The yellow metal is a traditional investor safe haven in times of turmoil. But is gold a good investment now? Let’s examine.

Inflation has made an emphatic arrival and is being felt throughout the economy, both domestically and globally. This has important implications for metals investors, particularly in the base and industrial segments of the metals and mining industry. And gold in particular is seeing a surge, thanks to its traditional standing as a safe haven for investors. But is gold a good investment now? More on that in a minute.

The signs of inflation’s unwelcome return can be seen in an ever-expanding number of headlines. Last week, the U.S. Consumer Price Index (CPI) for April rose almost 1% from March and was considerably above consensus expectations of a 0.2% increase. Meanwhile, core CPI, which excludes food and energy, also increased nearly 1% in April and above consensus.

The big takeaway from this reading is that on a year-over-year basis, total CPI was an eye-popping 4.2% higher and running at an annualized pace of 5%— the highest rate since 2008!

That year was significant and instructive, for it was the last time the global economy experienced massive commodity price inflation (particularly crude oil prices). Moreover, metals prices in the war-inspired inflationary years of 2003-2008 were lofty, with several base and precious metals hitting record (or near-record) highs.

[text_ad]

The difference between then and now is that in 2008, the crude oil price reached a record high of nearly $150/barrel before collapsing. This time around, oil prices are far below that number, yet there’s plenty of broad-based inflation worries to keep traders on edge—a reason for expecting the broad metals sector bull market to persist.

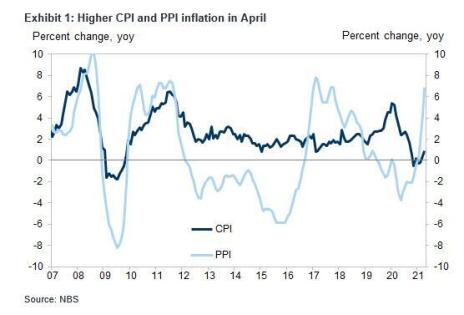

What’s also worth mentioning is that China’s Producer Price Index (PPI) for April showed an inflation rate that greatly surprised the market to the upside and reached nearly 7% year over year—the highest rate since 2017. This in turn sent analysts scurrying to explain the heated conditions in China and sparked fears that inflation in manufacturing-heavy China would ripple even further across the global economy.

Bitcoin vs. Gold

Surprisingly, the cryptocurrency market has entered the narrative for inflation-sensitive assets in a big way. Last week, Tesla CEO Elon Musk made waves when he tweeted that bitcoin would no longer be accepted as payment for his company’s electric vehicles due to environmental concerns.

The cryptocurrency market subsequently lost more than $365 billion. Moreover, according to Bitcoin.com, “The entire crypto-economy has dropped more than 6% and bitcoin dominance is down to 40%, the lowest the metric has been in two years.”

You might ask: What connection could bitcoin possibly have with the metals market? Quite a bit, as it turns out.

For much of the past year, observers have debated the effect that bitcoin and other cryptos were having on gold’s safe-haven demand. A case was advanced that bitcoin was the “safe haven asset of choice” among those of the millennial generation (due to that generation’s preference for intangible assets). As a corollary to this, it was further stated that the growth of the crypto market would necessarily undermine the investment demand for gold and other precious metals for years to come.

But betting against gold’s long-term record of being the premier haven of choice among safety conscious investors is a fool’s errand, as subsequent events have proved. The recent weakness in the bitcoin market bears witness to that, as one leading bitcoin tracking vehicle, the Grayscale Bitcoin Trust (GBTC), has lost 36% since peaking in late February.

By contrast, the gold price has gained almost 12% from its March lows and is likely headed higher over the intermediate term. And there’s plenty of anecdotal evidence to suggest that some of those gains came from cryptocurrency market outflows, as many bitcoin sellers have reportedly entered the gold and silver market.

Moreover, bitcoin’s biggest gains of the last year occurred during the August 2020-February 2021 period—a phase which saw crypto prices soar on speculative demand. During that same time, gold prices were in steady decline as safety demand was diminishing. Now, however, those roles have reversed.

But is Gold a Good Investment Now?

It’s clear, then, from the past year’s record that bitcoin has served as more of a speculative medium than a safe haven, while gold has maintained its long-term function as a hedge against economic and financial market uncertainty.

Many investors believe that gold performs best in an inflationary environment. While there’s some truth to this, it’s closer to the truth that gold has historically outperformed in fear-driven environments. In other words, it’s not inflation, per se, that causes gold prices to rise. Rather, it’s the fear of inflation that is one of gold’s major price drivers over the longer term.

Between the spreading worries over inflation, a jittery U.S. stock market, rising fuel prices/delivery disruptions and escalating tensions in the Middle East, gold has lots of fuel for its all-important “fear factor” revival. Indeed, fear has returned with a vengeance not seen since last year’s pandemic crash, and that’s a good reason to remain bullish on the yellow metal.

What do you think of gold? Do you own any gold mining or other precious metal stocks or ETFs in your portfolio? Tell us about them.

[author_ad]