The Fed completely blew the inflation call early last year when they called it “transitory” and dismissed the threat. Inflation has since gotten steadily worse and blossomed into a huge problem. Behind the curve and embarrassed, the Fed will have to make up for lost time.

Why is that a problem for stocks? Central bank policies have been a major contributor to the stock market’s rise over the past 13 years. It has kept interest rates at historic lows. Stocks have been strong in large part because money has had no place else to go to fetch a decent return.

But the crucial underpinning of recent bull markets is being threatened by inflation.

[text_ad]

The stated mission of the Federal Reserve Bank is to promote maximum employment and stable prices. The employment goal is achieved through accommodative policies of low interest rates and quantitative easing. Stable prices can require the opposite. It involves restrictive policies like raising interest rates and pulling back on other monetary easing to slow the economy and reduce price pressures.

When the pandemic hit and the ensuing lockdowns crashed the economy back in early 2020, the Fed adopted a hyper-accommodative policy to stimulate a recovery. It lowered the Fed Funds rate (the benchmark short-term interest rate) from 1.6% to between 0% and 0.25%, where it remains today. The Fed also implemented a $120 billion per month bond-buying program to pump liquidity into the banking system and hold longer-term interest rates low.

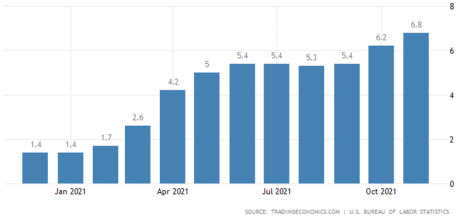

Right now, the maximum employment side is great. The unemployment rate is 3.9%, lower than previously thought possible. There are more job openings than applicants. That side is covered. It’s the stable price side that is getting out of hand, as the below monthly inflation chart (courtesy of Trading Economics) shows.

The Fed’s objective is to keep inflation at about 2%. As you can see from the chart, it has been well above that since last March. The December number came in at 7%, marking the eighth consecutive month of inflation over 5%, as measured by the Consumer Price Index. And it may get worse.

Rising Interest Rates Won’t Hurt ... At First

The Fed has already gotten religion about inflation. It ditched the “transitory” phrase and announced its intention to end its $120 billion per month bond-buying program and raise the Fed Funds rates much faster than previously anticipated to combat inflation and make up for lost time. Most observers see at least three 0.25% rate hikes in 2022, and a growing number are forecasting four.

Rising interest rates can be a problem for stocks. The market tends to be OK with the early stages of a rising rate cycle. Early on, rates are still very low, and the Fed’s tightening is a vote of confidence in the economy. But higher rates start to bite at some point.

In the last cycle, the Fed began raising the Fed Funds rate at the end of 2015. It raised the rate from the current 0% to 0.25% level to higher than 2% by late 2018. The market was solid until rates got above that 2% level. Then, the market sold off 20% in December of 2018. The Fed began lowering rates again the following year.

The lesson from the last cycle is that things are fine until late in the cycle, which normally might be years away. But things are different this time. Those measly 0.25% at a time rate hikes the Fed employed last time may not cut it in the current environment. That 0.25% pace was fine in the last cycle when there was virtually no inflation. But this time, prices are rising faster than they have in 40 years.

The Fed is way behind the curve. Current interest rates are priced for Armageddon. But the economy has been booming of late, with the highest GDP growth in many decades. GDP already well exceeds pre-pandemic levels. After having been distorted by the Fed, interest rates are not even close to reflecting the current environment.

Inflation grew 7% over the previous year in December. But the benchmark 10-year Treasury currently yields a mere 1.73%. Short-term rates are below 1%. Efficient bond markets should provide yields at pace with inflation, plus a bit more. Of course, that 7% rate may not reflect the longer-term average and it may moderate. But even at 3.5% or 3% inflation, interest rates are still miles behind reality.

So the Fed will have to make up for lost time. And there’s something else: The Fed has been embarrassed. If inflation doesn’t get fixed and becomes a long-lasting problem, the current Fed and its chairman, Jerome Powell, will have truly blown it.

The “transitory” call will go down in the annals of financial history as a blown call for the ages. Universities in the future will teach about this historic blunder and Chairman Powell will cement his place as a historical doofus. Embarrassment and humiliation can be powerful motivators.

Of course, inflation could moderate this year and next. It could peak around here and cease to be a big problem going forward. But if it doesn’t, look out. The current anticipated 0.25% rate hikes could prove woefully insufficient. It’s certainly possible that the Fed will have to raise rates much faster and higher than the market is currently pricing in. Steeply rising rates could end this bull market.

It’s a risk to consider. Beware the Fed.

How much has the prospect of rising interest rates changed the way you’ve invested in recent months: a lot, a little, or not at all?

[author_ad]