Right now, of course, the main focus is on interest rates, inflation and everything related to that (such as sanctions on Russia), and that’s all well and good—there’s no question that the market has been recently moving on comments from Federal Reserve members and the move in the 10-year note.

However, I learned long ago that the market’s real story isn’t going to be told by any headlines, and oftentimes the thing(s) that everyone is watching don’t do the best job of telling you if/when the market’s character has changed.

Long story short, with so many crosscurrents and dramatic headlines and moves out there, I figured this would be a good time to highlight the few things I’m really homing in on right now— market metrics that should tell me whether it’s best to remain cautious, or whether the bulls may be fighting back.

[text_ad]

Market Metric #1: New Highs/Stocks Cracking Resistance

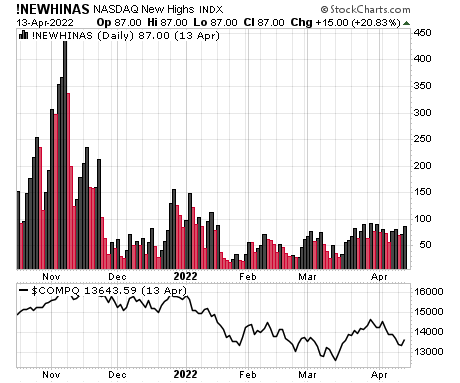

With the Nasdaq still sitting 15% off its peak, I don’t expect to see a few hundred stocks actually hitting new 52-week highs; that’s not realistic, and in fact, when you do see that many names doing well, you’re usually near a short-term market peak anyway.

However, what we’ve seen all year from growth stocks (and increasingly from other areas, too) is selling on strength—for the vast, vast majority of names, approaching any sort of resistance has led to sharp selling. Even during the latest rally, the number of new highs on the Nasdaq could never even hit 100 (and never really outpaced new lows, either). I don’t have a specific number, but if we see a sharp rally in the Nasdaq for a week or more, I’d like to see this figure begin to perk up, preferably above the century market.

Market Metric #2: Intermediate-Term Trend of Growth Funds/Indexes

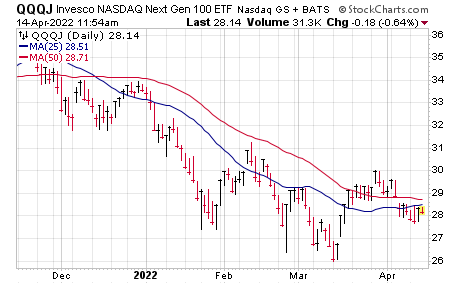

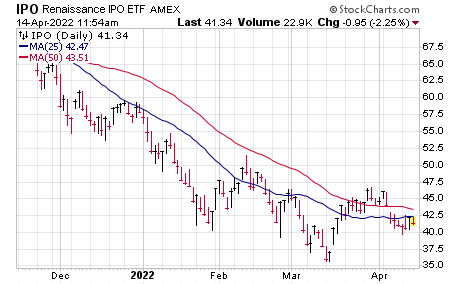

Obviously, I’m a growth guy, so I care much more about growth stocks than the rest of the market. But even beyond that, remember that growth stocks were the “leaders” of the downside, topping back in mid-November, and my guess is that they’re going to have to at least shape up for the market to have a good run—and most importantly, for potential fresh leaders to get going.

In-house, I’ve been watching what I call the “Growth Tides”—a corollary to our “Cabot Tides,” which is our main intermediate-term trend model—which is a collection of a handful of growth funds versus their short- and intermediate-term moving averages. Two to watch: The Nasdaq Next-Gen Fund (QQQJ) and the Renaissance IPO Fund (IPO), both of which aren’t in uptrends … but are also trying to hold the general bottom area from the past three months.

It would be a change in character if we see things like QQQJ and IPO get back above their late-March highs, especially in the near-term.

Market Metric #3: Chips (not the snacking kind)

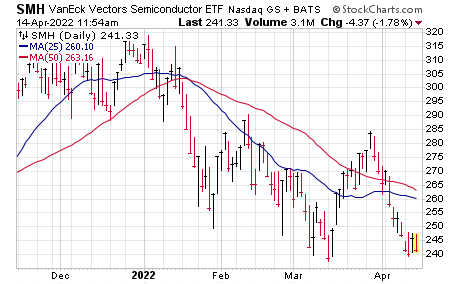

Decades ago, when manufacturing was the key driver of the economy and profits, astute market watchers liked to focus on the transport stocks, as the firms there would often provide a read on the overall economy—if truckers, airlines and rails were all circling the drain, it was a good bet that the blue-chip industrials were soon to follow.

Today, of course, the economy is different, and I think chip stocks have replaced transports as a “tell,” at least when it comes to the growth area of the market: Chips go into basically everything that the new economy runs on, so if those stocks are sinking (likely due to anticipation of weaker orders), it’s likely a sign of issues in tech, software, data centers and possibly even EVs and renewable energy.

Right now, the Semiconductor ETF (SMH) is actually leading the market lower—it’s already testing its correction lows, ahead of the major indexes. Obviously I’d prefer to see it gather some relative strength on the upside as a sign big investors are in “risk-on” mode.

Market Metric #4: Defensive Stocks

Speaking of “risk-on,” the flip side of that idea is defensive stocks—whether it’s toilet paper, toothpaste, razors or even things like utilities and giant health drug firms, when money is pouring into these names and out of growth, it’s telling you a lot about where big investors (who, remember, have to remain heavily invested) are putting their money.

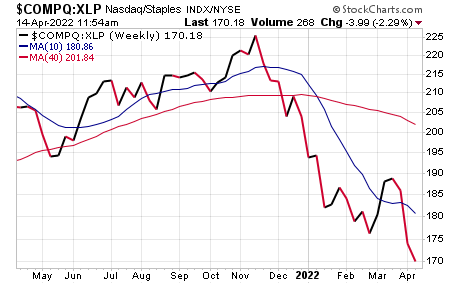

There are many ways to measure this, but I prefer our own Aggression Index, which compares the Nasdaq to the Consumer Staples Fund (XLP). It’s currently well below both its 10- and 40-week moving averages—I’d love to see this hold around here and leap back toward its March highs. Until then, it’s obvious that big investors are staying safe.

One Stock/Sector I Like Right Now

As for stocks, it’s obviously slim pickings out there, but one group that’s held up pretty well even during the recent slide is medical, and I’m not talking about the giant safe drug outfits but mostly small medical device makers. The fact that they’re holding up in the growth stock bloodbath is a good sign if it continues.

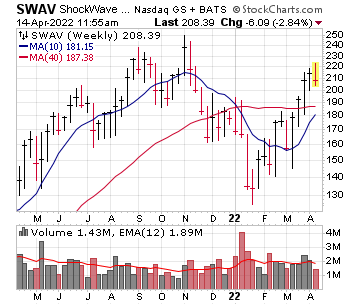

One of the better actors out there is Shockwave Medical (SWAV), which we wrote about in last week’s Cabot Growth Investor issue. Here’s what we had to say:

“Shockwave Medical was one of the small(er) medical outfits we mentioned a couple of times last year (unfortunately we didn’t pull the trigger on it) and it had a huge run—only to fall 50% during the recent growth stock debacle. Is the overall run over? We don’t think so; often these young growth stocks have a “re-set” decline that wipes out all the weak hands and refreshes the long-term uptrend. The story certainly suggests the stock hasn’t seen its best days: The company has come up with a new standard of care to treat calcified arteries, which is (a) obviously a growing market as the population ages and (b) isn’t served well by current treatments, with balloons ineffective and atherectomy’s have a steep learning curve and carry risks of perforations and artery blockages. As its name suggest, Shockwave has taken an old, proven technology called lithotripsy (been used for decades to eliminate kidney stones) and applied it here, using an inserted catheter that blasts sound waves to crack apart the calcium. It’s been proven to work better than other treatments, with a better safety profile, too, and because it’s not hard to train physicians, the uptake has been rapid—the firm’s had approval for peripheral arteries coming into last year, but won approval for coronary applications in early 2021 (market of six million procedures annually!), which caused revenue to explode—Q4 saw sales up 271%, with coronary products making up about three-quarters of revenue, and earnings actually came in at 34 cents per share, with huge profit gains expected going forward! As reimbursement levels improve, the sales force grows (both here and overseas; the firm just started selling in the U.K and France in Q4; Japan coronary sales should start late 2022/early 2023) and new products are released, Shockwave is going to get much bigger. To be fair, the stock could easily need more time and have more wobbles after its humungous 2020-2021 rally, but we think SWAV’s big rally (it recouped more than 70% of its decline) of late bodes well.”

The longer that SWAV can hold these recent gains, the greater the chance that it can get moving once the market finds its footing.

[author_ad]