Just last month, on news of Russia’s imminent invasion of Ukraine, overnight futures dropped sharply with stock market futures pointing to a 2-3% decline. Stocks opened lower the next day, but an hour and half later had pared those losses to less than .5%. By the close, the S&P 500 had risen 1.5% with the Nasdaq up over 3%.

An unfortunate side-effect of our 24-hour news cycle is that investors feel the need to act on a 24-hour cycle. If you simply wake up, read the newspaper (what a quaint idea!) to see how your stocks and the market as a whole performed the previous day, then watch CNBC a bit around lunch time, stock market futures may not matter to you. In a time of such wild—and immediate—off-hours overreaction, ignorance can be bliss.

[text_ad]

The market tends to react wildly to any unexpected news, not just invasions. Just look at the night Donald Trump was elected president.

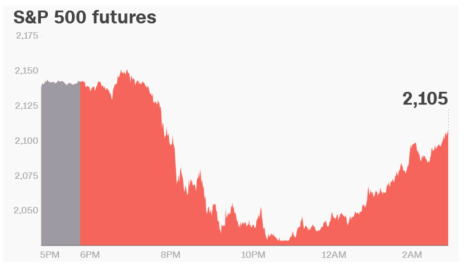

Wall Street panicked. Stock market futures plummeted, with Dow futures leading the way, falling as much as 900 points as the shock of Trump’s surprise victory set in. Take a look at this election night chart of S&P 500 futures, courtesy of CNN Money.

By the next day, that panic was magically gone, and all three U.S. stock market indexes were up slightly in Wednesday trading, kicking off a post-election rally that didn’t see a correction for nearly two years.

Stock market futures can be an interesting barometer of what to expect in the next day’s trading, but I would never trade them—nor would I buy and sell stocks based on them. If you had paid close attention to futures the night of the election or last month, it’s possible they could have influenced you to make a rash decision and needlessly sell out of perfectly good positions the minute markets opened the following day. By the time the next closing bell rolled around, you might have realized you made a huge mistake.

If that’s the case, then I don’t think stock market futures are worth your attention. In today’s 24-hour news cycle filled with multiple investing-related cable channels that draw eyeballs by instantly reacting to every market-driving (and futures-driving) event with an extreme take—either panic or euphoria—you’re better off tuning it all out. Pay closer attention to the stock charts—which, tellingly, do not include share price movement in the hours that are not between 9:30 a.m. and 4:00 p.m. eastern time. If those go south, that’s a reason to sell. A sharp drop in futures is not.

Stock market futures aren’t completely irrelevant. But they should never be relevant enough to influence your investment decisions.

[author_ad]