe too. But the wars in the Middle East, especially Syria, have created massive waves of migration as people have had their homes destroyed and want to find a safe place for themselves and their families. That influx of Syrian and other refugees is one of the triggering factors in the European anti-immigrant backlash.

But back to France and its election, it’s not obvious why the results of the French election should be giving such a big boost to the U.S. stock market. Here’s my take on it.

1) The U.S. market likes the European Union and wants it to continue and succeed. The E.U. was originally known as the Common Market, and that’s how U.S. investors still see it. A single European market is a global economic force and the U.S. stock market likes it that way.

Brexit was a shock for global markets because it raised the specter of a shattered E.U., with every country trying to protect its own interests, preventing jobs and businesses from leaving and raising protective tariffs and capital controls to serve national ends.

2) The run-off election between Emmanuel Macron (a centrist) and Marine Le Pen (formerly a leader of the far-right National Front) gives the market hope that another victory by a candidate who wants to take France out of the E.U. may be averted. Le Pen apparently resigned as leader of the National Front in a bid to increase her appeal to French centrists. But a win by Le Pen in the run-off could still throw cold water on the stock market’s current rally.

Le Pen has worked very hard to separate herself from the racist and nationalist views of her father, who founded the National Front in 1972. She actually kicked him out of the party in 2015. And her renunciation of the National Front’s leadership is likely just another step in trying to escape its history of extremism.

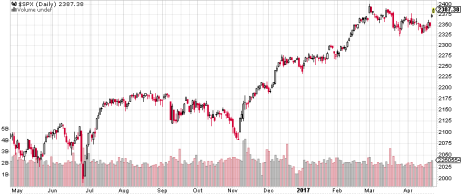

So U.S. markets will be watching very closely when French voters go to the polls on May 7. And the results may very well show up in the charts of the major U.S. exchanges. In the the daily chart of the S&P 500 below, you can see the reactions to the Brexit vote (the dip in late June), the U.S. election (the rally that starts on November 7) and the French general election (the two gap-up days at the end). Stay tuned for the reaction to the results of the May 7 runoff election in France.

[author_ad]