By Chloe Lutts

---

Passenger Rail in the U.S.

And the Other Rail

Two Railroad Stocks

---

I’ve been traveling between New York and Boston frequently for over three years. The transportation options between the two have definitely improved since I moved here; now I can choose the Bolt Bus or the Megabus, both of which have WiFi and electrical outlets. But I’ve also taken the Fung Wah and the Lucky Star buses, which leave from Chinatown and seat passengers on a first-come-first-served basis. They all get pretty cramped, especially on weekends and holidays. Yet, my absolute worst trips have been the ones I’ve paid the most for—when I’ve tried to take Amtrak.

Amtrak tickets usually cost about five times as much as bus tickets, which is theoretically worth it for the roomy cars, on-board food and drink and faster travel time. Unfortunately, the reality of Amtrak is quite different. After spending hours in Penn Station one winter, I resolved never again to take Amtrak when there was snow on the ground. The next summer, a train I was on slowed to a crawl due to flooding—it was not raining at the time. The final straw was last year, when I arrived at New York’s Penn Station in absolutely perfect weather to find my train’s arrival was delayed by at least an hour. Savvier—or at least more cynical—than before, I went outside, walked a block, and got on a Megabus for Boston. I called Amtrak from the bus to cancel my ticket, and I was halfway to Boston before that train even arrived in New York. I haven’t even tried to take the train since.

Obviously, anecdotal evidence is just that—but my experience with America’s passenger train system seems to jibe with its reputation. Amtrak—which is a government-owned corporation—has been a target of derision ever since it was created in 1971.

Why is passenger rail in the U.S. so lousy? For the answer, we have to look at Amtrak’s origins—the “company” was founded under Richard Nixon in 1971 to more-or-less save passenger rail in the U.S. by nationalizing it. Existing passenger rail companies were struggling with declining ridership and increased competition from airlines and the burgeoning highway system. (Depending on whom you believe, they may have also been burdened by more government regulation then and given less government support than other transportation modes.) Amtrak was formed by absorbing most of the existing passenger rail lines in the U.S.—in exchange for Amtrak stock, the U.S. government gave the new company train cars, equipment and capital. The one thing the rail companies didn’t give the government was their rail tracks or right-of-ways—any of them. And with the exception of most of its Northeast Corridor route, Amtrak still doesn’t own any of the rails it uses. Freight railroads do.

This is where it gets interesting: because while American passenger rail is among the worst in the world, our freight rail system is, without argument, the best. Last year, in July, The Economist wrote:

“America’s freight railways are one of the unsung transport successes of the past 30 years. They are universally recognized in the industry as the best in the world. Their good run started with deregulation at the end of Jimmy Carter’s administration. Two years after the liberalization of aviation gave rise to budget carriers and cheap fares, the freeing of rail freight, under the Staggers Rail Act of 1980, started a wave of consolidation and improvement. Staggers gave railways freedom to charge market rates, enter confidential contracts with shippers and run trains as they liked. They could close passenger and branch lines, as long as they preserved access for Amtrak services. They were allowed to sell loss-making lines to new short-haul railroads. Regulation of freight rates by the Interstate Commerce Commission was removed for most cargoes, provided they could go by road.”

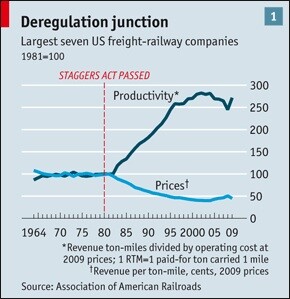

It’s practically the mirror image of the history of passenger rail in the U.S. And it has produced almost exactly the opposite result: While Amtrak hobbles along dependent on debt and government funding, American freight railroads are thriving. Here’s a chart from The Economist article (remember, a year old):

Freight railway’s success has plenty of fathers, from the coal industry (accounting for 45% of freight rail cargo, by volume) to China’s economic rise (intermodal “containers” of imports arriving on the West Coast are the fastest-growing cargo). And through it all, they’ve been giving Amtrak trains dispatch preference on their own lines. But now, attempts to improve Amtrak are threatening the freight railways.

The first is a new safety system called Positive Train Control (PTC) that was mandated by Congress, and signed by George Bush, in 2008. Railroads would be required to install the system on any line that also carries passenger trains at an estimated cost of $15 billion.

The second threat is a proposal to create high-speed rail corridors on existing lines. While I would love to be able to take fast, on-time trains around the country, the fact that Amtrak still uses freight lines everywhere but the Northeast Corridor makes the proposal a little more complicated—and a threat to the successful freight rail system we already have. From The Economist again:

“The trouble for the freight railways is that almost all the planned new fast intercity services will run on their tracks. Combining slow freight and fast passenger trains is complicated. With some exceptions on Amtrak’s Acela and Northeast corridor tracks, level crossings are attuned to limits of 50 mph for freight and 80 mph for passenger trains. But Mr. Obama’s plan boils down to running intercity passenger trains at 110 mph on freight tracks. Add the fact that freight trains do not stick to a regular timetable, but run variable services at short notice to meet demand, and the scope for congestion grows.

“The freight railroads have learned to live with the limited Amtrak passenger services on their tracks. Occasionally they moan that Amtrak pays only about a fifth of the real cost of this access. Some railmen calculate that this is equivalent to a subsidy of about $240m a year, on top of what Amtrak gets from the government. Freight-rail people regard this glumly as just part of the cost of doing business, but their spirits will hardly lift if the burden grows.

“Their main complaint, however, is that one Amtrak passenger train at 110 mph will remove the capacity to run six freight trains in any corridor. Nor do they believe claims that PTC, due to be in use by 2015, will increase capacity by allowing trains to run closer together in safety. So it will cost billions to adapt and upgrade the lines to accommodate both a big rise in freight traffic and an unprecedented burgeoning of intercity passenger services. Indeed, some of the money that the White House has earmarked will go to sidings where freight trains can be parked while intercity expresses speed by.”

Since that article was written, several high-speed rail projects have already been changed or canceled (although the Tampa-to-Orlando line that was one of the first causalities would have had its own tracks). It will be interesting to see what happens to the rest. Will the freight railroads’ interests continue to be sacrificed for the sake of passenger rail?

In the meantime, one thing is for certain: U.S. freight railroads are still doing great. Rail freight rates here are some of the lowest in the world, and the network is by far the largest. And while cargo volumes took a hit at the beginning of the recession, they’ve largely recovered, thanks to rail’s competitive pricing. Railroads are also benefiting from the commodities supercycle, as more and more basic materials need to be hauled thousands of miles. So it was no surprise to me when not one, but two railroad stocks were recommended in the latest Dick Davis Dividend Digest. The first recommendation comes from Richard C. Young, editor of Richard C. Young’s Intelligence Report. He wrote:

“Norfolk Southern Corp. (NSC) operates an expansive 20,000-mile network of railways throughout the eastern half of the United States and serves over 1,200 facilities, including every major port on the East Coast, and numerous Gulf Coast and river ports. ... In 2010, Norfolk generated $9.5 billion in revenue and $1.5 billion in income. Customers paid Norfolk to haul 182 billion revenue-ton-miles of freight shipments. To increase the income from those shipments, Norfolk has done more with less. For every hour worked by an employee in 2010, Norfolk moved a ton of goods 3,218 miles—an 11% improvement over 2009. The efficiency gains fostered a 36.4% increase in income from railway operations. NSC has paid a dividend every year since 1901. Today’s $1.60 in annual dividend payments offers investors a 2.5% yield. Over the past five years, NSC has outperformed the S&P 500 by more than 30 percentage points, with a compound annual growth rate of 9.6%. The efficiency of railroad fuel consumption is a draw for customers. In a study from November 2009, the Federal Railroad Administration found that rails were much more fuel efficient than trucks, beating them in all 23 types of movement compared. Rail transport was found to be up to 5.5 times more efficient at certain tasks than trucking, and at minimum was 1.9 times as efficient. With sustained high fuel prices, shippers are looking for the most efficient form of transportation. On land, that is railroads.”

The second recommendation comes from Bob Howard, editor of Positive Patterns. He wrote:

“GATX Corp. (GMT) is a deep cyclical. We can see that back and forth in the last 10 years. During this time, GMT has been stuck in an earnings range that I expect to be busted on the upside during 2012. The railroad business has never looked better and I expect RR earnings to continue their surge here. Ergo, GMT and others in that business will be along for the ride. We can clearly see the trading range here—about $15 to $50. I look for the momentum boys and funds to favor GMT ahead. I think right now is a splendid time to buy this deep cyclical. A close above the recent highs in the $43 area would suggest a fairly quick spurt to challenge the old highs in the low $50 area—and then it should move much higher on bigger volume.”

GMT yields about 3.5%, while NSC yields about 2.50%, so they’re perfect for income investors. Both crashed right along with the market and pretty much everything else last week, but long-term, they’re both trending up (especially NSC). I’d look for conditions to stabilize a bit, and then feel free to buy both of these steady dividend payers at discounted prices.

Learn more about top dividend stocks like NSC and GMT in Dick Davis Dividend Digest. Each month, we feature dozens of high-yield recommendations from the top advisors on Wall Street. Click here to get started today!

Wishing you success in your investing and beyond,

Chloe Lutts

Editor of Investment of the Week