Itching to get back out there and buy stocks again? Well, I’ve got some good news.

If you’ve been reading me for a while, you know I’m not a big predictor of what the market is going to do. I do time the market, of course, but that is mostly based on the trends of the major indexes and the action of leading growth stocks—interpreting whether big investors are accumulating or distributing key stocks and averages. That’s why Cabot Growth Investor’s Model Portfolio held at least 70% cash (very defensive for us) from early October through year end.

But, starting with the action in late December, there have been three separate, very unusual things that have occurred that are leading me to make a rare prediction: I think the market’s bottom is in, and while the next few weeks will probably be tricky (earnings season and such), I believe 2019 is going to be a great year to buy stocks.

So what is it that’s prompting me to make a prediction like that? Let’s go over them.

Reason #1 to Buy Stocks: Historic Oversold Readings at the December Low

I’ve written this before, but it still amazes me when I think about it—on December 20, 21 and 24, there were more than 1,000 stocks that hit new 52-week lows each day on both the NYSE and Nasdaq. The only other comparable time of such throw-the-baby-out-with-the-bathwater action was in October and November 2008. There have been single-day occurrences during big-market declines in recent years (2011, 2015, etc.), but not multiple days in a row.

[text_ad use_post='129627']

Even when you look at new lows as a percent of all stocks on the exchange, it’s a similar story—the December selling was one of the most intense seen over the past few decades. I wouldn’t buy just because a market has become “oversold,” but these periods of huge new lows (even the 2008 example) have in the past led to excellent one-year returns in the overall market.

Reason #2 to Buy Stocks: Extreme Pessimism at the Lows

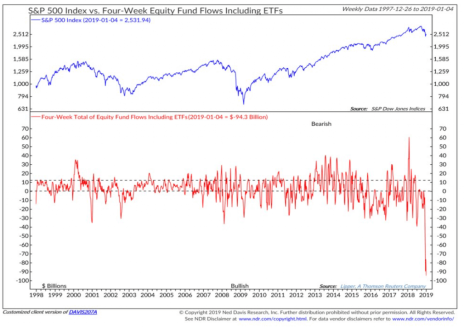

Not surprisingly, the December mini-crash finally caused investors to throw in the towel. There are many sentiment measures out there, but one of my favorites measures is real money flows—one of the indicators we follow in every issue of Cabot Growth Investor, for instance, simply looks at the amount of money flowing into and out of equity funds and ETFs. I like it because we’re talking about real money, not opinions.

Below is a similar measure to what I follow—the four-week sum of money flowing into (or out of) equity funds and ETFs. As you can see, panic was gigantic in December, with more than $90 billion cascading out of equities in a four-week span, by far the largest amount going back 20 years. (Chart courtesy of Ned Davis Research.) There’s no doubt that there was a stampede out of risky assets near year end, something that usually happens near important lows.

Reason #3 to Buy Stocks: A Rare Blastoff Indicator Gives a Buy Signal

Finally, the first two weeks of the market rally were not just good to see, but featured such amazing breadth that our 2-to-1 Blastoff Indicator gave a buy signal. This happens when, over the span of 10 days, the number of advancing stocks on the NYSE outnumbers declining stocks by an average of at least two to one.

Such powerful upside momentum is rare to see; excluding repeat occurrences (those happening within six months of each other), the 2-to-1 Blastoff Signal has happened just 10 other times since 1960—three months later, the S&P 500 has rallied as much as 12%; six months later, as much as 18%; and a year later, as much as 25%! Thus, even though the market is “overbought,” it tends to be a “blastoff” signal, leading to much higher prices down the road.

Possibly more important, the vast majority of these signals flashed near major market low points that often preceded good runs that lasted much more than just one year. The last one, in July 2016, did see the market sag for the next three months (into the uncertainty of the Presidential Election), but of course, stocks then boomed for the next 15 months.

What’s the Caveat?

Like I said above, the combination of the three factors above—historic oversold readings, crazy pessimism at the lows and then the blastoff buy signal—tell me the odds strongly favor that the worst is over. That said, I want to be clear that I’m not a raging bull right this second.

First off, my longer-term trend model (called Cabot Trend Lines) remains negative, as most major indexes are sitting below long-term moving averages. Said another way, there’s still a good amount of overhead resistance to chew through for most stocks and sectors.

Second, in the short term, we have earnings season and the market has just enjoyed four good weeks on the upside (reversing some of the investor pessimism mentioned above); given that the Nasdaq rallied 1,000 points off its lows, some sharp retrenchment and/or partial retest of the lows is possible in the weeks ahead.

Conclusion

Overall, I’m increasingly optimistic that there will be good money made this year, and moreover, that the upside will probably surprise the experts that are focused on Fed speeches, U.S.-China trade rumors and the like. But I’m also not ignoring the headwinds that are still out there.

My advice: Put on your optimist’s hat, and if you have a ton of cash, don’t be afraid to do a little buying, and then, if you develop some profits, to buy some more. Just be sure to pick your spots in the near term.

One name I think you can keep an eye on: LendingTree (TREE), which had a rough 2018 overall, but etched a nice-looking bottoming formation for a few months and has turned very strong of late. Fundamentally, it’s the largest online lending marketplace, bringing together millions of loan seekers with a ton of large loan providers in a variety of lending fields. While mortgage-related revenue is down, non-mortgage products (credit cards, insurance, personal loans, etc.) are booming; even with an expected 10% decline in mortgage loans this year, LendingTree’s management sees earnings up 30%.

Like so many stocks, there’s still overhead resistance to chew through, but starting a position on dips and looking to add shares if the stock and market head higher is one idea.

There are plenty of other growth stocks shaping up nicely as the market recovers. After reducing my Model Portfolio to just one stock at the height of the market turmoil in December, I now rate five stocks as “buys” in the Cabot Growth Investor advisory. To learn their names, click here.

[author_ad]