Spring has come to Salem, Massachusetts. Slightly earlier than usual but I haven’t heard anyone complaining about being able to put away their snow shovels or how little time they used their snowblower. In another month the moorings in the harbor will begin filling up with boats.

The news is full of non-news these days: the current and a former president each officially clinched their party’s nomination, the Fed declined to change interest rates but continued to foreshadow up to three cuts later in the year, and Oppenheimer won Best Picture at the Oscars.

No big surprises there.

And, to the extent there are surprises about the economy, they tend to be positive. Jobs added monthly continue to be surprisingly strong and unemployment historically low. Wages are growing without seeming to drive inflation. U.S. GDP growth is the envy of most countries. And the Dow continues its march towards 40,000.

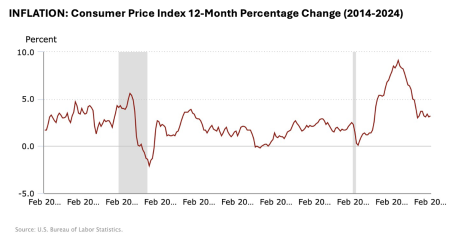

In the wake of the pandemic, inflation took off around the world and only started to come back to earth a year ago. Here in the U.S., inflation has moderated substantially and is still working its way down, although it remains a bumpy ride. The Fed may be standing by for now but they are monitoring very closely.

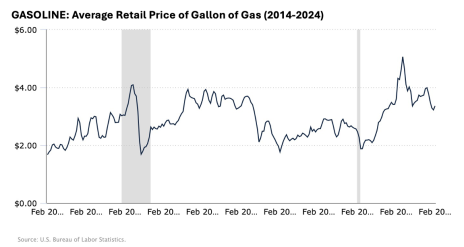

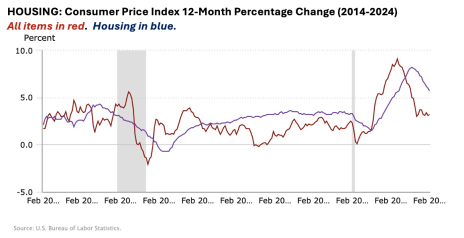

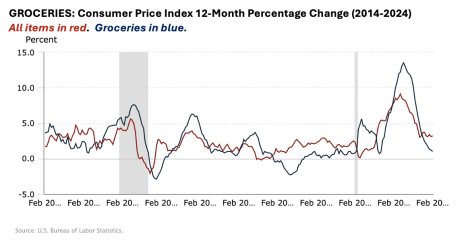

Regardless of what inflation is actually doing, there are three areas that disproportionately weigh on consumers’ sense of the cost of living – gasoline, groceries and housing – even if inflation were relatively tame. We experience the cost of filling up our vehicle regularly. Grocery shopping is a weekly occurrence. And, rent or mortgage payments may only be once a month but they are big and noticeable.

As shown below, gas prices have moderated substantially, with the average cost per gallon back under $4. Globally, energy costs are elevated since the pandemic and most of us would be happy to see them drop a little further, but they’re in the zone. And with EVs, hybrids and other more fuel-efficient cars, plus the increase in people working from home, gas prices don’t have quite the same economic shock value they used to.

Now that gas prices have settled down, the biggest remaining clouds in the sky are the high costs of housing and food.

After an initial drop early in the pandemic, housing costs grew substantially through 2023, whether in the form of rents or higher mortgage payments driven by increased interest rates. The growth rate has dropped substantially in 2024, but housing costs remain higher and the sticker shock will take time to wear off.

As with housing, grocery inflation has fallen dramatically in the last year, but the cost of groceries is still much higher than it was pre-pandemic, and staples like milk, eggs and meats have stayed stubbornly high where they continue to inflict maximum emotional (and financial) pain on wary shoppers.

One thing all four of the charts above have in common is they show inflation and prices continuing to moderate. Couple that with the fact that life goes on, and what is new and shocking today becomes a minor annoyance in 6-12 months and becomes the “new normal” after 12-18 months.

All of this is to say that the psychological weights dampening consumer bullishness are on the path to disappearing. As that happens, and interest rates continue to fall, more and more money will find its way back to the stock market, pushing prices higher.

But it’s not just rebounding confidence that will push the market higher.

All of this talk about artificial intelligence (AI) isn’t just noise. Generative AI in particular has the potential to deploy expertise on a larger scale and in places where it hasn’t been feasible before. Coupled with the advances in hardware and chip technology (has anyone seen what’s happened to Nvidia over the last year or so?), the next decade will see advances in productivity that will rival or top any other period in history. While not all industries will be affected equally, of course, we will be able to do so many things faster, better, and cheaper overall that productivity will explode like pouring gas on a fire. In February I wrote about how productivity growth is the primary driver of stock market growth (“Productivity Drives Stock Market Growth”). AI is going to accelerate productivity growth like we haven’t seen before. That makes the stock market look more attractive than ever. Whether you invest for profits/gains or yield/income, the next decade is going to deliver.

But here’s a little pro tip: don’t wait. Market conditions are strong and getting stronger. The long-term outlook is good but sentiment is still being held back by the grocery and housing prices noted above. As that abates, prices of stocks will get bid up. In addition to the gains over the next decade driven by productivity, getting in now will position you for gains as the slower investors take their time coming back to the market in the coming year or so.

[author_ad]