I want to tell you about some of the stock market trends I’m seeing today. But I have to admit, my mind is elsewhere right now…

By the time you read this, I’ll be on my annual long weekend getaway with my best buddies up in Lake Winnipesaukee, which is basically New England’s Great Lake. I’ve written about the trip before in this space (even including a few cigar-laden pictures from years past). We’ve been doing this getaway weekend for about 20 years now, and this looks to be another great year with about a dozen of my high school friends likely to make it up for at least part of the weekend.

So when I tried to think of a topic for my Wall Street’s Best Daily write-up this week, my mind kept wandering to boat rides and BBQ, cocktails and catching up. It’s always been a great time to recharge the batteries, so to speak.

[text_ad]

That said, I still have a lot on my mind market-wise, so instead of a prolonged story, I’m just going to run through a few stock market trends that have popped up in my research over the past few days.

11 Stock Market Trends

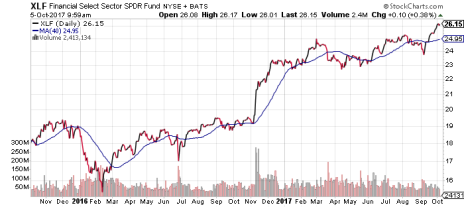

1. While it’s hard for me to really get excited about turnaround stocks and sectors, I am very intrigued and increasingly bullish on the financial stocks. As I’ve mentioned many times in my Cabot Weekly Review videos, the group’s U.S. post-election surge last year broke it free from a two-year consolidation, so it appears relatively “early stage” to me. And the sector basically consolidated for another six months this year, which ended with a high-profile shakeout to its 40-week line on fears of Hurricane Irma (see chart below). Since then, the action has been like smoke up a chimney. Whether it’s big banks or some Bull Market stocks—like E*Trade (ETFC), which I wrote about two weeks ago—I think there will be some money to be made here.

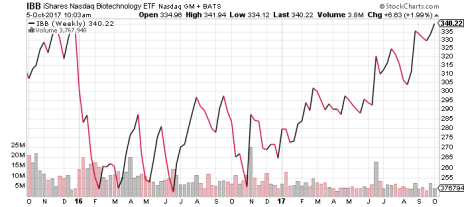

2. Similarly, I think the chart of the biotech sector indicates that most weak hands there have been kicked out. The group had a 40% decline in 2015 and early 2016, then spent about 17 months bottoming out. The huge-volume advance in June looked to be the kickoff, but as so often happens, the market had one final shakeout in August before getting going. It’s not easy to identify the clear liquid leader or two or the group quite yet, but on the whole, the action looks great.

3. I continue to see signs that investor sentiment (at least on an intermediate- to longer-term basis) is lukewarm at best, despite the new highs in the major indexes. Example 1: I just read an article online that said funds and ETFs that invest in bonds (thus safety) have just notched their first year of at least $100 billion inflows. And it’s only October! It’s hard to say the average Joe is exuberant about equities when most people are consistently putting tons of money to work in fixed income.

4. Another sign that sentiment is tame is the consensus in the wake of last week’s tax cut/tax reform rollout that the economy can never grow faster than 2%, which is about what it has grown since the 2000 internet bubble peak. I’m not touching politics with a 10-foot pole, but my point is that this type of thinking—that the economy is forever doomed to below-trend growth because of X, Y and Z—is pretty typical of “early stage” sentiment, which occurs near the start (or middle innings) of a long-term advance. Conversely, after a few good years, you’ll hear people saying that recessions are a thing of the past!

5. I remain impressed with the number of multi-year breakouts we’re seeing among individual stocks, many from vastly different sectors. This week’s example came from Cabot Top Ten Trader, where I saw a biotech stock like AbbVie (ABBV) and a giant refiner like Valero (VLO) both emerge from huge consolidations. Not that I’m harping on these two particular stocks, but the continued stream of long-term breakouts probably bodes well for the market.

6. Speaking of stock market trends, here’s a great statistic I picked up from Ryan Detrick of LPL Financial: This year was just the seventh time the S&P 500 rose each month from April through September. Of the prior six times, all finished higher in the fourth quarter (October-December), with the S&P 500 averaging a near-10% gain.

7. Moving away from the general market, a couple of points. First, it’s usually best to try to own the one (maybe two) best stocks in a group. Of course, “group” can be loosely defined, but my point is that you don’t need to own, say, four chip equipment stocks (a very strong sector at the moment). If you’re deciding between two stocks, try to go with the stronger one, assuming both are relatively well-traded.

8. Second, given that earnings season is right around the corner, I want to relay something I mentioned at the Cabot Wealth Summit a couple of weeks ago: If you have a hard time holding a stock through earnings, consider using a “profit test” with your position heading into a report. In other words, if you’re up, say, at least 5% (you can use a higher or lower figure), you hold your entire position. If you’re not, you sell a little. And if you have a loss of at least a few percent, you might sell half. The exact percentages and rules are up to you, but the point is that you can use the market as a feedback mechanism to determine whether to hold or trim your position into earnings.

9. Third, don’t forget to book partial profits from time to time. Even in a strong year like 2017, I regularly hear from subscribers who buy a stock, make some money, but then bail out when the stock sells off for two or three weeks, when in reality, the stock hadn’t done anything wrong. Oftentimes, taking a few chips off the table on the way up gives you more staying power during the inevitable correction/consolidation that most stocks go through, allowing you to potentially play out a larger move.

10. For all of the positive stock market trends mentioned above, I’m not 100% bulled up right now. Short-term (meaning, over the next couple of weeks), there are some signs of complacency and it still wouldn’t surprise me if we get a near-term pullback ahead of (or during) earnings season. I’m also still seeing lots of rotation on a day-to-day or week-to-week basis, which makes things a bit less sturdy than they would otherwise be. Lastly, let’s not forget that the Nasdaq itself isn’t much above its early-June peak—that’s not bearish, per se, but it’s not like we’re powering ahead right now.

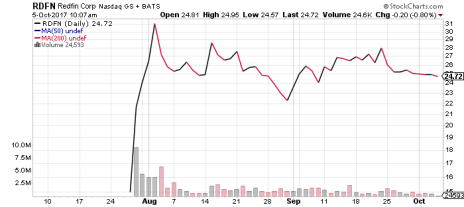

11. Last but not least, my thought going forward is this: Assuming the overall advance continues as the odds favor, I’ll be looking for some new leadership to emerge during earnings season. Some of that is likely to come from newly-strong areas like financials and biotechs (as well as retail), but some might also come from recent IPOs. One name to keep an eye on is Redfin (RDFN), a growing player in the online real estate industry. It was most recently mentioned in Cabot Growth Investor.

While its competitors focus on advertising, Redfin is a full-on brokerage, and it’s attempting to undercut the big players by taking a smaller cut of every real estate transaction. Revenues grew 35% in the second quarter, and though the firm is unprofitable, the potential is gigantic (it has 0.64% of its target market) as a small hike in market share can lead to huge sales gains. (Encouragingly, visits to its site and apps grew 43% in Q2.)

RDFN came public in July, soared for a few days, and has since been working on an IPO base. I need to do some more research on the company and its prospects but I’m intrigued. It’s worth watching to see if it can get going as the bull market progresses!

For additional updates on RDFN, consider joining Cabot Growth Investor. For more details, click here.

[author_ad]