Winning stocks are what we as investors strive for. But finding them is just part of the equation. Sticking with them can sometimes be the hard part. Let me explain.

Keeping Things Simple

A few years ago, I read a book called “The Perfect Speculator” by Brad Koteshwar, which was all about a fictional trader teaching his methods to a friend. It’s a great (and easy) read and it has lots of good investing tips.

One of those tidbits that made its way onto my sticky notes is: It’s Hardest to Keep Things Simplest. In the market, that is so true—with all the daily action of your stocks and the market, the daily headlines and of course real life (family, personal finances), it’s devilishly difficult to simply stick with the plan.

[text_ad]

Today, that mostly means sticking with winning stocks, but it also means sticking with the plan when it eventually comes to selling. Many subscribers are asking me whether it’s best to sell XYZ stock after two or three down days, thinking the trend is over. Well, it could be, but it strikes me as rear-view mirror thinking—because the past two years were so choppy, sustained uptrends seem like unicorns to most investors.

Conversely, I’m sure once these winning stocks begin to break key support (like, say, their 50-day moving averages), I’ll be getting questions about buying, when the smart thing to do would probably be to pare back.

None of this means you can’t take partial profits in some of your strong performers (maybe selling one-third of your shares on the way up) or pick up a few shares when a winning stock dips toward support.

But my point is that, once you’re invested in a stock, you’re usually better off ignoring the noise and simply following your plan. That will allow you to capture some winners when the bulls run, and pull the plug once the sellers take control.

What to Do When Winning Stocks are Extended

On a similar note, I wanted to comment on something that’s been coming up more and more in my conversations with subscribers. It concerns a stock being “extended to the upside,” which usually means a stock’s had a good upmove in recent days or weeks and is well above support.

Most investors take that as a sign that they should steer clear of the stock because a pullback is likely. For my part, I usually advise new buyers to try to grab shares on dips if a stock is extended.

However, the whole concept of being extended (some might call it overbought or simply being too high) is incomplete without looking at the bigger picture—stocks (and indexes) that become very extended early in their advance (after breaking out from a consolidation area) usually continue their rise to much higher prices. Conversely, when you see a burst of buying after many months of advancing, it often represents a good exit point.

Let’s start with the market itself. I recently screened for instances when (a) the S&P 500 closed a week at least 7.5% above its 35-week moving average and (b) that was the first time the S&P was that extended to the upside in at least six months. Turns out there have been six instances between 2003 and 2016 (just shy of once every two years).

And what happened after the market became very extended? It went higher! Three months later, the S&P 500 was up an average of 5.4%; six months later, the gain was 9%; and during the next year, it rose as much as 17%. So it turns out buying when the market initially became extended was a good move. (We got another one of these “signals” four weeks ago when the S&P 500 was at 2,367, which probably bodes well for the bull market.)

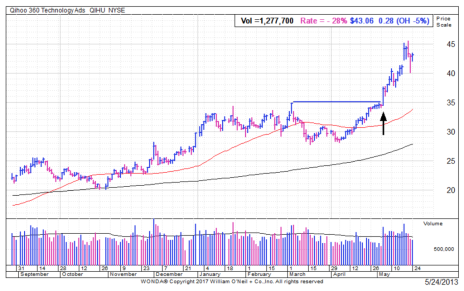

For individual winning stocks, it’s a similar story. Let’s look at Qihoo 360 (QIHU), which was a rapidly growing Chinese online search provider a few years ago (it’s since gone private). The Chinese stock built a huge two-year, post-IPO base and then broke out above 35 in May 2013—it went bananas, rising from 35 to 45 (30%) in just 11 trading days. At that time, the stock was a whopping 35% above its 50-day moving average.

But that was just the first act. Shares moved sideways during the next five weeks, but eventually doubled again by mid-September. Thus, the power early in the stock’s move portended great things in the months ahead.

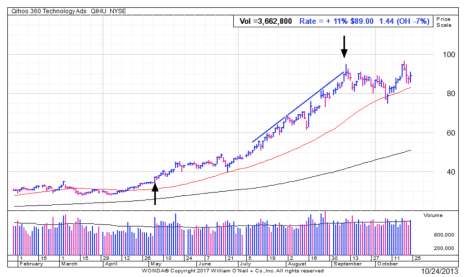

However, such wild strength is a different matter if a stock has been running five-plus months without any pullback below its 50-day line. That was Qihoo’s situation in early September—by that point, it had been north of its 50-day line for five months (including a stretch of 10 weeks above its 25-day line!) and had enjoyed a huge advance during that time.

Then Qihoo’s advance accelerated, rallying from 78 to 95 in a matter of days; it was again 37% above its 50-day line, but also 118% above its long-term 200-day line. Sure enough, the stock effectively topped out for five months, and after a brief surge in February/March, it collapsed.

A Winning Stock I’m Watching

So why write about this now? Because we’ve seen many stocks break out powerfully in recent weeks and then tighten up—if they accelerate higher from here, that will likely be a good “tell” of higher prices down the road.

One name I’m keeping an eye on is Universal Display (OLED), which broke above resistance of 68 in February, leapt above its old high of 74 a few days later and then catapulted as high as 88.5 two days after that! Here’s what I wrote about the stock in Cabot Top Ten Trader a couple of weeks ago:

“Organic light emitting diodes (OLEDs) have become one of the hottest display technologies due to their thinness, efficiency and flexibility. They’re being used on Google’s Pixel phone, the Apple Watch, Oculus Rift and Samsung Galaxy Gear smartwatches. In fact, by 2022, it’s estimated that the market potential for display OLEDs will hit $35.4 billion, up 125% from $15.7 billion in 2016. Universal Display is right in the thick of the action, manufacturing OLED displays for smartphones, MP3 players, laptops, TVs and lighting products. The company has also been investing heavily in intellectual property. In 2016, it acquired OLED IP from BASF, and acquired Adesis, a privately-held contract research organization specializing in organic and organometallic synthetic R&D. The company had just 4% revenue growth in 2016, but sales growth accelerated to 20% in Q4, which was just reported last Wednesday. Reported revenue of $74.6 million beat by $6 million, and EPS of $0.55 beat by $0.13. Perhaps more important, the?year ahead looks great for shareholders. Analysts expect revenue to grow by 23% in 2017 (and another 34% in 2018), and EPS?to expand by 36%. Universal Display also declared its first-ever dividend as it looks to give some of its $343 million cash hoard back to shareholders.”

Admittedly, the company is what I call “down the food chain”—if a big customer sneezes, OLED could get the flu. But given the initial power of OLED’s breakout, its big story and big earnings estimates, I’m OK taking a small position here or on dips, thinking higher prices are coming down the road.

For more updates on OLED and additional momentum stocks, consider taking a trial subscription to Cabot Top Ten Trader.

For more information, click here.

[author_ad]