Believe it or not, I actually have a stock to recommend today: Square stock. But first, let’s talk about the African bush-sized elephant in the room: the stock market, and where I think it goes from here.

I’ve been at Cabot more than 20 years, and last week will rank right up there with the most abnormal of them all.

We all know (and felt) the damage, so there’s no need to rehash what happened. Instead, the question is what happens from here, so let’s dive into some things on my mind and action I’ll be watching closely:

After Market Meltdown, Where to From Here?

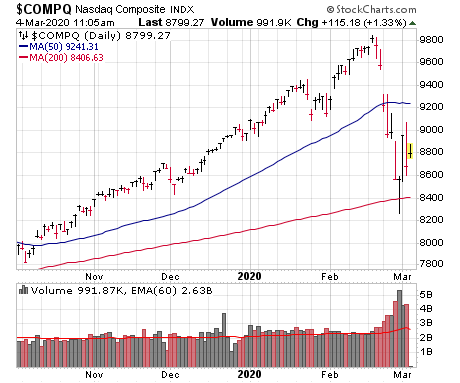

First, the rolling crash last week produced some rare oversold readings—on Friday, for instance, more than 900 stocks on the NYSE hit new lows, while more than 700 did the same on the Nasdaq. Meanwhile, the five-day advance-decline line showed just 17% gainers, which is very rare. Of course, things can always get worse, but there’s a decent chance last Friday’s intraday low (Nasdaq at 8,250 or so) can hold for a bit.

[text_ad]

That said, we’ve probably set up the classic plunge-rally-retest (or multiple retests) scenario—it takes more than just a few days in most cases for investors to reposition their portfolios and for investor sentiment to dampen. Obviously, there are no sure things, but the odds favor that the first bounce or two in the market will probably fail.

“But Mike!” you point out. “Didn’t you say the same thing in December 2018 and the market simply turned and ran higher?” Yes, I did, but two things: First, by that point, the market had been skidding for almost three months, giving people time to panic and puke. And second (and more important), we received some key “blast-off” indicators soon after that—in fact, we began buying back in in mid-January! Hey, I hope history repeats, but we have to see it happen to believe it.

What about the Fed? The rate cut (and easier policy from other central banks) is probably a longer-term positive, but it doesn’t change the dynamics of the here and now much. Just follow the market.

What about the flip side of all this—that the market has kicked off a sustained down move? I’m open to this possibility, too, especially given the “power” of the meltdown last week—such momentum could be a sign that the market is smelling something really bad. Even if it’s not a prolonged bear phase, I’m still open to the chance the “crash” phase hasn’t ended yet.

Still, when looking at the evidence, most stuff tell us it’s still an overall bull market:

- First, our long-term trend model (Cabot Trend Lines) is still positive, though it bears watching.

- Second, most leading stocks, while cracking in the near-term, haven’t yet showed any massive, longer-term breaks (like we saw out of Nvidia (NVDA) or Align Technology (ALGN) in late 2018, for instance).

- Third, prolonged down moves almost never occur when the reason for the slide is so well known right away. (The virus is the lead story on just about every news website.)

All in all, then, I’m cautious, holding plenty of cash and cutting back on most new buying. The goal here is capital preservation—there will be awesome opportunities during the next sustained rally, but the key is to get there with lots of capital and confidence. If you have some broken stuff, selling into a rally (or trailing a very tight stop) makes sense to me.

Why Square Stock is a Buy

Now, on to individual stocks. Personally, I’m content to basically wait for a new uptrend, but I’m not opposed to a little nibbling here or there if you have cash built up. Just realize that it’s going to be tricky, with lots of volatility, rotation and news-driven moves. I think what you want to look for are stocks that (a) are holding up relatively well, but (b) aren’t still miles away from support and are swinging around wildly.

One of my favorite individual stock ideas this second is Square (SQ), the popular payment firm that was a huge leader back in 2016-2018. It went dead for a long time (around year-end 2019, it was still about 40% off its peak), but growth hasn’t suffered—Square’s core payments business is still thriving (seller-driven revenue up 26% in Q4), its Capital (short-term lending) sales rose more than 40%; all in, gross merchandise value sold via Square was up 26%.

Those are positives, but the “new” aspect of the story is the firm’s peer-to-peer money transfer Cash App, a competitor of PayPal’s Venmo. However, Square has been more successful at monetizing the app through some fees for businesses (say, when a user deposits money into a bank from the app), with more opportunities going forward (it recently launched an investing feature for those on the App). At year-end, 24 million people used the App (up 60% from a year ago), and even outside of Bitcoin-related revenues, sales were $183 million, nearly double that of a year ago. Analysts see total revenues up in the 25% to 30% range this year and next, with cash flow and earnings growing nicely, too.

Square stock is still in the midst of a very long (now 18-month) consolidation, but so far in 2020, the action has been pretty solid—the stock rose seven weeks in a row, and actually found big-volume support last week. To be fair, in recent days, SQ stock has fallen off, but I’m curious to see how it acts at support near the 50-day line.

And if you want to know what other stocks I’m currently recommending to my Cabot Growth Investor advisory subscribers, click here.

[author_ad]