So many of my readers have been asking the last couple months: Is now the time to get out of the market and conserve your cash? My answer to them is a resounding no!!! You should always stay invested in a down market. For a couple reasons.

There are two major problems with holding cash: 1) Your cash doesn’t make you any extra money. The only way to make your cash grow is to invest it in something: stocks, bonds, gold, artwork, even a lousy money market fund (which still pays less than 1% annually); and 2) No one has ever proven that they can properly time the market so that you get in at just the right time (the bottom) and exit at the peak of the bull run (the top). So, if that’s your shtick, you can plan on a lot of anxiety and extra trading costs, which will just result in lower returns.

If you don’t believe me, I can cite numerous financial studies that prove it. But one of the best examples is a recent study done by Charles Schwab Corporation. Here, I’ve paraphrased the company’s findings:

[text_ad]

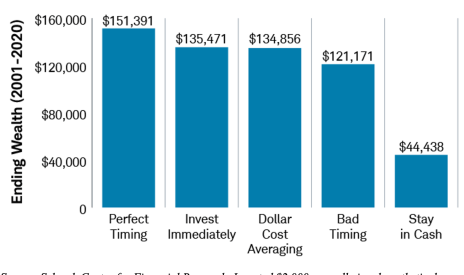

Schwab offered an example of five investors who invested $2,000 each year and plied their differing strategies over a period of 20 years (2001-2020). Here were the results:

Investor #1 was a perfect market timer (impossible, but fun to think about!). He got in and out at just the perfect times, cashing in at the highest points, and re-entering at the lowest points. His results: $2,000 turned into $151,391.

Investor #2 didn’t dilly-dally; she put her money to work as soon as she got it. She accumulated $135,471—only $15,920 less than the perfect market timer.

Investor #3 decided that dollar cost averaging was going to be his strategy. That means he decided to divide his money up and buy in smaller amounts at regular intervals, regardless of price. He turned his investments into $134,856 at the end of 20 years.

Investor #4 was like most investors—a very bad market timer, getting into and out of the markets at just the wrong times. Yet, she still managed to end up with $121,171 with bad timing.

Investor #5 elected to stick his head in the sand, and just put his money in the bank. I hate to tell you this, but his annual $2,000 contributions amounted to a measly $44,438—after 20 years!

In Other Words - Stay Invested in a Down Market!

The moral of this story, as you can see in the below graph, is that market timing isn’t the best strategy, but it is almost three times better than hoarding your cash. There’s a big opportunity cost in holding cash: the cost that could be realized if your money was utilized in a better investment. Now, just think if you were investing more than $2,000 per year—the gains would be incredible!

Source: Schwab Center for Financial Research. Invested $2,000 annually in a hypothetical portfolio that tracks the S&P 500® Index from 2001-2020.

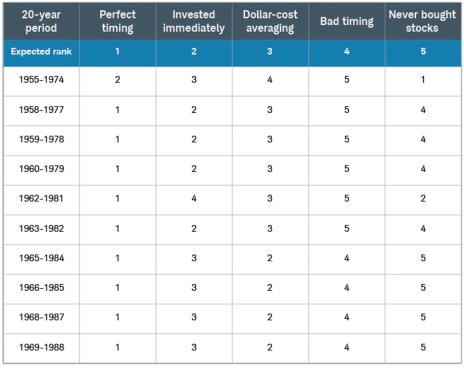

This is just a piece of Schwab’s total analysis in which the company reviewed a total of 76 separate 20-year periods. The results were essentially the same as these five scenarios.

As you can see, only 10 of 76 periods had unexpected rankings. That’s a pretty good reason for staying invested, in my opinion.

Here are a couple of specific real-world examples, related to our various Cabot advisories.

In December 2011, my colleague Tim Lutts recommended a little stock called Tesla (TSLA) to his Cabot Stock of the Week readers, when it was trading at a mere 6 per share. It wasn’t exactly a time when many people were buying stocks: the S&P 500 was at the tail end of a rough second half of 2011, down about 6-7% from its July 2011 peak. Tim’s Tesla stock recommendation has turned out fairly well: readers who bought on his recommendation and have held on through every market correction since (as Tim has) have a tidy 9,739% return!

A more recent example of our analysts recommending stocks during a time of market turmoil, and having it pay off quite handsomely, is a small-cap stock called Repligen (RGEN). Tyler Laundon recommended the little-known biotech to his Cabot Small-Cap Confidential subscribers in November 2018 and added more shares in late December of that year. Mind you, the fourth quarter of 2018 wasn’t an easy time to be an investor – the S&P came within an inch of bear market territory, falling 19% from mid-September through Christmas Eve.

And yet, Tyler recommended RGEN in early November then doubled down just before New Year’s. The result? A 182% return in three and a half years, nearly tripling the 65% return in the S&P 500 over the same span.

There are countless other examples, but these are two that came quickly to mind. It pays to stay invested in the stock market, even during turbulent periods like the one we’ve been mired in through the first half of 2022. Don’t take all your money out of your investment account and put it in some low-yielding savings account. While things may seem grim now, eventually they’ll turn around – they always do. And when they do, you’ll be happy you didn’t sell out of all your stocks.

If you need help picking which stocks to buy now, we at Cabot have 17 different investment advisories recommending new stocks at this moment! To find out which advisories are right for you, click here.

What are examples of big winning stocks you’ve held onto for years by staying invested in all market environments? Tell us about them in the comments below!

[author_ad]