Worried about your stocks after today? Seven decades of stock market performance after presidential elections say you shouldn’t be.

Mercifully, Election Day is here. I hope this is the last time I ever have to write about the 2020 presidential election, and what the result might mean for stocks. If it’s not, these next few weeks/months could be quite bumpy for investors. Wall Street wants a result. It doesn’t care who wins—just so long as there’s a definitive victor so we can all move on with our lives. Decades of stock market performance following an election bear that out.

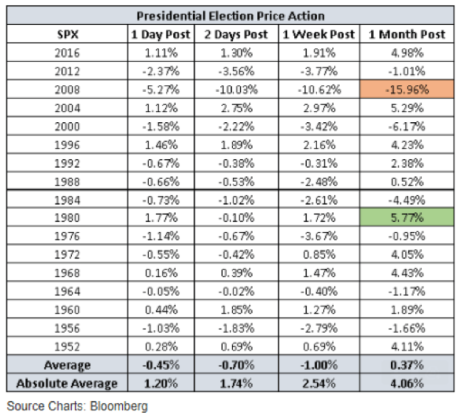

The following graphic, courtesy of Bloomberg and first pointed out by our own Jacob Mintz to his Cabot Options Trader subscribers on Monday, shows how the S&P 500 has behaved in the days, week and month that follow presidential elections, dating all the way back to 1952:

All told, the average movement in the benchmark index is a paltry 0.37% the month after an election. Of the 17 presidential elections in that time period, only four of them prompted a move in the S&P 500 of more than 5% – in either direction – in the ensuing month. Two of those barely passed the 5% threshold – 1980 after Ronald Reagan first won office (+5.77%), and 2004, after George W. Bush won a second term (+5.29%).

[text_ad use_post='129622']

The other two occasions were historical outliers.

In 2008, President Barack Obama was elected in the midst of the worst economic recession since the Great Depression. From October 2007 to March 2009, large-cap stocks plummeted more than 56% while U.S. unemployment rose into double digits. Obama’s election did little to stop the bleeding, hence the nearly 16% nosedive you see in the month that followed it.

Then there was the 2000 election. The race between George W. Bush and Al Gore was infamously too close to call, and wasn’t settled for another three weeks, when following a recount Florida finally declared Bush its winner—by 537 total votes!—securing him the 25 Electoral College votes necessary to finally declare victory. During those three weeks, the market was held hostage by the uncertain outcome, and stocks fell more than 6%.

This year is even more unique. We already have a 100-year global pandemic that seems to be worsening by the day, and an economy that’s improving but with an unemployment rate (7.9%) still more than twice what it was at the beginning of the year. Now comes an election that the incumbent has openly threatened to contest even before knowing the results, and which is naturally complicated by record numbers of mail-in ballots, many of which won’t be counted until after Election Day.

Thus, the possibility of another “hanging chad”-type cliffhanger is fairly high.

What Wall Street wants is a swift resolution. If either Joe Biden or Donald Trump is (accurately) declared winner tonight, tomorrow, or at least by the end of the week, then you can expect stock market performance to follow its historical pattern in the coming month. In other words, it will likely be up or down 5% or less.

However, if this thing drags on for another few weeks, expect bedlam, with the possibility of 2000 or even 2008-type losses becoming higher with every day of uncertainty that passes. Wall Street hates uncertainty; it always wants clarity.

For your portfolio’s sake, that’s what you should root for today. Who you voted for is your business, and not relevant to investing.

But your hard-earned money needs a clear winner, as quickly as possible.

Let’s hope we get it.

[author_ad]