About a year ago, my wife and I made the seemingly drastic decision to get rid of our cable. With a mortgage, a car payment and two young kids in day care, the increasingly high cost of paying for a couple hundred channels of Seinfeld re-runs, countless CSI spinoffs and way too many things involving the Kardashians had simply become impossible to rationalize. So, we “cut the cord,” opting for the comparatively cheaper life of streaming video through our Apple TV. Thousands of other Americans are doing the same, and media stocks have fallen out of favor as a result.

The Netflix Effect

Last week provided the latest proof. Shares Disney (DIS) and Comcast (CMCSA) dropped like rocks due to problems the two media conglomerates were experiencing due to cord cutting. Disney stock declined 4.4% on Thursday after CEO Bob Iger warned shareholders that 2017 profits would be merely “in line” with last year’s, in part due to weakness in its TV properties (Disney owns ABC, ESPN and The Disney Channel and Freeform).

[text_ad use_post='129622']

Meanwhile, shares of Comcast (which happens to be the high-priced cable company whose cord I cut), tumbled 5% after the company said it could lose as many as 150,000 subscribers due mostly to competition from streaming companies like Netflix (NFLX) and Amazon (AMZN).

The losses in CMCSA and DIS were an extension of much longer drawdowns in both high-profile media stocks. Here’s what the DIS stock chart looks like over the past two years.

Despite a nice post-election recovery, DIS is down more than 7% in the last two years—a time when the S&P 500 is up more than 28%.

Comcast’s misery hasn’t lasted nearly as long, but CMCSA stock is down nearly 10% since the beginning of June, and is now threatening to plummet below its 200-day moving average.

Comcast and Disney aren’t alone. Other media stocks tumbled last week too, perhaps by osmosis.

Twenty-First Century Fox (FOX) fell 6.4%, CBS Corp. (CBS) was down 5.3%, and Viacom (VIA) (which owns Nickelodeon, Comedy Central, BET and other cable channels) was down 4.4%. Year to date, those three media stocks are down an average of 5.3%.

Juxtapose those sour results with those of NFLX, which is the purest (and best) play on the streaming video boom. It’s up 44% in 2017, and 80% in the last year. Quite a difference!

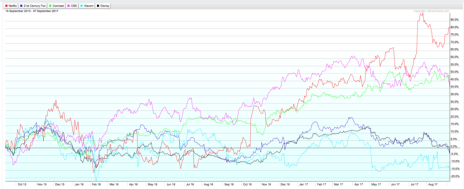

Now, just for fun, let’s plot the five media stocks mentioned above on a two-year chart with NFLX.

Even the two media stocks (CMCSA, CBS) that have performed well over the past two years have managed barely half the returns of NFLX stock. The other three are either down or flat during that time.

Sell Media Stocks, Buy NFLX

Bottom line: what happened to media stocks last week was not an aberration, but a symptom of an era that is becoming increasingly dominated by streaming video. People prefer not to pay higher prices for dozens of channels they don’t want. Thanks to Netflix, Amazon, Hulu and others, they now have that option.

Unless companies like Comcast figure out how to significantly reduce their prices and remain solvent, I doubt cord-cutting will slow anytime soon. And media stocks may continue to suffer as a consequence.

[author_ad]