We previously surveyed a group of readers, asking you how many stocks you own, how much time you spend on your investing, and how you feel about those numbers. More than 40 of you replied, and your answers reflected the challenges facing real investors with limited time and money but also included many strategies for tackling those challenges.

Before we get to the strategies and anecdotes, here’s a brief summary of your responses.

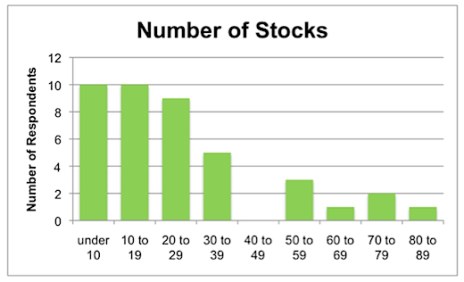

Respondents own anywhere from 2 to 80 stocks, although most (75%) own between 5 and 35. The median (middle) and mode (most common) responses are both 20, while the average is 24.7 (because of a few very high answers). Here’s a histogram of the answers, with each bar showing how many respondents own that many stocks:

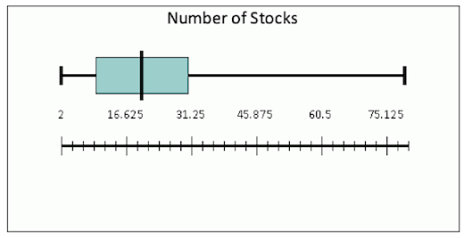

And here’s a box and whisker plot of the data, which shows the range of answers as a black bar, the median as a vertical black line and the interquartile range as a blue box. You can see that most respondents hold fewer than 30 stocks.

Looking at the high and low ends of the graph, some answers can be explained by unusual circumstances, while others are simply investors at the extreme.

[text_ad]

The respondent with only two stocks, D.A., says he “will probably add one or two more in the next few months,” and that he spends almost two hours a day looking for new investments.

The respondent who owns 50 stocks is also a bit of an anomaly; a portfolio manager: he manages $18 million.

However, the highest response, 80 stocks, came from an individual investor. His portfolio is large, at $7 million, but his primary reason for holding so many stocks is a dedication to buy-and-hold investing—he’s held some of his positions for over 20 years.

Investors have several reasons to prefer concentration when deciding how many stocks to own

Portfolios with tons of holdings certainly aren’t the norm among this group though. More respondents hold 20 or fewer stocks than hold over 20.

The first is simply time. As a respondent named Yohann wrote: “I usually own three to four stocks at any given time. This is based on the amount of time I have to research what I want to purchase, my ability to purchase the stock at a price point I’m comfortable with, and my confidence in my ability to know the stock inside out and keep up on updates. I’m happy with this number. I could be comfortable with owning one or two more, but I don’t wish for it.”

In addition to limited time, readers also cited a limited amount funds as a reason for concentration. As Ken T. wrote:

“I currently own nine stocks across two portfolios. I typically keep between three and six stocks in each portfolio, depending on the market trends (six to 12 total positions). The reasons are two-fold. First, I find that I’m comfortable keeping track of a handful of stocks, and three to five, possibly six per portfolio is comfortable to me. Second has to do with portfolio size. They’re not that large and I don’t like to make stock purchases of less than $3,000–$4,000 as I feel the performance of smaller positions is eroded just in the commission cost to buy and sell the position.”

Lastly, the third and most universal reason given for having a highly concentrated portfolio was to maximize the impact of each stock pick. One portfolio manager wrote to say her firm “holds no more than 10 individual stocks at a time, and it is because we follow the idea of focused investing and watching the basket... As Buffett said once, diversification is for those who don’t know what they’re doing.”

Another devotee of concentration wrote in: “I own 10 stocks in my $52,000 portfolio. I try to keep three to five stocks long term and five to seven as traders. That’s about the max for me. I agree that you make more with less stocks.”

Another reader, Richard, wrote: “I’m in my 70s and retired now, but decades ago I read somewhere that technical studies had shown that you can get all the diversification you really need with just 8-12 stocks that are sufficiently uncorrelated, e.g., not all in the same sector. I’ve used that guideline since then, and it’s worked well for me.”

James “Don” D. takes the idea almost to its extreme, writing:

“I usually keep my portfolio around four or five stocks, investing around $10,000 per stock at the beginning of the portfolio, the profits are better that way as I have enough shares to win big when I’m right... I’m a firm believer that for growth investors a widely diversified portfolio is a substitute for a lack of knowledge.

“If we know what makes a stock rise then only choose those stocks; the best ones in the group. If I had a larger trading account, I still wouldn’t own more stocks, I’d just put more money in the four or five that I want. A small portfolio is easier to manage and quite frankly when I start looking for more than that, I find myself picking stocks that are not as good as I want so I just stick with the top four or five and I’m doing OK.”

Other investors prefer a larger number of stocks

Of course, as you can tell from the charts above, not all our respondents are adherents of concentration. But of the investors who own more than 20 stocks, many expressed a desire to own fewer.

John B., for example, wrote: “I chose 20 as a reasonable number for diversification and ability to keep current... [However] it feels like I’m spending more time tracking developments regarding these stocks and researching alternatives than I really want to, and it has occurred to me to go back to mutual funds just to regain control of my time.”

A reader named Elliot wrote: “I’m embarrassed to say that I currently own 27 stocks. I’d like advice on getting this number down. I have just started stock picking this year and I am having a hard time picking because too many things look good, yet speculative. I have at least 10 stocks that I am speculating in and waiting for them to go boom or bust, but I am also having a hard time with core holdings and finding good spots to add, so I find that rather than adding to current holdings, I buy something else that looks more undervalued.”

Mark W. has a similar problem. He wrote: “I have 51 investments including 10 muni bonds. Most are individual stocks, a few foreign ETFs. Wish I could stay at 35, but can never get there.”

Of course, the reason these investors wind up with too many stocks is the same reason you wind up with too much of anything (shoes, glassware, knick-knacks)—too much buying and not enough selling. Buying a new stock fills investors with a sense of infinite possibility and hope for the future. Selling a stock is final, and many investors see it as a chore.

Paring down their number of stocks is a priority for many

Knowing when to sell stocks can be a challenge.

One respondent, Larry S., summed up the dilemma nicely, writing: “I currently have 30 companies in my portfolio. Most are recommendations... I find it hard to limit my portfolio to only 20 when there are so many compelling reasons to buy stocks. There is no shortage of financial pundits who are raving about the virtues of this company or this industry or the latest technology that will revolutionize the way we do things. The real trick is knowing when to sell or if to sell at all.”

Another reader, Jamie B., wrote: “In answer to your question, I am currently holding 29 positions—down from over 45 six months ago. I have been trimming in this current rally. Why do I have so many? I love to buy value. I am in it for the long term. The hardest part of this game for me is selling.”

And a reader named Bill wrote: “I am 80 with a stock portfolio right now of about $600,000 and close to 75 names. I have two sections: one I call ‘holdings’ (40 names, $475,000). The other, ‘stocks,’ contains the balance. I know this is too many, but I buy more than sell.”

Well, as they say, the first step is admitting you have a problem.

If you feel your portfolio is a bit bloated, and you’d like to take the second step, some of our other respondents shared some excellent strategies for keeping their portfolios at fighting weight.

Reader Charles B. has developed a sell method that works for all his holdings. He wrote: “I normally carry about 10–12 high-quality stocks, although sometimes it has risen to 18–20, but not for long because my ‘weeding out’ approach takes over and brings the portfolio back to 10–12... I list each owned stock in an Excel spreadsheet and after each day’s closing, I update the mental stops (never published stops!) based on the highest price each stock has reached under my ownership, and also calculate the daily gain/loss since purchase. Regarding losses, when a stock dips to -5%, it’s a candidate for selling, but is sold only when it exceeds -10%. When a stock stops growing and just goes flat-line, believe me, it gets my close attention.”

These readers have solid strategies to determine how many stocks to hold at any time

David averages up in his best stocks: “I generally own between 8 and 15 stocks. Right now I own 14. I try to keep adding to positions that are working and so I end up with about eight stocks carrying the weight of my portfolio. Right now, I have more because (a) the market is doing well and (b) I am ‘nibbling’ at a few new names to see how they do—all the while looking to add to what I already own.”

Robert L. buys larger positions when his portfolio grows: “I currently hold eight stocks. This is also equal to the amount in the model portfolio... Over time, I plan to increase the amount of shares I can purchase for each new stock as opposed to increasing the amount of stocks I own.”

Steve B. keeps his number of holdings in check by letting his portfolio size dictate his position size: “I manage about 25 stocks in significant amounts... I settled on a dollar amount range to have for any one stock, and the result divided into my total stock holdings = the number of stocks I hold. Periodically, the amount range goes up, and the number of holdings goes down.”

That just about summarizes the results of my little survey. Thank you to everyone who responded; I found the answers very enlightening. I hope they help you too, if you sometimes struggle with right-sizing your portfolio.

I want to leave you with one final response, from a reader named Neil S. I like what he had to say and want to share it:

“The number of stocks in my portfolio—for the past 30 years—has been 10 to 12.

... It’s a manageable number that both allows for diversification and substantial growth—if you’re lucky enough to pick the right stocks.

The time I spend ‘managing’ my portfolio is minimal. I check the final prices daily and research anything that appears to be out of normal or raises a question. But generally speaking, that can all be done in 15 minutes or less. When I get dissatisfied with the performance of one of my holdings, I generally put in more time—keeping a closer eye on it and looking for a good exit point. I’m always adding to my ‘wish list’ of potential buys, but I usually only buy to replace something I’ve sold. This system has worked well for me over the years and I’m now comfortably retired.”

[author_ad]

*This article has been updated from a previous version.