Speculative trading by stock market investors is on the rise, prompting some to claim markets are approaching a bubble that could soon burst.

We’ve seen signs in many different data points recently. First, the volume of call options has been consistently exceeding puts for some time. This is especially true for small-size option transactions, or “odd-lot” call option buyers.

Second, the record-setting level of initial public stock offerings (IPOs), especially among the so-called “blank-check” companies, is another sign of potential market excess.

[text_ad]

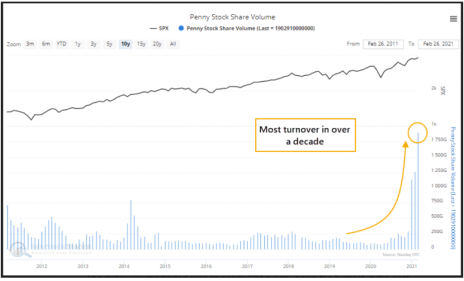

Last week, analysts at Sentimentrader raised another red flag, as you can see below.

The latest data through the end of February shows that the volume of penny stocks traded reached nearly 2 trillion shares. That’s the highest turnover in more than a decade.

And it adds up to the highest dollar volume in speculative penny stocks traded (at $84 billion) in the last 30 years. In fact, the only time penny stock volume was higher than last month was all the way back in the first quarter of 2000.

On the other hand, there are also a number of positive indicators, including strong market breadth, which tells a different story.

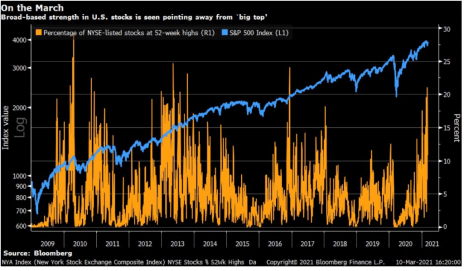

For instance, the number of stocks traded on the New York Stock Exchange (NYSE) making new 52-week highs has been climbing steadily over the past 12 months, according to a recent Twitter post from Schwab’s Liz Ann Sonders. Likewise, we’re seeing strong buying interest from investors, as you can see in the below chart (courtesy of Bloomberg).

This tells me that market breadth in the more established companies listed, i.e. those listed on the NYSE, remains quite strong. In other words, it’s not just low-priced speculative shares that are rallying.

Also, analysts at Bank of America Merrill Lynch noted last week that the NYSE advance-decline line remains near its highs, in spite of recent weakness. This means there are more stocks advancing higher than are falling by the wayside.

Likewise, the number of S&P 500 stocks trading above their 10-day price moving average has improved even on days when the blue-chip stock index has lost ground.

This tells me that, despite increased speculation in some areas of the market, strong market breadth adds up to nothing more than sector rotation taking place beneath the market’s surface. Investors are merely swapping some of their tech sector holdings for cyclicals like financial, industrial and energy stocks. And that’s a healthy sign for a continued bull market.

If you need help navigating this increasingly choppy market, and want to reduce risk but maintain bullish exposure, you can so by trading covered calls. New to trading covered calls, or options trading in general? I highly recommend subscribing to our Cabot Profit Booster advisory, where every week options expert Jacob Mintz offers a new covered call trade on one of Cabot’s top recommended growth stocks, and keeps a portfolio that’s diversified as possible to any outcome.

To learn more, click here.

[author_ad]