There are a million different factors that investors can examine in order to get an edge, including all the macro fundamentals, company-specific data and chart/technical analysis. Really, though, at the end of the day, the stock market and individual stocks can only do three things: go up, go down, or chop sideways—and it all comes down to spotting a change in character as stocks transition from one phase to another.

The good news is that, right now, I’m growing increasingly convinced that the market in general, and leading stocks in particular, have changed character for the better—likely indicating that a sustained uptrend has finally gotten underway. Let’s dig into why.

[text_ad]

Offense vs. Defense

One thing I like to follow is the relative performance of the Nasdaq—which is driven by growth-oriented chip stocks, technology stocks, internet and biotech stocks—and the consumer staples sector, which offers stodgy, dividend-paying defensive names. Obviously, when the Nasdaq is outperforming, it’s more of a “risk-on” environment and usually is conducive to making some solid money.

Shown here is a chart of the Nasdaq/consumer staples relative performance, along with 10-week and 40-week moving averages. When the ratio is above the lower of those two moving averages, and that lower moving average is advancing, then growth-centric stuff is outperforming. If not, money is flowing more toward defensive titles.

You can see here that the ratio kited higher for all of 2017 and most of 2018 before breaking down in mid-October, which was a great “sell” signal. The next green light came in early January, followed by a downturn in early May. And the Nasdaq continued to underperform in the months that followed.

But now the indicator has turned positive again, with the ratio above its lower (10-week) moving average, and that average has turned up. Just like any other indicator, there’s nothing magic about this one, but it is a sign that big investors are switching to offense.

Staying “Overbought”

From the start of May through mid-October, the major indexes were generally stuck in a wide trading range—every time they rose for a few weeks and optimism rose, they started to pull back. And every time they were in the dumps for a few weeks and pessimism rose, they rallied. Rinse and repeat.

But that action is typical of choppy markets. By contrast, a hallmark of strong environments is that the market (and individual stocks—see below) get “overbought” and stay that way for weeks. So far, that’s what we’re seeing.

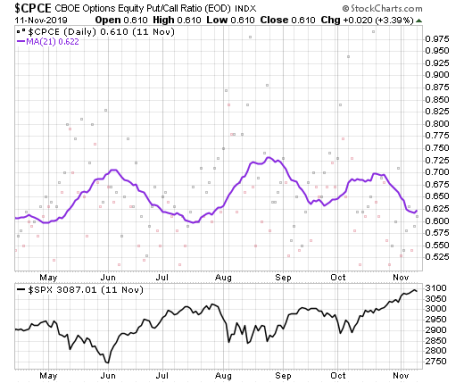

Take a look at the daily chart of the S&P 500, with the 10-day moving average of the equity put-call ratio below it. In May, July and September, low put-call readings (meaning people were optimistically betting on further upside) led to sharp market pullbacks. But this time around, the ratio got “low” by Halloween—yet the market has continued to push higher!

Obviously, at some point, the market is going to retreat, and if that retreat turns ugly in a hurry, I’ll change my thinking. But right now, the ability of the market to ignore this and other overbought-type readings is a good sign that something bigger may be afoot.

Stock Market Leaders Leading

During the past few months, I’d bet nearly everyone here experienced the following situation a couple of times: You found a company you really liked, monitored the stock, and when it showed signs of strength (possibly on earnings), you jumped in. Shares did OK for a week or two but then they began to fall—slowly at first, but continuing along, until they tripped your stop a few weeks later.

This sort of action—strength is repeatedly being sold into—is another characteristic of choppy-to-weak markets. But now we’re seeing the opposite, with (a) big, powerful breakouts or big-volume lifts, and (b) follow-on gains in the days to come with little giveback.

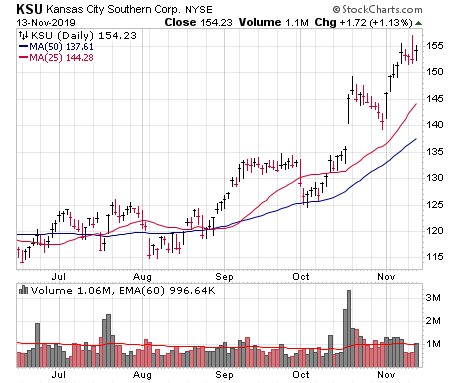

There are tons of names following this script. In the cyclical realm, look at Kansas City Southern (KSU), which gapped to new highs on earnings in mid-October, pulled back reasonably for a week and a half and then zoomed to higher highs on five straight days of big volume.

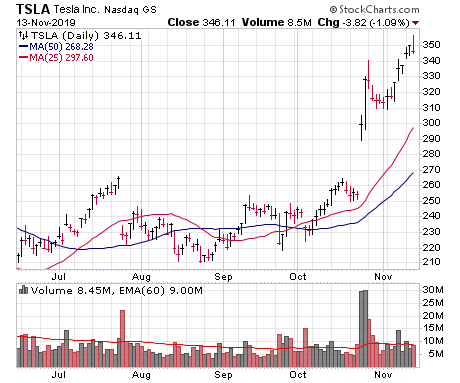

For a turnaround, look at Tesla (TSLA), which etched a decent base from late July through mid-October, then soared two straight days after earnings on massive volume. It could have easily given back 40 or 50 points, but instead it calmly caught its breath and has since marched to new recovery highs on excellent trading volume.

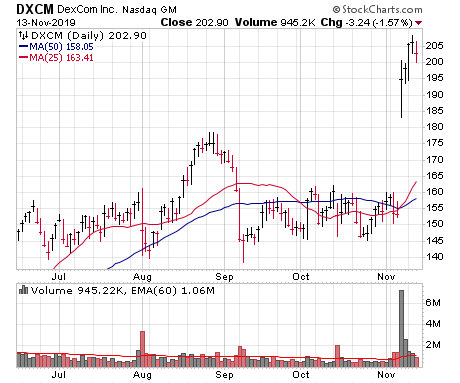

And, in the strong medical sector, there’s Dexcom (DXCM), which spent 14 nauseating months chopping up and down before catapulting to new highs on earnings last week—only to zoom up another 10 points since then.

I’m not trying to say there aren’t any flies in the ointment out there, or that the evidence can’t get iffy going forward. That’s one reason why I’m stepping (not leaping) back into the market during the past couple of weeks—picking your stocks and spots remains important.

But the bigger point is that , for the first time in at least a few months, the character of the market has changed—for the better. The longer it continues, the better the odds we’ve entered an advance.

[author_ad]