The Federal Reserve insists it’s “transitory inflation.” Twitter CEO Jack Dorsey tweeted (what else?) that “hyperinflation” is already happening. Others have warned that the U.S. in on the brink of rare and much-feared “stagflation.”

Who’s right? And what’s the difference for your portfolio? To examine that, let’s do a deeper dive into what each of these terms means, the last time they happened, and how the stock market responded when they did occur.

Transitory Inflation

The easiest term to comprehend is transitory inflation, which is just like it sounds: a temporary – or transitional – period of inflation. That’s what the Fed has consistently called this period of 4-5% inflation, which began in April.

[text_ad]

Last week, in announcing its intention to begin tapering its bond-buying, the Fed reiterated its transitory refrain again, saying high inflation was “expected to be transitory.” Jerome Powell and company are confident that, in the coming months, price hikes will start to ease, unemployment will continue to fall (as it did last Friday, to a Covid-era low 4.6%) and economic growth will return to pre-pandemic levels. However, Powell had previously said inflation pressures could last “well into next year,” so the term “transitory” is a bit relative; that could end up meaning an entire year.

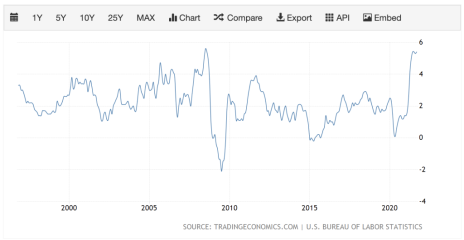

The last time U.S. inflation was this high (5.4% in September), it was indeed transitory – but not in a good way. That was in 2008, and it lasted two months (see 25-year inflation chart courtesy of Trading Economics, below), in July and August of that year—just before the Great Recession sent prices and stocks plummeting. This time, the Fed is betting (hoping?) prices will fall for the opposite reason – a booming economy rather than a cratering one.

Hyperinflation

“Hyperinflation is going to change everything,” Dorsey tweeted ominously on October 22. “It’s happening.”

Is it? In countries like Argentina, Sudan, Nigeria and (perennially) Venezuela, it is. But hyperinflation, which Investopedia defines as a “term to describe rapid, excessive, and out-of-control general price increases in an economy,” is quite rare in the U.S. It means prices rising in excess of 50% per month, with increases as much as 5-10% per day. That’s like if a gallon of milk went from $3.50 this month to $5.25 next month.

While hyperinflation is happening in certain underdeveloped nations right now, it has also occurred in much larger emerging markets such as China and Russia in the past. But in the U.S., it’s nowhere near time to press the hyperinflation panic button. And considering Mr. Dorsey also owns Square (SQ), which is contemplating getting into mining cryptocurrency – which benefits from unstable national currencies, including the U.S. dollar – I would take anything he says on the subject with a Margarita-glass worth of salt.

Stagflation

This one’s a bit more realistic. It hasn’t happened in the U.S. in roughly four decades – the last time it occurred was from 1974-1982. Not coincidentally, the S&P 500 was essentially flat in those eight years, so the effects were real.

What is stagflation exactly? It’s slow economic growth coupled with relatively high unemployment AND rising consumer prices. Or, more simply, it’s inflation paired with recession—or at least stagnant growth. Fortunately right now, we only have the inflation part, though many are concerned that once the current economic rebound loses steam that prices will remain high even as growth stagnates – or worse. As the October jobs report revealed, however, the U.S. economy is not stagnating, despite ongoing supply-chain problems and labor shortages.

The Bottom Line

It’s not worth worrying about these latter two scenarios anytime soon. Hyperinflation is little more than a Jack Dorsey fantasy; and stagflation, while a real threat that has plagued the U.S. for nearly an entire decade in the last half century, doesn’t seem close to becoming a reality anytime soon.

For now, we just have plain old inflation. And so far, the market has behaved just fine—the S&P is up nearly 15% since the beginning of April, which is the month inflation topped 4% for the first time. Wall Street seems to trust the Fed on the transitory nature of this inflation period.

And what if it’s not transitory? What if inflation stays above 4%, say, into next summer? The last time it lasted longer than a year was from 1989-1991, during the first Gulf War. And you know what? Stocks rose double-digits.

Granted, using something that last occurred 30 years ago as a guidepost is treacherous business. But it’s further proof of something investors have discovered in the last six months: inflation doesn’t kill stocks; recessions do. Stagflation would too, as those of you who were investing in the ‘70s no doubt remember. But right now, stagflation is a worst-case scenario – a spooky story to get clicks and viewers.

Don’t change the way you invest no matter how many times you hear the term – not until the unlikely event that it actually happens. And the same goes doubly for hyperinflation.

Sure, long-lasting inflation is a concern, but more because it would fly in the face of the Fed’s transitory claims – and we all know Wall Street doesn’t like surprises. But don’t let fear dictate how you invest or prevent you from buying stocks that look promising.

Not in this bull market.

How closely have you been paying attention to inflation concerns? And have you invested based on them?

[author_ad]