Share prices and oil prices aren’t often linked. But from a 10,000-foot view, a stock market-oil prices correlation does exist, to a degree.

At roughly $70 a barrel, West Texas Crude oil prices are the highest they’ve been in nearly three years. The S&P 500, meanwhile, is at all-time highs. It’s not a total coincidence. The stock market-oil prices correlation is more profound than you may have realized.

Here is a 10-year chart plotting the performance of the S&P (blue line) vs. crude oil prices (red line):

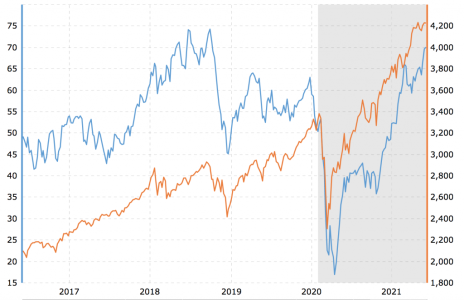

Now, stock prices and oil prices have been two very different things in the last decade. As you can see – and no doubt already knew – stocks are up big (more than 220%) while oil prices are down big (about 30%) during that time. But look at the way the two lines move; it’s often in tandem.

[text_ad]

In mid-2014, oil prices fell off a cliff, and didn’t stop falling until early 2016. During those 18 months, stocks were down too, though in a far more delayed and muted fashion; the S&P kept climbing steadily for another year, until July 2015, then fell more than 12% in the ensuing six-plus months as oil prices crashed to new lows.

For most of the next three years, oil prices recovered, albeit slowly—and so did the market. The next big price dip came in late 2018, coinciding with the infamous fourth-quarter market correction that year amid escalating U.S.-China trade tensions. Then, of course, came February and March of 2020, when stocks lost a third of their value in six weeks, and oil futures went negative (minus-$37 a barrel!) for the first time in history.

Stocks recovered quickly—shockingly so. Oil prices bounced back too, but not with as much conviction as stock prices – understandable given that Covid-19 had slowed the global economy to an unprecedented halt. But as stocks put their foot on the gas pedal starting in November, right around the election, oil prices started to accelerate as well.

Stock Market-Oil Prices Correlation Becoming More Defined?

This five-year chart, courtesy of MacroTrends, illuminates the increasingly close relationship between share prices and oil prices in recent years:

That begs the question: which is the chicken and which is the egg in this stock market-oil prices correlation? Do oil prices drag down the market when they fall and lift it up when they’re on the rise, or is it the other way around? The one-year gap between oil prices falling and stock prices falling from 2014-2016 seems to suggest that it’s the former.

But here’s the thing: the correlation is imperfect, and only proves out over time. Stocks seem to only truly be affected by oil prices – rising or falling – in extreme situations. When oil prices lost three-quarters of their value in the middle of the decade, stocks fell. When oil fell roughly 40% in three months at the end of 2018, stocks tumbled 20%. And everything plummeted during the Covid crash last year.

In the short term, stocks and oil operate independently of one another. Things like inflation, the unemployment rate and GDP growth have a far more immediate, tangible impact on markets. But the long-term relationship between oil prices and stock prices is clear, as the above charts show. When oil prices move strongly in one direction or another, as they are this year, share prices eventually tag along, just not as dramatically. Sure enough, as oil prices have spiked 43% in 2021, the S&P is up 12%.

So put aside your inflation and post-recovery slowdown fears for a minute and remember this: unless oil prices suddenly crash again, the stock market isn’t likely to go completely belly up either. Ten years of data show that.

[author_ad]