For those that know me, they know that I can be very sarcastic and the headline above, and what I write below is full of sarcasm. So take what I’m about to write with a grain of salt ... and let’s have some fun.

Let’s start here …

The leader of the “meme” stock revolution is a man named Keith Gill who goes by the name “Roaring Kitty” online. And having made several million dollars pumping stocks like GameStop (GME) in 2021, Gill quietly disappeared from public life, until …

A couple weeks ago, Roaring Kitty started posting videos to Twitter/X signaling that he was back. This sent shares of stocks like GME and AMC (AMC) surging higher.

However, that big move higher in meme stocks was short-lived as these stocks came crashing back to their lows just a couple days later.

[text_ad]

And while the stocks were falling apart again, my options scanning tool picked up on big call buying in GME, focused on one particular option. Here was that trade:

Buyer of 120,000 GME June 20 Calls for $5.50 – Stock at 22

I didn’t know who was risking $66 million in buying these June calls, but it was something that piqued my interest!

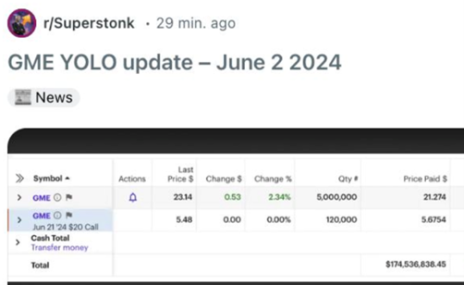

And just two weeks later, on Sunday, June 2nd, Gill made it clear that he was the big buyer when he posted this snapshot of his brokerage account:

Gill had bought 5 million shares of GME at an average price of 21.27 and had bought 120,000 calls at an average price of $5.67.

So how did the market react to this “news”? GME traded as high as 41 on Monday morning, which meant his stock position had gained $100 million and his options position had appreciated in value by approximately $185 million.

Not bad!!

Next up on the tongue-in-cheek trader Hall of Fame ballot is Nancy Pelosi and her husband (trust me this is NOT a political take).

The former House speaker reported a portfolio gain of 65% in 2023, which easily beat the S&P 500’s gain of 24% on the year, and much like Roaring Kitty above, the Pelosi pair used options to gain leverage in their portfolios, though in the case of the Pelosi family, they bought calls on more classic stocks like Nvidia (NVDA) and Palo Alto Networks (PANW).

And in fact, this is hardly the first time the Pelosi family has easily beaten the market, having often bought and sold positions right before news broke. So much so, another friend of ours in Washington D.C. introduced the PELOSI Act, noting. “While Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other, hard-working Americans pay the price. The solution is clear: we must immediately and permanently ban all members of Congress from trading stocks.”

Again, I’m not going to get into the political world as you don’t want my opinion on these matters, however, other traders have seen this outperformance as an opportunity, and have created “Pelosi Portfolios” looking to mimic her stock and options trades.

Stepping back, no one is going to seriously compare the trading chops of a guy nicknamed Roaring Kitty or Nancy Pelosi to Warren Buffett or Stanley Druckenmiller … however, you have to shake your head and smile at how money is made in the market these days.

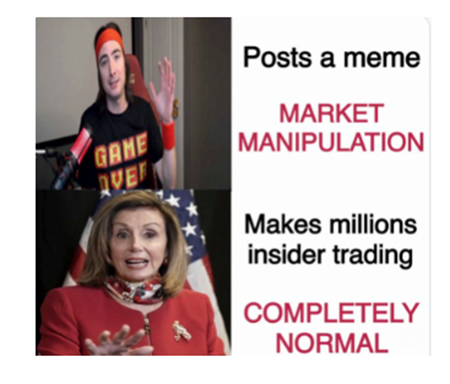

And finally, below is a somewhat funny meme sarcastically pointing out how the GME/AMC guy’s trades are perceived versus how some of our politicians successfully invest:

[author_ad]