Is it different this time?

We are officially in a bear market. The definition of a bear market is when the market indexes fall 20% or more from the highs on a closing basis. Yesterday, the S&P 500 closed about 30% down from its closing high last month.

The last bear market was in 2008 and 2009 during the financial crisis. That was one of the worst bear markets we’ve ever had, with the S&P 500 falling more than 50%. Because of the long length of time since the last bear market and the severity of that crisis and selloff, investors are understandably concerned.

[text_ad]

Every bear market is scary. But I think this one is scarier than most. The selloff was lightning-quick. A month ago the market was rolling along in a familiar pattern of making new all-time highs, after a year in which the market indexes were up about 30%. Then suddenly, out of nowhere, everything went to Hell in a handbag.

It isn’t because the recovery ran out of gas. It isn’t because excesses built up and bubbles formed over the long recovery. A black swan event swooped in out of nowhere and screwed everything up. The coronavirus has destroyed this market, like a meteor hitting the planet. A weird special event has thrown the world into a tailspin and the end is still nowhere in sight.

To add perspective, the events of September 11, 2001 thrust the economy into a recession. Of course, it hit an economy that was already teetering and not nearly as strong as the pre-coronavirus economy. But the economic disruption only lasted about a week. And it was nowhere near as severe as this one.

The whole country is shutting down. Yesterday, just about every state ordered bars, restaurants, stores, gyms and every large gathering to shut down, indefinitely. In an economy such as ours, you can’t do that. We may not be in a financial crisis now. But if you shut down the economy for several months, I can assure you it will be.

How many small businesses can afford to shut down until the summer? My guess is not many. What happens when these businesses can’t pay the rent? What happens when the people that own the buildings can’t pay the mortgage?

How long will these draconian measures last? Will it be over in a month or will this go on until July or August and maybe beyond? Nobody knows. At some point, the widespread suffering inflicted by the crashing economy will be worse than the virus ever was. When will we get the all-clear to go back to work?

We’ll never get the okay from these geek healthcare experts. They probably won’t be comfortable until there is a vaccine available for the country’s 350 million residents. And that might be a year away. But we’ll be in a depression by then.

At what point do business and government officials decide that the economic emergency is so bad that people are better off dealing with the virus, in an election year? We will probably find out.

I believe that if the market knew a bad truth it would be much better than this uncertainty. If the market knew for sure that this Apocalyptic shutdown would last until the end of May and no longer, it would probably rally 5,000 points on the Dow. But until it can grasp the extent of the economic shock, it probably won’t be able to find a bottom.

The Thing about Bear Markets

I can’t sugarcoat things. That’s where we are. But it will pass. It may get still uglier before it gets better. But, one way or another, it will get better. It always does. This virus won’t bring down Western civilization.

Every bear market has its unique horrors. There is always a sense that this could be “the big one.” That this will destroy investing. It will finally expose stock market believers and investors for the greedy fools that they truly are. But markets always come back and prove market believers right.

Consider this: The 20th century featured two World Wars, a Cold War, a Great Depression, runaway inflation, civil unrest, many recessions and bear markets and more. Yet, the Dow Jones Industrial Average began the century at a value of about 50 and ended the century a little over 11,000.

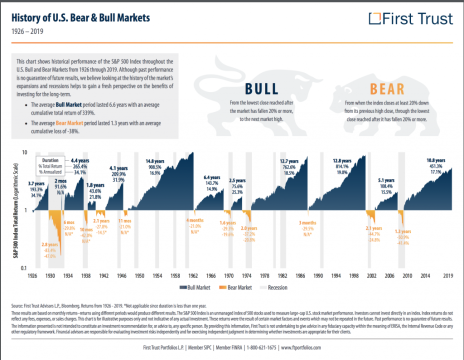

In scary and uncertain times like this, it’s well worth looking back at the history of these bear markets. Let’s go to the video tape, courtesy of First Trust.

Since 1926, a bear market has come along an average of about every six or seven years. The average bear market has lasted 1.3 years and with an average loss to the bottom of 38%. And that number factors in the Great Depression. The average bull market has lasted 6.6 years with an average cumulative total return of 339%. Since 1926, it has been a bull market about 86% of the time.

We’re emotional creatures. Our emotions tell us to flee from danger. We are naturally wired to buy into a rising market and sell when things get bad. But history dictates that we should do exactly the opposite. History is crystal clear on this one. Bear markets present great opportunities to buy cheap ahead of the next bull market.

I don’t know how this will play out. It’s bad. I admit it. Things will probably get worse before they get better. But try to forget those jerk pundits on the news. Just step away from the hysteria for a minute. You see the history. The market is already down 30%. Taking a cold and objective look at the situation, does this seem like a good or a bad time to invest? You tell me.

[author_ad]