Remember the bull market of the late 1990s, when growth stocks were screaming higher day after day as internet stock mania lured otherwise sane people into quitting their jobs and becoming stay-at-home day-traders? Back then, it was common for hot stocks to move 5%, even 10%, in a day! Today, by contrast, a 3% move gets headlines; most stocks are trading far more placidly. In fact, market volatility has been so low that the Volatility Index (VIX) recently logged its second lowest closing ever!

Granted, low market volatility is calming—in a way—but the thought of this placidity also triggers in my mind the old saw, “Never Sell A Dull Market Short.”

That’s because experience has shown that a period of low market volatility is often the calm before the storm—and the storm is often a buying frenzy that sends stocks soaring to new heights.

[text_ad]

No one expects that today, especially since we’ve already had a good advance since last November’s U.S. election. There are far more people warning of bubbles now than blastoffs.

The Most Bullish Chart I Know

But I’ve learned to expect that the majority are frequently wrong.

Plus, I’ve learned that optimism pays much better!

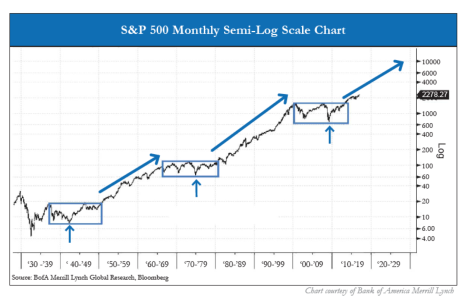

So today, I want to show you the most bullish chart I know.

It’s a simple chart, starting at the market’s famous 1929 peak. It shows the long tedious healing period that came next (including the Great Depression), followed by a solid 16-year advance, including the fabulous era of the Go-Go Stocks of the 1960s.

It shows the tedious market of the 1970s, when inflation without growth (stagflation) bedeviled economists, and the wonderful 19-year advance that followed, which ended with that 2000 market mania.

And it shows the ensuing 14-year consolidation period (including the recent Great Recession), followed by the kickoff of our current still-young advance—which is likely to end in a frenzy of bullishness yet to be named.

It’s surprising that so few people get exposed to charts like this—because these charts are not at all hard to read. But most people are too focused on the short term—which generally means the short-term problems of the day.

But if you want to do better than the average investor, you’ve got to think differently. Ignore the day-to-day news that every one else is reading and watching. Look at long-term charts. And find yourself some undiscovered stocks that have great upside potential.

Today I’ll give you two of these stocks, one for investors focused on growth, and one for investors focused on value.

One Great Growth Stock

This is the kind of chart that Paul Goodwin calls a “tractor.”

It just keeps pulling ahead, muscling through the market’s rough spots like a wild boar going through a garden.

And with good reason!

This company is the number one operator of hotel rooms in China, with roughly 2,770 hotels in operation and more than 700 in development. Some of these hotels are leased and some are franchised, but the majority are “manachised,” meaning the company installs onsite managers who work with the franchisees.

In the latest quarter, revenues were up 4% from the year before to $240 million, while earnings were flat, at $0.20 per share. But that was a rare slow quarter and investors are clearly looking ahead. In fact, analysts are estimating that earnings will grow 24% this year ad 22% in 2018.

This stock was first recommended by Paul Goodwin of Cabot Global Stocks Explorer (formerly Cabot Emerging Markets Investor) in March 2016, and just a couple of days later, I echoed Paul’s recommendation by adding the stock to the portfolio of Cabot Stock of the Week. A year later, investors who followed our advice are looking at profits of roughly 70%.

To learn the name of this stock, which we still have rated Buy, you have two choices:

You can join Paul’s readers, and focus on the exciting world of emerging markets investing.

Or you can join my readers, and get a whole smorgasbord of stock recommendations, from aggressive growth stocks to high dividend-payers to deeply undervalued stocks ripe to rebound.

One Great Value Stock

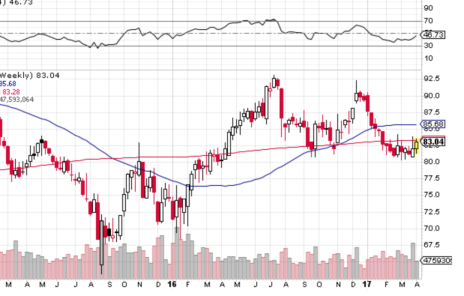

Speaking of deeply undervalued stocks ripe to rebound, how about this chart?

This stock—a major integrated oil company you’ve certainly heard of—is not only 10% off its recent high, it’s also a real bargain. New deepwater drilling programs, combined with improved efficiencies, are expected to yield impressive earnings growth of more than 100% this year. Plus, the stock yields 3.6%!

You can learn its name, and get the most up-to-date recommendation, by becoming a regular reader of Crista Huff’s Cabot Undervalued Stocks Advisor. Crista has three portfolios—Growth, Growth & Income, and Buy Low Opportunities, all with a wide selection of undervalued stocks for you to choose from. Details here.

The sooner you start, the better.

[author_ad]