The month of July was the best month for stocks since 2020, as the S&P 500 gained 9.1%, the Nasdaq rose 12.4%, and the Dow added 6.7%. And what made this impressive stock rally even more impressive was that the news in July seemingly couldn’t be worse. So where do we go from here?

Let me start here … as I always tell subscribers to Cabot Options Trader/Cabot Options Trader Pro/Jacob’s Private Circle, my crystal ball is currently in the shop, but I hope to have it repaired sometime in the not-so-distant future. However, until it is repaired, we will have to take the cues from the market, and stocks. And the past month’s market strength, in the face of bad news, is very encouraging.

For example …

Despite the bad news, the Chicago Board of Options Exchange Volatility Index (VIX), which is often times referred to as the “fear index,” has been steadily declining for the past two months. What this means is traders are less fearful of a big market decline. This is a great sign for the market bulls and the future of this stock rally.

[text_ad]

Second, I track the daily option activity by the largest hedge funds and institutions in the world, and my scanning tool has not picked up on large-scale put buying activity since early in June. This is another positive sign.

And finally, despite the overwhelmingly bad news recently, the market has held its June lows, and then more recently, soared higher. Here are some of the random items that would have sunk stocks earlier this year, but in the month of July, were met with buying:

Microsoft (MSFT) gained 7% after the company “missed expectations.”

Walmart (WMT) warned about earnings, and in reaction the stock fell 7.5% the next day. However, by the end of the week, WMT stock had recovered nearly all of those losses.

Similarly, Best Buy (BBY) cut its forecast for the second quarter and fiscal year. In reaction to this news the analyst community quickly lowered their numbers for the company. Yet, how did the stock fare? After initially falling in early morning trade, BBY actually finished the day higher by 3.5%.

And we can see these somewhat counterintuitive stock reactions to bad news via a tweet and chart from @GinaMartinAdams on Twitter: “Stock price reactions to earnings misses in SPX are now the lightest in our records. Clearly sentiment got too bearish in front of this earnings season.” Focus on the red bar on the right side of the graph that represents this earnings season:

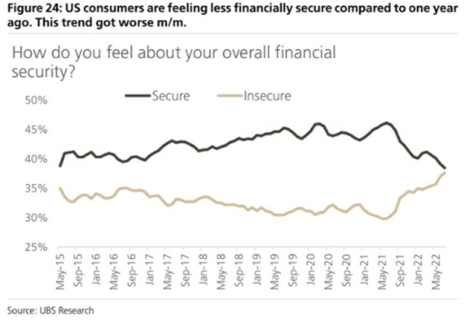

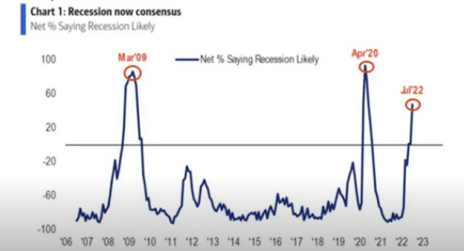

Next up, the two charts below pretty nicely sum up why so many investors, as well as money managers, are worried about the economy.

First, here is a chart from UBS showing that consumers are growing increasingly worried about their financial security:

Next, here is a Global Fund Manager Survey from Bank of America showing fund managers’ worries about a recession are at the highest levels they’ve been at since the start of Covid, and the housing meltdown before then:

Yet despite this negative sentiment, the market has been charging higher.

And in terms of sectors, it’s hard to get worse news than the housing sector, as just recently U.S. home builder sentiment plummeted in July to its lowest level since the beginning of Covid. It was the second-largest monthly drop since 1985! Not good!

With this in mind, of course housing stocks are crashing right? Nope! The Housing related ETFs (ITB, XHB) are trading at multi-month highs.

While there is no guarantee that the worst is behind the market, I’m fairly encouraged by the stock rally in July, and the reaction by stocks early in earnings season. Maybe, just maybe, the worst is behind this market.

While none of us can tell the future, do you thinks this is a bear trap or that the rally is for real?

[author_ad]