Remember six months ago, when gold and silver stocks were red hot amid rising prices for gold, silver and other precious metals? That seems like a far more distant memory now that safe-haven metals are plummeting in response to a rising dollar and record stock prices. Just look at what’s happened to the GLD ETF in the last month.

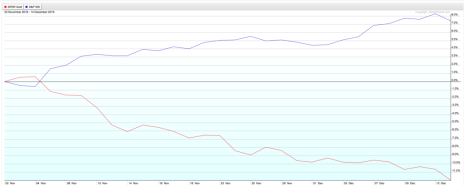

The SPDR Gold Shares (GLD) fund, known as a proxy for the price of gold because it’s the largest physically backed gold exchange traded fund, is nearing 52-week lows, having fallen 12.5% since November 4. It’s no coincidence that the downward spiral in the GLD ETF has coincided almost perfectly with the post-election Trump rally in the market.

Take a look:

Gold (and, to a lesser degree, silver) is a safe haven for investors in turbulent times. It’s also a hedge against a weakening dollar. And right now, the dollar is the strongest it’s been in more than a decade (see 10-year chart of the U.S. Dollar ETF below).

So, it’s no surprise that gold prices are tumbling—down nearly 15% from their mid-summer highs. Silver has gotten slammed even harder, with spot prices now 17% off of their August highs. As a result, silver ETFs such as the iShares Silver Trust (SLV) ETF (-22% since August) and the PureFunds Junior Silver ETF (SILJ)—a fund comprised of 20 junior silver miners that I cautiously praised for its stellar performance the first half of the year, but down 37% since August 18—have gotten slammed too.

The extreme volatility in gold and silver in 2016—a huge uptick in the first half of the year, followed by a comedown of almost equal measure in the second half—tells you all you need to know about the fickle nature of commodities, precious metals in particular.

There’s a reason we don’t have a commodities newsletter among our 12 Cabot Wealth advisories, and that very few of our experts recommend gold and silver stocks as anything other than short-term momentum buys, as Mike Cintolo did earlier this year in Cabot Top Ten Trader. In today’s investment climate, gold and silver aren’t reliable long-term investments. They may have a good few months when the market tumbles or the dollar weakens. But those big up-moves are little more than a mirage.

[text_ad]

The fate of the GLD ETF, the SLV ETF, the SILJ ETF and others over the past few months was nothing new. Those funds have been rising and falling (mostly falling) since gold and silver prices touched record highs in 2011 as investors were still emerging from their bunkers in the wake of the global recession. Now that the economy, the market and the dollar have not only stabilized but flourished, precious metals don’t have nearly as much utility as fear-driven safe havens.

Now, that doesn’t mean you should ignore gold stocks and silver stocks altogether. Cabot Top Ten Trader was chock full of them in the first half of the year, and if you subscribe to the service and followed Mike’s momentum-based gold and silver recommendations then you probably did quite well. (If you don’t subscribe and want to, click here.)

Also, there are bullish and bearish ways to play gold and silver right now if you’re an options trader. Jacob Mintz, our options trading expert and chief analyst of our Cabot Options Trader and Cabot Options Trader Pro advisories, spotted the following massive options trades in gold miners recently:

Bullish:

Buyer of 25,000 Gold Miners ETF (GDX) January 19 Calls for $1.25

Buyer of Gold Miners ETF (GDX) January 20 Calls for $0.86

Bearish:

Buyer of 10,000 Gold Miners ETF (GDX) January 19 Puts for $1.09

Here’s Jacob’s take on what those trades mean: “We are at a major point, and traders are expecting continued volatility” in gold and silver stocks.

So, if you’re clamoring for a way to play the ongoing volatility in precious metals, or simply want to learn how to trade options, you could subscribe to either of Jacob’s options services.

But if you’re exclusively a long- or intermediate-term investor, I’d avoid the GLD ETF, the GDX ETF and all things gold and silver for the foreseeable future. There are better, less volatile places to invest your money—especially in today’s market.

[author_ad]