Snap, Inc. (SNAP), parent company of the popular photo-sharing app Snapchat, reports its first quarterly earnings as a public company later today. Some hope that positive results will be a savior for this moribund stock, which has been floundering since the day it came public. Who could have foreseen such a fall from grace? Lots of people actually, including yours truly. Before it came public, I outlined the reasons “Why You Should Avoid the Snapchat IPO.”

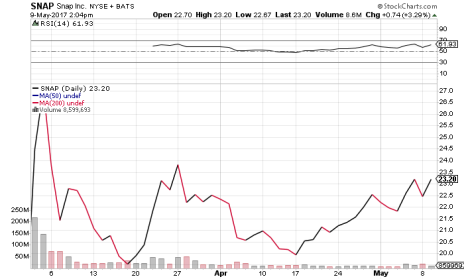

On March 2, SNAP stock opened its first day of public trading on the New York Stock Exchange at 24. Two weeks later, it was down to 19, and the stock hasn’t eclipsed 23 since. In essence, SNAP has been a loser from the get-go (see chart).

Perhaps that could change later today. Expectations are understandably tepid for a company that has never turned a profit: analysts estimate losses will come in at $0.19 per share. For the year, Snap is projected to lose $0.51 per share. Those are low bars, so a “beat” on SNAP’s first earnings go-round could push the stock above 23 resistance.

[text_ad use_post='129622']

But that would be a minor victory for a stock that had so much hype. Given the lack of profits and no turnaround in sight, it could take a while for Snap to fully right the ship. In fact, that was my primary reason for caution about the Snapchat IPO two months ago.

Here’s what I wrote:

“The company is nowhere near profitable, and its losses are deepening. Last year, Snapchat lost $514 million, up from $373 million in 2015. Twitter’s losses were even greater ($645 million) the year it came public, but its revenues ($665 million) were much better than Snapchat’s.

“Having lost more than half a billion dollars in 2016, it could take Snapchat years to get in the black. Just ask Twitter. But that didn’t stop early backers of the Snapchat IPO from pumping up the valuation to irrational levels. SNAP started with a market value of $23.6 billion—just shy of Twitter’s $25 billion market cap upon its debut.

“Facebook had been around for nearly a decade when Mark Zuckerberg finally took it public. It raked in $3.7 billion in sales and $1 billion in net income the year before its market debut. Facebook was a mature social media company, and even it struggled mightily after its IPO.

“Twitter, a far less mature (though universally recognized) company, got an early hype-fueled surge in its first couple months of trading, but has been spiraling downward in the three years since.

“Snapchat is even less mature; it’s been around for five years, it only started to monetize by selling ads last year, even its founder (Evan Spiegel) is just 26 years old! But it’s a big name that most people know, with plenty of growth potential, and that makes it intoxicating for early backers and investors.”

Fortunately, most investors didn’t take the bait, recognizing that the Snapchat IPO was overpriced. I sincerely hope you were part of the majority.

Now, that doesn’t mean SNAP won’t become a good investment after a few quarters of impressive sales growth and narrowing losses. It’s still a promising company with a popular, mainstream product. But like most high-profile IPOs, the Snapchat IPO was doomed because the hype exceeded the company’s fundamentals.

Moral of the story: avoid initial public offerings. Especially when they’re from a fledgling social media company.

You should, however, invest in the fast-growing stocks with strong fundamentals. One advisory to consider is our Cabot Top Ten Trader which features liquid momentum stocks that are poised to jump on earnings. Just this year, our readers grabbed 53% gain in Clovis Technology, 49% gain in Coherent, 38% gain in Applied Optoelectronics and many others.

For more information, click here.

[author_ad]