Mercifully, the longest government shutdown in history is over—for now. That’s a huge relief for the hundreds of thousands of Americans who didn’t receive a paycheck for 35 days. On Wall Street, however, the end of the shutdown has been met with indifference, with stocks actually down in early Monday trading. That’s no surprise: the government shutdown stock market rally over the past month-plus shows how little investors cared about the historic work stoppage in the first place.

Government Shutdown Stock Market Rally By the Numbers

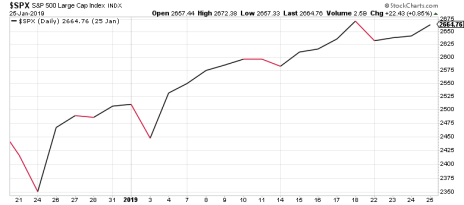

Since the government shutdown began on Dec. 22, stocks are decidedly up. During those 35 days (ending last Friday), the S&P 500 and Dow Jones Industrial were both up more than 10%, while the Nasdaq was up more than 13%. Here’s what the government shutdown looked like on a chart (of the S&P 500):

Hey, Wall Street has never been known for its empathy. On the contrary, that looks like downright glee over so many people being out of work.

[text_ad use_post='129622']

As always, however, context matters when it comes to stock movement. In this case, the government shutdown came at the tail end of the worst market correction since the 2008-09 recession. Stocks put in a bottom (on Christmas Eve) at virtually the same time the shutdown began. The shutdown may have accelerated the selling for that one day—the Christmas Eve selloff was one of the great market bloodbaths in recent memory. But since then, investors have been buying back in for a solid month, with no regard for the political climate.

Reasons Matter Less than Trends

And that brings me to my real point: reasons for rallies and corrections are overrated. Any time stocks move in one direction or another, even if it’s a slight move, analysts feel the need to give some underlying reason that explains why investors were buying or selling. But more often than not, the trend is the only reason why stocks are behaving a certain way.

When stocks plummeted in the fourth quarter last year, rising interest rates, the fractious U.S.-China trade relationship, and the specter of a possible recession were among the reasons ascribed to the correction. A month later, those concerns haven’t necessarily gone away; it’s just that investors happened to start buying stocks again.

If anything, you would have thought that piling a government shutdown on top of all the sky-is-falling worries over interest rates and the trade war would have made market conditions worse. Instead, stocks perked up in a big way.

Of course, there are real reasons why the market rises or falls in the big picture. When the subprime mortgage crisis sparked the worst recession since the Great Depression, stocks crashed. In the decade since, as U.S. GDP growth has remained positive, the housing market recovered, and the unemployment rate was cut to a 50-year low, stocks have been in a bull market. Over time, reasons why stocks rise and fall show themselves. On a day-to-day basis, or even a month-to-month basis, reasons matter less than trends.

And right now, the short-term trend is up, despite Monday’s slippage. The intermediate-term trend is still down, as stocks are down 10% from their September peaks. And the long-term trend is still up—stocks are up 15% in the last two years, and 48% in the last five years.

The government shutdown stock market rally made for an interesting juxtaposition. But more than anything, it was the latest evidence that short-term political concerns don’t have much of an impact on stocks.

[author_ad]