My Thoughts on the Encouraging Market Rebound, Tesla on Fire, Semiconductor Stocks as an Important ‘Tell’ and Other Items.

To say it’s been an interesting couple of weeks would be a big understatement, with a very sharp six-day pullback in the broad market last week due to fears surrounding the coronavirus (and its effect on economic growth)—even the S&P 500 fell nearly 4% from high to low, while indexes like the S&P 600 SmallCap (off more than 5%) fell even more sharply.

And then this week, the bulls have pounced! The major indexes have snapped back nicely, with a bunch of stocks powering ahead, too, as last week’s fears dissipated to some extent. While I’m not ready to say the market is ready to just go up, up and away, the snapback is certainly an encouraging sign.

While I’m not going to give away all my thoughts and top stock picks, I do want to relay a few big-picture stock market thoughts I have:

[text_ad use_post='129627']

5 Stock Market Thoughts

1. First off, just to state the obvious: While I can’t say the market is going to be up, up and away from here (in fact I would guess the odds are against that), at the very least the fact that the major indexes so quickly recouped large chunks of relatively sharp losses is a good thing—in effect confirming my view that it’s still an overall bull market and the news-driven decline wasn’t likely to morph into a major decline. It’s obviously better than the alternative of the market not getting off its knees after last week’s selling.

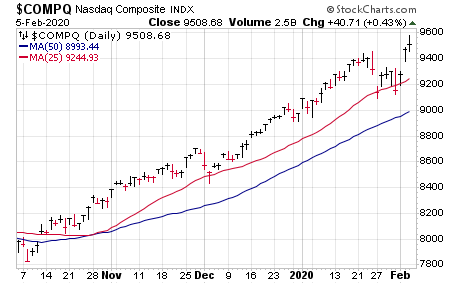

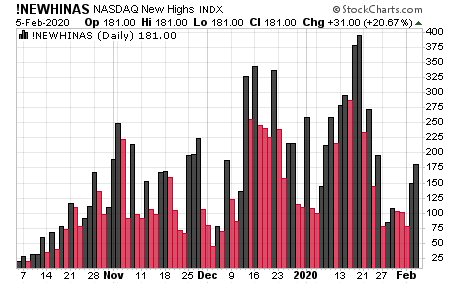

2. That said, the rebound has brought along far fewer stocks than the prior advance. Below is a chart of the Nasdaq Composite (already back to new high ground!) and another of the number of stocks hitting new highs on that exchange—you can see a couple of weeks ago there were ~350 names reaching virgin turf, but recently, it’s more like 150.

That kind of divergence has led to some intermediate-term tops over time (including the year 2000 top!), but I wouldn’t read much into that—I would simply say that, until proven otherwise, the advance is more selective, which usually means more stocks will be subject to potholes, volatility and the like.

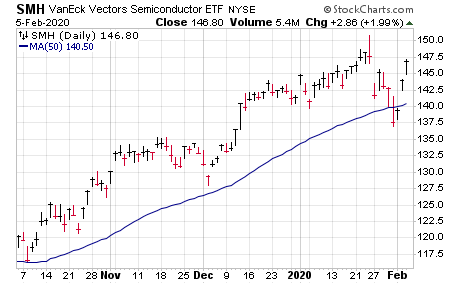

3. I also continue to think the “sector on the margin” is semiconductor stocks—meaning that group’s moves should provide clues to the health of the market in the near-term. Their exposure to both many leading growth trends and the coronavirus (both supply and demand exposure in China) makes them a good “tell.”

You can see that the Semiconductor ETF (SMH) got hit much harder than the big-cap indexes, dipping below its 50-day line last Friday. Now it’s bounced nicely, albeit still shy of its prior peak. From here, keep an eye on whether SMH lags any further rallies in the market (or even breaks back below its 50-day line), or conversely, if it helps lead the way higher. It should be telling.

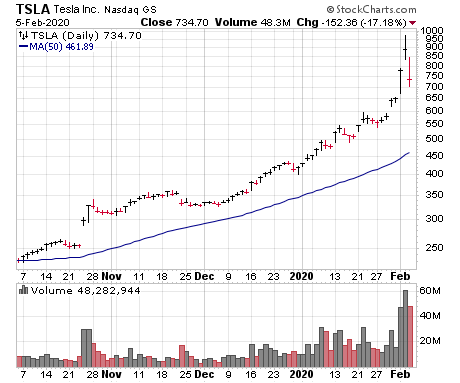

4. I can’t write about my stock market thoughts these days and not mention the moonshot that is Tesla (TSLA). I’ve gotten many questions from people who own it and those who want to. Here are a few of my thoughts:

4a. While I doubt Tesla stock implodes 50% or anything like that (see more below), it’s looking like the two giant back-to-back gap-ups this week in the stock (highlighted by a long-term $7,000 price target!!!) may be a short/intermediate-term top in the stock. Of course, maybe I’m wrong (timing these things is an odds thing), but personally, I’d be sure to ring the register with at least some of my shares.

4b. If you don’t own some, I’d tend to let TSLA consolidate for a while, assuming you’re more of an intermediate- to longer-term player like myself. (If you’re a short-term trader, have at it!) My guess is TSLA stock will need a few weeks at least to come out of the public eye and set up.

4c. Lastly, while I never make market-wide proclamations based on one stock, the fact that TSLA has been one of, if not the, leading growth stock, and the fact that it may have topped for a bit, could be something that affects the market as a whole.

5. Lastly, with the market off its knees, you want to keep your eyes on stocks and sectors that held up well during the virus selling and quickly rebounded to new highs—and, importantly, didn’t give up that rebound quickly (like, say, many cloud software stocks did). That doesn’t mean you shouldn’t wait to buy on dips (or, preferably, tightness), but these are names that look like they want to go higher if the market cooperates and should, at the very least, be flagged.

1 Growth Stock to Consider

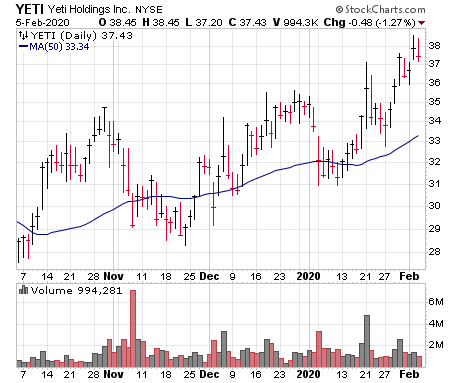

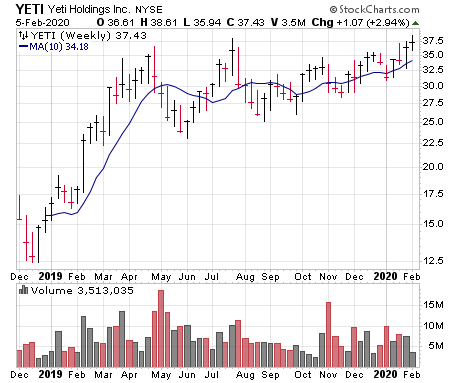

One example is Yeti (YETI), the higher-end maker of mugs, drinkware and coolers that are becoming more and more popular despite some rip-off brands. (And for good reason—in my experience they work much better.) The stock hasn’t been a leader of the advance, but that’s OK; sometimes, after the first “real” consolidation, some new leaders emerge, especially during earnings season.

That’s a possibility with YETI as we head into its quarterly report on February 13. Longer-term, I like the stock’s nine-month consolidation that’s featured higher lows in recent months, while short-term, I like the volume clues seen in January and the fact that the stock is toying with all-time highs despite the market’s recent action.

A dip is certainly possible, but any decisive upmove on earnings would be tempting.

[author_ad]