If you’re bracing for a September stock market correction, you’re not alone. It’s a sentiment shared even by people who don’t actively invest. To wit…

The other day, I was taking my dog for one of the dozen or so daily walks she insists upon (only slightly exaggerating) when I bumped into a neighbor who loves dogs and loves to talk. We covered a wide range of issues – how the start to the school year is going (we both have young kids), when vaccines might be available to them (they’re all under 12), how fortunate we were to have narrowly dodged Hurricane Ida (we live in Vermont). Most of our chit-chat was banal, with no strong opinions offered. Then the stock market came up.

“My goodness,” my neighbor blurted out, “how can stocks still be so high?!”

Good question. Mind you, this woman is not an active investor – she mentioned something about her IRA. Nevertheless, given all the turmoil in the world right now (damaging hurricanes, the Delta variant running wild, the ugliness of the Afghanistan exit, supply-chain shortages, businesses struggling to hire people, inflation worries, etc.), she felt that stocks had risen too far too fast. In fact, she felt stronger about that than her kids’ vaccination eligibility timeline or our neighborhood general store (again, this is Vermont) closing down for 10 days because it couldn’t find enough workers.

[text_ad]

Granted, this is just one woman’s opinion. But it’s one that I hear every time I talk to people – neighbors, acquaintances, friends, family members. When the subject of the stock market comes up, they all want to know how and why stocks continue to be so high during a time of such profound global volatility. And it’s a fair question.

But stocks don’t fall just because the majority of people think they should. Stocks fall when the big institutional investors start selling. And for the past 204 trading days (dating back to October 2020), they haven’t been selling – that’s how long it’s been since the S&P 500 last fell by at least 5%, the fifth-longest streak in the history of the index.

Since last Halloween, the S&P has advanced more than 38%. That’s a big 10-month jump in normal times – and an astoundingly massive leap for the middle of a once-in-a-century global pandemic.

Still, as my colleague Tim Lutts likes to say, stock market rallies don’t die of old age. And neither will this one. In fact, I think a year from now, stocks are likely to be higher than they are today – perhaps much higher, depending on how quickly Covid-19 (hopefully) fades.

But I do think a correction of at least 5%, and perhaps 10% or more, is imminent. In fact, a September stock market correction of some kind seems likely. Here are three reasons why:

3 Reasons to Expect a September Stock Market Correction

1. September is Historically the Worst Month

Since 1928, the S&P 500 has fallen an average of 1% in September – easily the worst of any month, according to Yardeni Research. The next-worst months are February and May, tied with an average loss of a mere 0.1%.

Why all the September selling? Because that’s when the hedge funders return from their summer vacation in the Hamptons and start selling off their biggest losers. With so much sector rotation in recent months – dating all the way back to February – they are bound to have plenty of laggards. So, starting this week, with Labor Day in the rearview mirror and Wall Street back in full swing, expect to see some selling. As the historic September numbers suggest, chances are it will last a few weeks – perhaps even the rest of the month.

2. Stocks are Overvalued

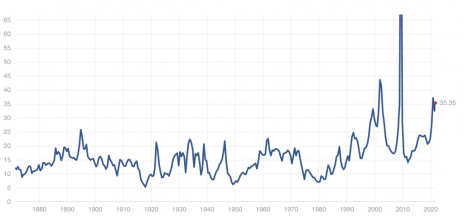

I’m not a value guy, per se, but it’s hard to ignore a price-to-earnings ratio of 35. That’s the trailing twelve-month P/E of the S&P 500 as of this writing, matching the highest reading since last December (39) and more than double the median P/E ratio for the index of 14.86, which dates back roughly 150 years.

True, stocks have been trading at elevated valuations for more than a year now – the S&P hasn’t traded at less than 30 times earnings since May 2020, coming on the heels of the ratio being in the low 20s for years prior to the post-Covid crash rally that started in March 2020. Still, the high P/Es have done little to scare investors out of stocks. But as this chart, courtesy of Multipl.com, shows, large spikes in the benchmark index’s price-to-earnings ratio typically don’t last long, and are usually followed by a sharp decline.

3. Investor Sentiment is Growing more Bullish

It’s counterintuitive to think that increasing bullishness among investors is a bad thing. But it is. When investors become overly bullish, it’s usually right before the selling begins.

Right now, investor sentiment is starting to get bullish again. After dipping as low as 33% bullish on August 18 – just two weeks ago – the AAII Investor Sentiment Survey, which every week surveys where its members feel the market will be in six months, has zoomed up to 43% bullish, a two-month high. That’s above the historical average (which dates back to 1987) of 38%, but below the one-year high of 56.9%.

So, while investor sentiment isn’t too out of whack yet, it’s escalating very quickly.

Conclusion

We try to stay away from stock market predictions here at Cabot. We’re trend readers and market timers – our growth investing expert Mike Cintolo is named one of the Top 10 Market Timers by the Timer Digest on almost an annual basis, including last year. And while he has been telling his readers that all signs are pointing to higher stock prices in the next six months to a year, he has repeatedly warned them to expect a correction of some kind before the next true rally ensues.

Here’s hoping it does. While market pullbacks can be scary and frustrating in the moment, they’re almost always for the best in the long term. A 5% or 10% dip is a chance to buy stocks at discounted prices. And it often sets the table for a market rally that can last weeks or even months.

So don’t fear a September stock market correction. Embrace it when it comes. If you play it right – selling out of your weakest stocks, keeping your more neutral performers on a tight leash – you can avoid too much pain in your portfolio, and have plenty of cash ready to go for the next leg up.

The big upward swings are when the real money is made. And they typically follow some sort of market correction.

Where do you see the market going from here? Are you bullish about the next couple months or expecting a pullback?

[author_ad]