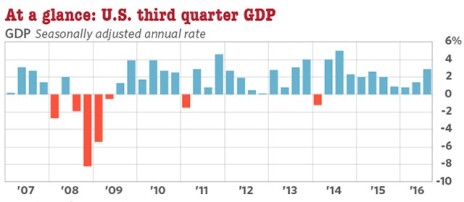

Last Friday, the Bureau of Economic Analysis gave us some long-awaited good economic news, announcing that third-quarter Gross Domestic Product (GDP) growth came in at 2.9%, the highest growth in two years.

One category of spending that stood out was Business Investment in Structures, which rose 5.4%, compared to the 2.9% decline in the prior quarter. And that bodes well for many industries, particularly companies in the cyclical building trade—businesses like Jacobs Engineering Group (JEC).

Bob Howard, Editor of Positive Patterns, recently recommended Jacobs Engineering in my Wall Street’s Best Investments. Bob has been a contributor to Wall Street’s Best Investments for many years, and has an impressive track record of recommending undervalued stocks with great potential.

Here’s what Bob Howard had to say about Jacobs Engineering

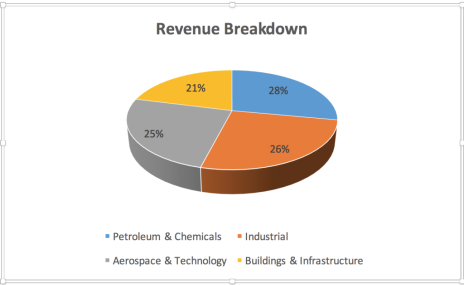

“Jacobs is a high-quality Global Engineering and Construction firm that is first class in every way. JEC has a market cap of about $6 billion and no net debt. The balance sheet is strong, and free cash flow is excellent. Revenue this year should be around $11.4 Billion, which is below peak numbers and about the average number for the last 5-7 years, as business has been flat.

“The building and infrastructure trades are deeply cyclical, and it’s been 8-10 years since business was really good. I think the need for what JEC does is about to break loose, and we should see a bulge in the backlog business starting next year. This is an ideal time to buy this cyclical company; it should make a good, 3 to 5-year trade.

“JEC plans, designs, builds, and maintains projects. The slowdown in the economy over the past decade has resulted in a build-up of demand for the future. Just take a look at infrastructure; we all know the USA needs a ‘fix’—roads, bridges, buildings, and so on. And don’t forget power plants—as the global population continues to expand, there will be increased demand for power. Already, too many power plants are running at capacity (and above).

“JEC mentions three sectors that should show strong bookings ahead, areas where the company feels confident business will be “good” and maybe better than that. These include road infrastructure, cybersecurity, and Life Sciences.

Acquisitions and Cost-Cutting Lead to Bottom-Line Growth

“The company has made 16 different acquisitions since 2011 in areas of future growth (especially environmentally-related business). And there is potential here for much higher earnings. A strong balance sheet strong and handsome free cash flow has prompted JEC to buy back stock. Additionally, the company has recently completed a comprehensive cost/reduction program, which should show up in the numbers as early as the next quarter.

“JEC has a good track record in a very tough business. Competition is brutal, and margins are fairly thin. But despite the problems in the construction business, JEC has continued to thrive, grow, stay out of trouble, and maintain a good, solid balance sheet.

“Earnings have been fairly steady—$3.23 in 2013, $2.96 in both 2014 and 2015, and probably about $3.00 this year. Hopefully, we’ll see JEC break out of the earnings doldrums in 2017-18, as the order book picks up. The consensus EPS is $3.08 this year and $3.25 in 2017. I believe those are modest expectations, and also think we will see much higher earnings by 2018.

Shares are also Technically Attractive

“If you were to draw a line from the ‘top’ of the chart in 2009 at the $103 area, to the ‘top’ of the 2014 area of $67, you would see that the breakout area to end this downtrend is the $60 area. If JEC can break $60, this pattern will turn positive and we should see a very rewarding rally, along with some nice volume expansion.

Jacobs Engineering—founded in 1947—is clearly an example of ‘down, but not out.’ Right now, the decline of its shares—combined with the promise of a resurgence of spending in its customer base—presents an excellent buying opportunity, as Bob Howard notes.

As you can see from the following chart, the revenues at Jacobs Engineering are well-diversified. Typical projects include oil refineries, manufacturing plants, and roads and highways. Uncle Sam comprises some 20% of its sales, and is the company’s largest single customer. But with more than 200 offices in over 25 countries, it is far from the only customer needing Jacobs’ services.

And as the economy continues to pick up, post-recession, Jacobs’ opportunities will also expand. And already its backlog is reflecting this.

Infrastructure is at a Critical Level

Bob mentioned three prime areas that show strong bookings: infrastructure, cybersecurity and Life Sciences.

As we are aware, much of this country’s infrastructure dates to the 1950s and 1960s. The condition of our infrastructure is so bad that the American Society of Civil Engineers gives it a grade of D+.

The EPA says we need to spend $384 billion on America’s drinking water treatment and distribution systems over the next 20 years. Almost 20% of our roads are in poor condition, according to the Federal Highway Administration. And the U.S. Department of Education found that over half of America’s public schools need to be repaired, renovated or modernized.

No doubt, improvements are coming, but have been slow to arrive. State and local governments took a big hit during the recession and spending on infrastructure is at a 30-year low. But most industry experts believe it has reached almost a crisis point, and that infrastructure spending will begin to rise, most likely by the federal government loosening its pocketbook to encourage state and local spending.

Cybersecurity is Booming

Whereas infrastructure dollars are hard to come by right now, cybersecurity is an area that is booming. The market is forecast to expand from $122 billion in 2016 to $202 billion by 2021, at a compound annual growth rate (CAGR) of 10.6%. According to the Identity Theft Research Center, in 2015, more than 178 million Americans have been victims of cyberattacks—and that number has nowhere to go but up.

Life Sciences is Growing at an Attractive Pace

As for Life Sciences, the Gartner research firm forecasts that IT spending in the life sciences sector will hit $54 billion by 2019, and that rise should open up opportunities for Jacobs.

Those are just three segments of Jacobs’ market base. The company is seeing an increase in its backlog, rising to $18.3 billion as of last quarter, indicating the turnaround may be near. As well, gross margins for Jacobs rose in both quarter one and two this year. And as Bob notes, the company’s cost reduction plan is proving to be successful, with General and Administrative expenses declining by almost 10% to date.

Jacobs beat analysts’ expectations by three cents last quarter, posting EPS of $0.78, and it has raised its earnings guidance for 2016.

Consequently, the company’s organic growth looks attractive, and combined with Jacobs’ acquisitive nature, we can expect additions to the bottom line from both. And as we know, earnings lead stock prices (almost always!), so getting into the stock prior to earnings acceleration may be a good way to ‘build’ a position in this stock.