Who will win the presidential election? History says the next seven weeks of stock market performance should reveal the answer.

“May you live in interesting times.”

That quote is known as the “Chinese curse.” It’s been often quoted for so long because it’s ironic. Interesting is normally a good thing. But in terms of world events, it’s not cool. World wars are interesting. Natural disasters are interesting. We’re much better off with tranquil and boring.

But this has been an interesting year nonetheless. Everything was rolling along just fine until one of the Four Horsemen of the Apocalypse showed up. The country and the world have been grappling with pestilence in the form of a pandemic that has shut people in their homes and crashed the economy. No one alive has experienced anything like this before.

That alone makes 2020 a year for the ages. But the “interestingness” may not be through with us yet. There is a presidential election coming up in November that may be different than ever before.

The two political parties have never been so far apart, and the vitriol has never been greater, at least in recent history. And the race could be close. At the same time, the integrity of the election and results could be thrown into question by largely untested mail-in voting.

[text_ad]

If there is any question regarding who won, the parties are unlikely to handle it well. A contested election could get rather ugly. The market could get roiled for weeks or even months after Election Day while things get “sorted out.” And Wall Street may already be anticipating this risk.

Presidential Election Years Good for Stocks

But predicting the future is a dicey business. You never know. This year is a testament to that fact. It’s also true that the market has a long history with presidential elections. After all, they happen every four years. And that history is remarkably positive.

In fact, the stock market has fared very well in presidential election years. According to a 2019 study by Dimensional Funds, in the 23 elections since 1928, the market was positive in 19 of those years and only recorded a decline four times (1932, 1940, 2000, and 2008).

But there were very powerful reasons besides the election that the market went down in those years. In 2000, there was the bursting of the tech bubble. The financial crisis began right before the 2008 election. And the first two had to do with the Great Depression and the Second World War.

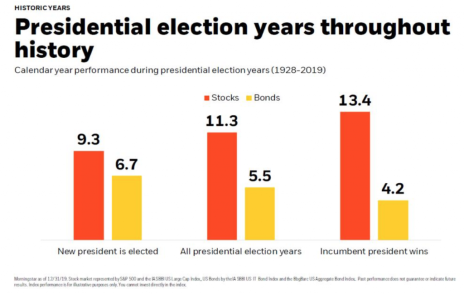

Taking a look at the above chart (courtesy of Morningstar), you can see that election years have been quite positive for stocks. Since 1928, the average return in presidential election years is 11.3%, better than the S&P 500 average annual return over the same period. But there are some things worth noting.

The market typically does better when an incumbent is reelected (13.4%) versus a new president (9.3%). Of course, there is a major common sense reason for that. The economy affects the election, not vice versa. When the economy and market are doing well, a president is more likely to be reelected.

As well, the last two years of a presidential term have better market performance than the first two. A rationale for this is that the first two years there is more uncertainty as the president focuses on new agenda items. The second two years typically carry more of a focus on reelection and the economy.

The Number to Watch

The market has also been a very surprisingly accurate predictor of who wins the election. The performance of the S&P 500 in the three months leading up to Election Day has correctly predicted 87% of elections since 1928, and 100% of elections since 1984. On years when the three-month returns are positive, the incumbent party wins. On years when the index is down, it loses.

By that gage, the key level is 3,295, the closing value of the S&P 500 on August 3—three months before Election Day. Right now, the market is very near that level (about 1.5% above) with about eight weeks to go before the election. It could go either way.

That gives you some historical perspective. The main thing is that, historically, the economy determines the course of the market, not the election. Stock market performance is more reliant on the economic cycle and the bull/bear cycle. As long as the economy is positive, which it usually is, markets tend to be just fine with whoever wins the election, at least in the beginning.

Of course, the past can’t predict the future. And there are some powerful reasons why things could be uglier this time. But the economy is growing rapidly and will likely continue to do so regardless of who wins the election. We are likely in the early days of a new bull market. Those things should ultimately prevail regardless of what happens in November.

Even if the election is contested and the market heads south, the volatility should be relatively short lived and the market will recover. Look what it did after the Covid-19 selloff in March.

[author_ad]