Stock Market Video

Shoveling Through the Olympics

Without Curiosity Conviction Is Stubbornness

In Case You Missed It

---

In this week’s Stock Market Video, I admire the progress made by the major indexes and tell subscribers to enjoy the resulting buy signal. But he also cautions that the market is highly reactive to news, which prevents us from recommending jumping in with both feet. Stocks discussed include: SolarWinds (SWI), UnderArmour (UA), Western Digital (WDC), Athenahealth (ATHN) and Cabela’s (CAB). Click below to watch the video!

Shoveling Through the Olympics

Not that you need another commentary about the Olympics, but since they’ve been going on for at least three months, I think I should weigh in.

As with most sports fans, my gripe isn’t with the Olympics themselves. I share the common awe at the skills of these dedicated athletes. I also share the common disgust with the bad stuff: doping, sore losers and ungracious winners, poor sportsmanship and unbridled patriotism. Oh, and rhythmic gymnastics, of course, which is just one of the sports whose esthetics just make me gag. Synchronized swimming is another, but I’m going to cut the list off there.

My real gripe is with NBC (Surprise!), whose decision makers are giving us so much of what they think we want that it’s making us sick.

It used to be that coverage of the Olympics was primarily about the events themselves. We watched hours of prelims and events with only the nattering of commentators to distract us. And if the coverage was always heaviest when our own countrymen were competing, well, that was okay too.

And then, very occasionally, we would get an “Up Close and Personal” segment giving us the story of an athlete’s life, her family, his training runs through hip-deep snow, their tragic relatives or triumphantly supportive communities. All good stuff.

Television executives found that those segments were wildly popular, so they added more (and more and more) of them to the mix until what we have now is the spectacle of a bunch of little heart-warming narratives running around doing sports. It’s like having a meal that’s all garnishes and desserts. It’s fun, but it’s not nutritious. My wife calls it “The Olympic Show.”

And after a while, it just gets tiresome. Really tiresome.

Personally, I think that someone at NBC needs to stop hiding behind their audience surveys and make the principled decision that the network is going to present the Olympics as a sports event. Because this pre-packaged pandering crap has put me (and lots of other people I know) so out-of-harmony with the Olympics that I haven’t even been turning the TV on at night.

And that’s what I think about the Olympics.

And, since you asked, yes, I do have an investing point to make.

If you suddenly realized that your source for investing news was giving you more of what you wanted than what you needed, what would you do?

It’s something you should think about, because I think that’s exactly what’s happening, especially if you’re tuning in to daytime investment news channels on cable or the more sensational online services.

How can you tell if you’re getting what you need? Ask yourself if what you’re seeing and hearing is just too perpetually dramatic to be true. If you’re being over-warned about impending market collapses or over-tempted by upcoming bull surges, you’re probably not getting any real useful information. Or maybe you’re hearing yet another story about the marquee stocks like Apple and marquee leaders like Mark Zuckerberg. If that’s the case, what you’re getting is the equivalent of our Olympic coverage, which is too sensational and too full of useless content.

If you would like to see what genuinely useful stock information looks like, I would be happy to send you the latest issue of Cabot Top Ten Trader. Free. Gratis. For nothing.

What you will get is just the 10 strongest stocks in the market (with no penny stocks, no thinly traded mayflies and no stocks with good numbers that are just sitting there). The Trader will tell you why each stock is strong, analyze each chart, give you the fundamentals and recommend a buy range. It’s delivered to regular subscribers every Monday after the market closes.

If you’re interested in solid nuts-and-bolts growth stock recommendations and finding market leaders before they pop, this may be exactly the letter for you. It’s the 80–20 rule on stock picking in a weekly letter form.

And if you’ll just email TimothyLutts@cabotwealth.com and put “Free Top Ten” in the subject line, I’ll see that you get the latest issue.

P.S. I still have high hopes for the closing ceremonies at the Olympics. Keep your fingers crossed.

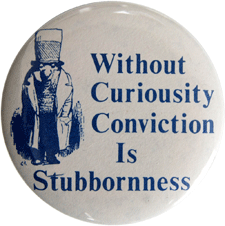

Here’s this week’s Contrary Opinion Button. Remember, you can always view all of the buttons by clicking here.

Without Curiosity Conviction Is Stubbornness

In investing, you must always keep an open mind, because (as another button says) “Unexpected events occur frequently.” So while conviction is a wonderful attribute, particularly if it’s achieved via comprehensive research and it goes against the spirit of the crowd, it should never be so firm that it is blind to new information. [Editor’s note: As someone (probably economist Paul Samuelson, and not John Maynard Keynes as everyone thinks) is supposed to have responded to an accusation that he had changed his mind: “When the facts change, I change my mind. What do you do, sir?” Curiosity is a taste for changing facts.]

---

In case you didn’t get a chance to read all the issues of Cabot Wealth Advisory this week and want to catch up on any investing and stock tips you might have missed, there are links below to each issue.

Cabot Wealth Advisory 8/6/12 — The World in 2050

In this issue, Cabot Global Energy Investor editor Lou Gagliardi looks at the long-term consumption trends, especially in the U.S. and China, that will boost oil prices in the coming years. Featured stock: Plains All American Pipeline (PAA).

---

Cabot Wealth Advisory 8/9/12 — The 80/20 Rule

In this issue, I look at the wildly popular Pareto Principle that sees big effects coming from small causes. Featured stock: Chemical & Mining Company of Chile (SQM).

Have a great weekend,

Paul Goodwin

Editor, Cabot Wealth Advisory

P.S. Have you ever wanted to cherry-pick the best investment ideas, from the smartest people on Wall Street?

Now you can.

The Dick Davis Investment Digest pores over hundreds of financial newsletters and institutional research reports to cull the shrewdest advice with the greatest potential to make you money. They cast a wide net over all types of investment categories and sectors: large-caps, small-caps, blue-chips, mutual funds, exchange-traded funds, gold, silver, technology, health care, energy--you name it, they cover it.

You get $71,073 worth of investment research for 35 cents a day!

For less than the cost of a cup of coffee, you can get a stock recommendation every day of the week from the likes of Louis Navellier, Tom and David Gardner of Motley Fool, John Buckingham and Patrick McKeough.

Savvy investors have relied on Dick Davis Investment Digest through every kind of market ever since the first issue came out in 1981. Now it’s your turn to profit from it’s wisdom.