Should You Sell in May and Go Away?

I’m sure you’ve heard that old adage, “Sell in May and go away.” But did you know that historians believe it dates back to an old English saying, “Sell in May and go away, and come back on St. Leger’s Day”? The latter reference is to the St. Leger’s Stakes, a thoroughbred horse race held in mid-September and the last leg of the British Triple Crown. The rhyme became relevant in the U.S. around World War II.

Essentially, the strategy is based on the Halloween Indicator, which posits that the stock market is significantly stronger from November to April than in the May-through-October period.

I’ve seen plenty of studies allegedly “proving” this point, but like any data, if you choose the right time periods, you can align the conclusion with almost any theory you may concoct.

But the most recent stats I’ve seen are the result of a Bloomberg study which looked at the 1988-2017 time period—and not just in the U.S. Their conclusion: American stocks fared much better than their Asian and European counterparts.

[text_ad]

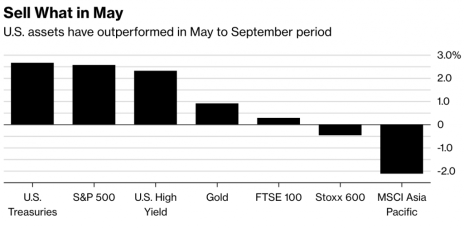

U.S. assets have outperformed in May to September period:

Source: Bloomberg

Note: Median return from May 1 to Sept. 15 (1988-2017)

According to the study, the return for MSCI Asia Pacific Index from May 1 to September 15 (the 2017 date for Britain’s St. Leger Day horse race) was -1.2%; the European Stoxx 600 didn’t do much better, turning in a -1% loss and the FTSE 100 posted a -0.4% return.

During that same 30-year period, the S&P 500 returned 1.2%. Furthermore, in 10 of those 30 years, U.S. stocks were also negative, but Asian and European stocks suffered more, showing losses 19 and 16 times, respectively.

Jeffrey Hirsch, editor of the well-respected Stock Trader’s Almanac, and a contributor to our Wall Street’s Best Investments and Wall Street’s Best Dividend Stocks newsletters, recently issued a ‘be ready to trade’ alert on this subject, saying, “May officially marks the beginning of the ‘Worst Six Months’ for the DJIA and S&P. May has been a tricky month over the years, a well-deserved reputation following the May 6, 2010 ‘flash crash’ and the old ‘May/June disaster area’ from 1965 to 1984. Since 1950, midterm-year Mays rank poorly, #9 DJIA and NASDAQ, #10 S&P 500 and Russell 2000, #8 for Russell 1000. Losses range from 0.1% by Russell 1000 to 1.9% for Russell 2000. Since April 2 we have been watching for the seasonal MACD sell signal. It has not yet triggered. When it does, we will issue an email alert with trading ideas for weathering the ‘Worst Six Months,’ May to October.”

Lastly, Mark Hulbert, publisher of the Hulbert Digest, looks at the strategy in a different light. In an article he published last year, he concludes that, “New research finds that this pattern’s historical track record can be traced to only a few years, specifically, the third year of the presidential four-year term. During the other three years of the four-year term, in contrast, the pattern is statistically non-existent.”

The study was performed by Kam Fong Chan, a senior lecturer in finance at the University of Queensland in Australia, and Terry Marsh, an emeritus finance professor at the University of California, Berkeley, and CEO of Quantal International, a risk-management firm for institutional investors.

So, what’s an investor to do? I don’t have to tell you that if you jump around, trying to time the market perfectly, you are going to miss out on the very best days with the greatest gains. It’s just impossible to do this 100% right, all the time. Certainly, there are indicators that we follow very closely at Cabot to warn of major directional changes in the market, and Mike Cintolo, Paul Goodwin, and Tim Lutts are very good at that specific market timing. Yet, the market never repeats itself exactly, and hopping in and out of it is a pretty sure way to lose money.

Instead, I think it’s much better to fine tune a strategy to help you make money during the different seasonal cyclical periods in the market. Data on those cycles is fairly easy to discover. From there, find the sectors and stocks that look attractive.

Year-to-date, the best sectors have been Consumer Discretionary, Technology, and Energy. With tax cuts, rising earnings, declining regulation, and a better economy, there should be some excellent returns in a number of stock market sectors this year.

Brokerage firm Charles Schwab likes Financial, Healthcare, and Information Technology. Fidelity thinks that Banking, Tech-enabling Healthcare, Industrial Robots, 3-D sensing technology, and Power Providers are attractive. BlackRock Investment Institute favors Momentum, Value, Financials, and Technology stocks.

Fortunately, our newsletter contributors offer picks for each of these arenas. Here are a few stock ideas for the sell in May period - let’s call them sell in May stocks - from recent publications:

3 Sell In May Stocks

Sell in May Stock #1: Capital One Financial Corporation (COF)

From Vita Nelson, DirectInvesting.com:

Capital One Financial Corporation (COF) offers a range of financial products and services to consumers, small businesses, and commercial clients through branches, the internet, and other distribution channels.

Its current total market capitalization of $46.6 billion makes COF a large-cap stock.

According to Yahoo! Finance, consensus estimates call for it to earn about $9.83 per share this year, up from $7.25 per share last year, and to go to about $10.79 per share next year. It has paid dividends to investors since 1995 and has increased its payments for five consecutive years.

According to Morningstar, the stock is trading 21% below its Fair Value Estimate, making it attractive for investors with a long-term investment horizon. Technically (from the chart’s perspective) COF also looks attractive, trading 10% below its 52-week high.

Sell in May Stock #2: Aurinia Pharmaceutical (AUPH)

From Tom Bishop, BI Research:

Aurinia Pharmaceutical (AUPH) has slipped during the stock market correction and I think this is a good “official” buying opportunity.

Aurinia is a clinical stage biopharma company focused on the global nephrology and autoimmune markets, so there are no revenues yet. Its main focus is on its ongoing Phase 3 trial of voclosporin for lupus nephritis after completing a very successful Phase 2. Lupus affects about half a million people in the U.S. alone. About 60% of lupus patients develop kidney problems, most notably lupus nephritis, which affects between 125,000 and 200,000 diagnosed patients in the U.S. and between 175,000 and 200,000 more in Europe.

Aurinia estimates that voclosporin could be priced at $50,000 to $100,000 per year. If you take the low-end number of patients and price, just in the U.S., you get over $6 billion annual market potential. So, the company’s estimate of peak annual sales of at least $1.4 billion seems quite conservative … just for the U.S. One analyst figures $1.6 billion.

All five analysts covering AUPH rate it a Buy with an average target of $12. I agree.

Sell in May Stock #3: Southern Company (SO)

From Roger Conrad, Conrad’s Utility Investor:

Southern Company (SO) is now the highest-yielding stock in the Dow Jones Utility Average.

In late February, Moody’s Investors Service rated the outlook for Southern Company’s Mississippi Power unit “positive,” citing a workable settlement between the utility, regulators and customers for final cost and rate recovery at the Kemper power plant.

Although investors shouldn’t expect an encore performance of the 70% earnings growth that Southern Company posted in the fourth quarter, the underlying numbers highlight tailwinds with staying power: a superior 12.4% return on equity for regulated projects, steady 1% customer growth, a 3.5% uptick in industrial sales, and annual growth of 9% in the gas utility’s rate base.

Trading at 14.7 times earnings, Southern Company rates a Buy for patient investors.

Bottom Line

As always, make sure that any investment you buy fits into your overall strategy and risk comfort. And don’t lose any sleep over timing the market; just stay on your tried-and-true path of buying good stocks with excellent prospects.

[author_ad]