Markets are Never Wrong, Opinions Are

Knowledge Speaks, But Wisdom Listens

Stock Market Video

In Case You Missed It

---

A brief tour down recent news headlines offers a disturbing picture of the stock market. Recession fears in the Eurozone, the decrease in China’s estimated gross domestic product growth for this year and a domestic unemployment figure that’s still too high for comfort are only a few reasons that people refuse to put their money in growth stocks.

After spending several hours looking at the doom-and-gloom news stories this week, I’m reminded of a quote from Jesse L. Livermore: “Markets are never wrong, opinions are.” You’ll notice that’s also the title of this essay, and with good reason.

Livermore was one of the most successful stock speculators of the early 20th Century. By the time he died in 1940, the man had made (and lost) fortunes of more than $100 million. Putting it into perspective, Livermore’s net worth in today’s dollars ranged as high as $14 billion. The number depends on what standard you use to convert the money from its worth in 1929 to today’s money.

My topic today isn’t about Livermore, though his life would make for a series of highly interesting articles--but rather the nature of opinions in the mainstream media.

Earlier this week, I happened upon a piece in The New York Post that suggested pulling your money out of growth stocks and staying away would be a good method of protecting yourself from the losses certain to come soon. After all, the second quarters of the past two years--2010 and 2011--have brought dips in the market.

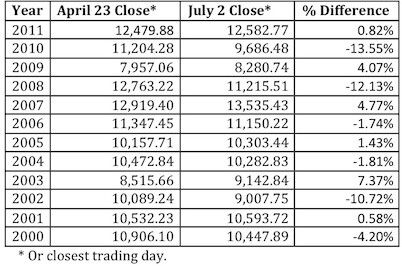

The writer bolstered his argument by citing the decline of 13.6% in the Dow Jones Industrial Average between April 23, 2010 and July 2, 2010.

Immediately after this, the writer cited the 15.9% drop in the Dow between April 29, 2011 and September 23, 2011. The writer next mentions the 49%(!) drop in stocks between May 3, 2008 and March 6, 2009. The 2008 to 2009 drop, however, was measured using the S&P 500 instead of the Dow, which is only one problem I have with his argument.

The writer concludes that these second-quarter drops mean investors should follow the old British saying to “Sell in May and go away, then stay away until St. Leger’s Day.”

St. Leger’s Day falls in roughly mid September, and is notable because it’s the final day of the British horseracing season. U.S. investors would know the adage better as the “Halloween indicator,” though--the date to reinvest is thought of as November 1. This is because St. Leger’s Day is unlikely to be known by non-Brits.

The theory behind the saying is that stocks traditionally decline in May and don’t start rising again until mid-September in Britain or until after Halloween in the United States. The Post article I mentioned above applies this theory to March instead of May, reasoning that since the second quarter has been so bad for stocks, investors should pull their money right out of the market and not re-invest until November 1.

There’s one big problem with this idea.

The writer’s initial period is April 23 to July 2 in 2010. I’m fine with this timeframe as a sample, because the second quarter is April 1 through June 30. By the stated logic this piece begins with, I expected the writer to examine only the same period.

But he doesn’t do that--April 29 to September 23 of 2011 includes the back two months of the second quarter and all but a week of the third quarter, while the writer takes nearly an entire year for his third data point as proof the second quarter of the year is bad. (He also switches indexes from the Dow over to the S&P 500 to bolster his case.)

So I looked at this writer’s initial time period and see how the Dow--and not the S&P--did in each year between 2000 and 2011. Here’s what I found:

In the last 12 years, the Dow Jones Industrial Average has closed in positive territory half the time and in negative territory half the time in the time period between April 23 and July 2.

Now, I’m not disputing the Post writer’s on the fact that springtime in the past two years has shown declines in equities. However, my quarrel with his article is that he keeps expanding the time period to prove his point. It’s a simple case of shifting the facts until he finds a set of numbers that fits his theory rather than trying to offer an objective appraisal.

Granted, the job of The New York Post is to sell newspapers, so I understand. But after seeing the flaws in his reasoning, it’s hard to conclude you should take this one man’s advice and yank all your money out of the stock market.

Rather, what you should be doing is keeping in line with the signals from your investing system. Remember the quote from Livermore about opinions?

If you’re really worried about the safety of your money in these turbulent investing times, and are unsure the bull market will last, I suggest taking a look at a value-investing system like the one in Cabot Benjamin Graham Value Letter. Editor Roy Ward picks stocks based on the principles of security analysis, which is targeted not toward the charts ... but instead toward the idea of long-term growth. Click here to learn more.

---

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

Knowledge Speaks, But Wisdom Listens

Amazingly, this quotation is widely attributed to Jimi Hendrix (1942-1970) ... but there is no actual proof that he either said it or wrote it. There is, however, proof that Oliver Wendell Holmes (1809-1894) wrote, “It is the province of knowledge to speak, and it is the privilege of wisdom to listen.” It is tempting to see these as dichotomies, existing in two different people, but I prefer to believe that both qualities may be contained in one person, and that the true wise and knowledgeable person will speak when sharing knowledge is appropriate, and listen otherwise.

---

In this week’s Stock Market Video, Cabot Top Ten Trader Editor Mike Cintolo discusses the rolling correction that’s currently going on in the market. Some stocks might ignore the correction all together though, and we still remain bullish. Featured stocks: OpenTable (OPEN), Freeport-McMoRan (FCX), Joy Global (JOY), Equinix (EQIX), LinkedIn (LNKD), CA (CA), Lennar (LEN), Dunkin’ Brands (DNKN) and Tesla Motors (TSLA). Click below to watch the video!

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 3/5/12 - Keep Up Your List of Leaders

On Monday, Cabot Market Letter and Cabot Top Ten Trader Editor Mike Cintolo discussed the benefits of separating your stock portfolio into three classes of leaders, and what you should do to keep that list updated. Featured stock: Equinix (EQIX).

---

Cabot Wealth Advisory 3/8/12 - Staying Humble: Golf and Investing

On Thursday, Cabot China & Emerging Markets Report Editor Paul Goodwin wrote about the similarities between golf and investing in great growth stocks. Both have lots of tips, and both require intense practice in order to gain mastery. Featured stock: Yum! Brands (YUM).

Happy Investing,

Matt Delman

Editor, Cabot Wealth Advisory

Editor’s Note: You want to invest, but news of the bull market fading has got you worried. Our ultra-safe investing system can help you bank gains even in down times. Click here to learn more.