Stock Market Video

The Only Market News You Can Really Use

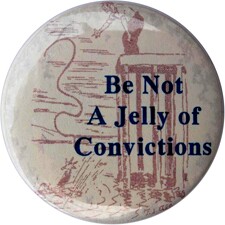

Be Not A Jelly Of Convictions

In Case You Missed It

---

In this week’s Stock Market Video, Editor of Cabot Market Letter Mike Cintolo talks about his new intermediate-term buy signal for the market; it’s not the strongest he’s ever seen, but the sellers look to have left the building. And, best of all, the recent rally has allowed investors to separate the wheat from the chaff. Names mentioned include: Amazon.com (AMZN), Oasis Petroleum (OAS), Facebook (FB), eBay (EBAY), Regeneron Pharmaceuticals (REGN) and the financial and emerging market sector funds (XLF and EEM, respectively). Click below to watch the video!

The Only Market News You Can Really Use

An online search through Friday morning’s headlines brought two related stories about the employment picture in the United States. The first was a report from the Labor Department that the U.S. economy had added 146,000 jobs in November, pushing the unemployment rate down to 7.7%, the lowest since December 2008.

The report showed that Super Storm Sandy had a smaller impact on employment than had been expected. And the numbers were much better than the 85,000 jobs and unchanged unemployment rate that economists had predicted.

The news wasn’t totally rosy, of course. Analysts quickly pointed out that the lower unemployment rate probably reflected discouraged job seekers dropping out of the job search as much as stronger employment. And 7.7% isn’t anyone’s idea of a good rate.

This job creation number would have had a completely different impact had it come in, say, October, ahead of the national elections. But investors seem to have liked the numbers and the markets opened on the upside on Friday, but quickly grew mixed as European news and the continuing puzzle of the Fiscal Cliff took a toll.

The second piece of news was buried a little deeper in the financial section of the newspaper. It reported that Apple (AAPL) has begun preparations to move production of one of its lines of Macintosh computers back to the U.S. from China!

Details are sketchy, but it’s possible that Apple is helping Foxconn, the Taiwanese company that operates factories in China, to set up an assembly plant in the U.S. Foxconn’s Chinese facilities have been criticized for awful working conditions, and a homeland operation would make sense both economically and from a P.R. point of view.

Wages in China have been increasing at 15% to 20% per year, and with U.S. wage growth proceeding at a glacial pace, the numbers now make sense to reverse some offshoring.

I have two observations about these two stories. The first is that, although economic progress in the U.S. is moving slowly, it is moving. The economists who said that it would take three or four years to recover from the effects of the Great Recession look pretty accurate. But recovery is happening.

The second observation is that whenever there is a major slosh in any direction by an economy (or even just part of an economy), there is an inevitable counter-slosh. So the flood of jobs that left for China won’t all come back, but some will … and some will drift from China to Vietnam, Indonesia or some other underdeveloped countries that want to take their first step on the development ladder by offering their biggest asset: cheap labor.

For investors, the lessons are familiar ones. Neither bulls nor bears last forever, and the best thing you can do is to use headlines as entertainment, but use the market itself as the source for your investing tactics. Mike Cintolo notes in this week’s video that market conditions have turned positive, and that a little more exposure is appropriate. That could change, and if it does, our advice will change. But the strategy will remain the same. You must take the current trend of the market seriously; it’s the only financial news that you can really use.

$insert("/sitecore/content/ads/SOM/2012-01-Play-the-market”,"wc21") Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

Be Not a Jelly of Convictions

Tim’s Comment: This is one of the more challenging buttons to interpret. Its greatest value lies perhaps in its potential to stimulate the formation of a mental picture of jelly, into which a cook has mixed “convictions.” My best interpretation is that when more than one conviction is involved, contradictions can arise, and leave you confused, trying to serve more than one master.

Paul’s Comment: The picture on this button seems to show one man in distress in the water and another high and dry on a nice strong dock. So the text seems to be a comment on having firm convictions rather than wishy-washy ones. But your guess is as good as mine.

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 12/3/12 – Has Apple (AAPL) Peaked?

Tim Lutts, editor of Cabot Stock of the Month, writes in this issue about the importance of momentum and sentiment in the fortunes of Apple and Coke stock, and why the market ultimately tired of both. Stocks discussed: Apple (AAPL), Coca-Cola (KO) and Stratasys (SSYS).

Cabot Wealth Advisory 12/4/12 – How to Know When a Bull Market Starts?

I wrote in this Cabot Wealth Advisory about the Law of Unintended Consequences and about how Cabot market timing indicators can ensure that you will know when a new bull market arrives with real certainty. Stock discussed: Nam Tai Electronics (NTE).

Cabot Wealth Advisory 12/6/12 – The Stock Market Teaches Bad Behavior

Cabot Market Letter chief Mike Cintolo looks at the bad lessons markets have been teaching investors since 2011, encouraging quick profit-taking, and why that won’t be ideal when a real bull market returns. Stock discussed: Regeneron Pharmaceuticals (REGN).

Have a great weekend,

Paul Goodwin

Editor of Cabot Wealth Advisory

and Cabot China & Emerging Markets Report

---

Related Article:

The Law of Unintended Consequence

---