The U.S. unemployment rate has dropped to a 10-year low, and the stock market is at all-time highs. Coincidence? Perhaps. But there’s a long history of stock market results and the unemployment rate being intertwined.

The last time the official unemployment number was this low (4.5%) was May 2007. The following month, i.e., after the jobs numbers were reported, the S&P 500 hit new all-time highs above 1,500. Now that the rates have finally dipped back to 4.5%—having risen as high as 10% in October 2009—the S&P 500 is knocking on the door of a new all-time peak

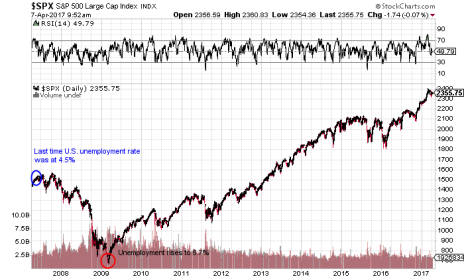

This 10-year chart perhaps paints a clearer picture:

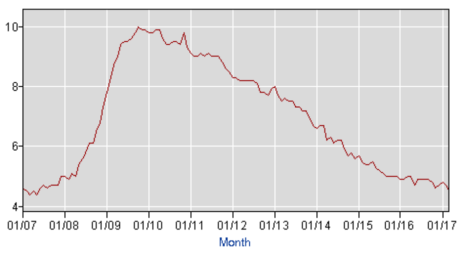

Now look at this 10-year chart of the U.S. unemployment rate, courtesy of the Bureau of Labor Statistics’ website:

Those charts aren’t an exact inverse of each other, but they’re close. Stocks started to fall in late 2007, just as the unemployment rate started to creep higher. Market losses accelerated in 2008 and early 2009 as the rate of jobless Americans doubled, though the market rebounded about six months before the jobs numbers started to improve. From 2012 through 2015, unemployment fell from 8.5% to an even 5%. During that time, the S&P 500 raced from the 1,250s to higher than 2,000.

Stock market results aren’t predicated solely, or even primarily, on the jobs numbers. But the unemployment rate is a byproduct of things like GDP growth, corporate earnings growth, retail sales, housing starts, consumer confidence, investor sentiment, etc.—and literally all of those things are trending in the right direction these days.

Which brings me to the Fed. The solid jobs numbers are thought to make another Fed rate hike in the next few months likely (Bloomberg currently puts the odds of another interest rate hike between now and June at 66.5%), and that has some investors nervous. But as we’ve written repeatedly in this space, it shouldn’t.

As our Mike Cintolo wrote in December, rising interest rates are not a bad thing for stock market results, at least in the long term. And the two rate hikes in the last four months have done almost no damage in the short term. Perhaps investors are finally seeing the bigger picture more quickly when it comes to interest rates—that the Federal Reserve only hikes the rates when it thinks the economy is improving. And as the two 10-year charts above tell us, an improving economy makes for improving stock market results.

That sounds simple and obvious. But some investors lose sight of that, and instead panic when interest rates increase. Over the long haul, however, rising interest rates are a good thing—a reward for a falling unemployment rate, improving GDP numbers and escalating retail sales.

Remember that when the Fed raises the rates again in the next two months.