The U.S. stock market keeps humming along, pushing to new record highs earlier this month. There are many reasons for the rally: unemployment at a 10-year low, North Korea tensions dying down (for now), historically low volatility. But stocks have also been propped up by a strong Q3 earnings season.

Though not every company has reported its third-quarter earnings results yet, the 95% of S&P 500 companies that have haven’t disappointed. Those companies have grown earnings year over year by an average of 6.2%, exactly double the 3.1% growth rate economists expected. That’s a lot of convincing earnings beats!

Here are some other encouraging numbers from Q3 earnings season, courtesy of market research firm FactSet:

- Seven. That’s the number of sectors, out of 11, that have reported year-over-year earnings growth in Q3, with energy stocks the runaway leader at 135% growth thanks to extremely poor earnings results a year ago amid plummeting oil prices. Information technology (+19.7%) and materials (+10.7%) are the other two sectors reporting double-digit EPS growth.

- 9%. That’s the average sales growth, with nine of 11 sectors reporting increases. Energy companies also lead the way in top-line growth at 19.8%, followed by materials (+15.3%) and information technology (+10.5%).

- 74%. The percent of S&P 500 companies that have beaten earnings estimates, ahead of the one-year (71%) and five-year (69%) averages.

[text_ad]

Perhaps the most important earnings-related number is this: Since Q3 earnings season began in the second week of October, the S&P 500 is up 1.5%. That’s not a jaw-dropping jump, but in a bull market that’s already the fourth-longest in history without a correction of at least 5% and fast-approaching the longest correction-free rally ever recorded, it’s impressive. Another strong earnings season has undoubtedly helped extend the rally.

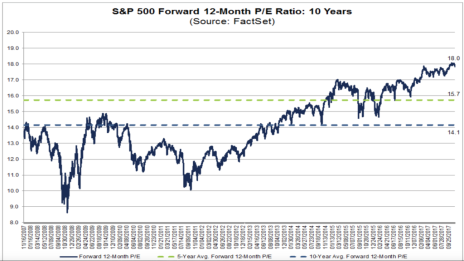

To be sure, not all the numbers from this earnings season have been so rosy. Five sectors have grown earnings by 0.2% or less, with financial stocks pulling up the rear with an average EPS year-over year EPS decline of -8.3%. Utilities have also had a rough quarter at -4% earnings growth. And with a forward P/E of 18.0, the S&P 500 is trading at its highest valuation since 2004. To value stock investors, that’s a major red flag, and doesn’t look good on a chart.

Even growth investors should be leery of that number, and the sheer number of days since a market correction of any kind. All our growth experts are advising caution—Cabot Top Ten Trader chief analyst Mike Cintolo notes the “sluggishness in the broad market,” with many stocks hitting 52-week lows of late.

But not one of our experts recommends selling your stocks. On the heels of a strong Q3 earnings season, and with the usually fruitful holiday shopping season getting underway in earnest this week, the U.S. stock market still has plenty of momentum. If you abandon ship now due to high-valuation fears, you could miss out on some more big gains to come!

[author_ad]