It’s been a month or so since my last Cabot Wealth Daily column, and obviously a lot has happened. So instead of presenting a lesson, I’m going to do one of my stream-of-consciousness issues—a few bullet points of what I’m seeing, what I’m keying off of going forward, some stocks I like and other things on my mind.

Let’s get started.

My Thoughts on the Stock Market

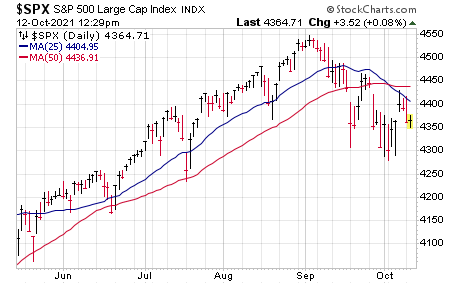

- First and foremost, I really liked the strong bounce last week in the major indexes and many leading growth stocks. But until proven otherwise, I think the correction that began in early September and has (so far) chopped 6% off the S&P 500 and 8% or so off the Nasdaq is still in effect. You can see here, very simply, the rally in the S&P stalled out short of the 50-day moving average, which is a key input into my intermediate-term (Cabot Tides) trend model (which remains negative).

[text_ad]

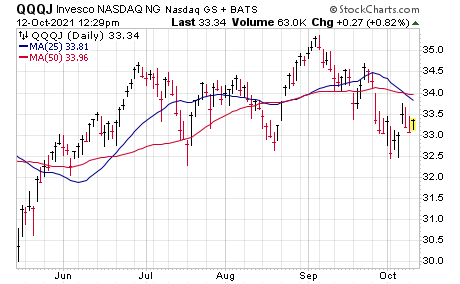

- Confirming this is the fact that much of the growth arena and the broad market are also in correction mode. For growth, look at the Nasdaq Next Generation 100 (QQQJ), basically a junior version of the Nasdaq 100 (and filled with many names we watch or own)—it fell 8% so far and remains stuck in the mud. As for the broad market, coming into Tuesday of this week, only half of NYSE stocks and one-third of Nasdaq stocks were above their 150-day moving average.

- Throw in the fact that this correction came after a long advance for the S&P and a ton of stocks, and I simply think the onus remains on the bulls to confirm a new uptrend—a strong move by the indexes above their 50-day lines and some breakouts among potential leading stocks (maybe on earnings later this month?) is what I’m looking for.

- That said, I do see positives. First, the bounce last week plays into my thought that this is a (well-deserved) correction after a big move—but within an overall bull market. The big-cap indexes are still well above their respective 35-week moving averages, which is part of my longer-term (Cabot Trend Lines) trend model.

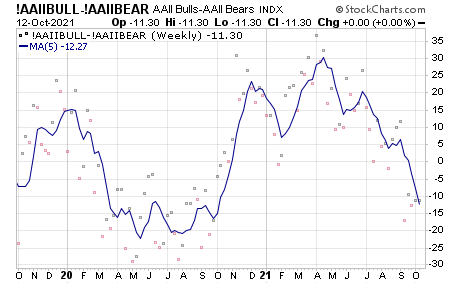

- Plus, whereas investors were as giddy as could be earlier this year (remember all the meme/Reddit stock moves in January and February?), I’m finally seeing some real worry seep in. The Investors Intelligence survey of advisors has just 40% bulls, the lowest level since April 2020, while the AAII survey’s five-week moving average (shown below) has sunk back to the depths of 2020 when everyone was in their pandemic bunkers.

- Long story short, I still think the near-term is a bit of a coin flip—I wouldn’t be surprised at all if the market has another leg down on some bad news (tapering, inflation, supply chain issues). But overall, I do think the odds favor this downturn leading to another solid leg up, likely led by growth stocks.

Individual Stocks I Like and Sectors to Watch

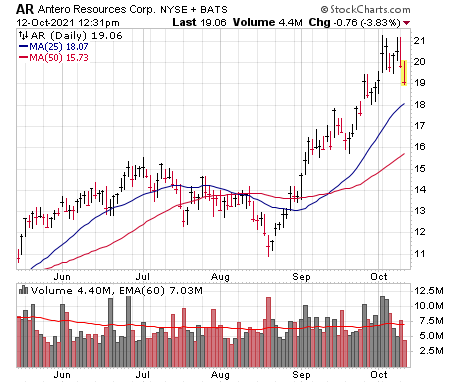

- It’s hard to trust commodity stocks, which can turn tail in a heartbeat based on prices, but I’m guardedly optimistic that the move in energy stocks can go on for a while—the sector has been the dog’s dinner for years, of course, and the leaders of the group just broke out of four-month zones a couple of weeks ago. Moreover, the best names in the group have shown outrageous buying volume as they lifted off, which is usually a good sign.

- To me, the two leaders are Devon Energy (DVN) and Continental Resources (CLR) in oil, with Range Resources (RRC) and Antero Resources (AR) the first to get going among natural gas plays. My guess is short-term shakeouts will come—but should be buyable.

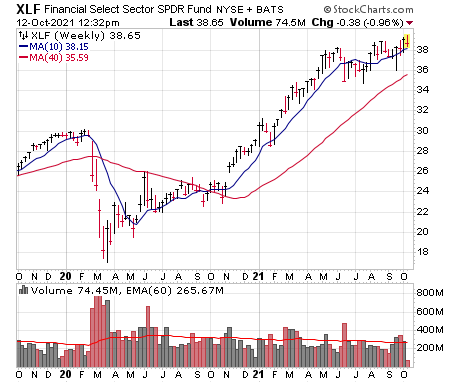

- Also, just chart-wise, I continue to monitor a bunch of stocks and indexes that (a) did nothing for two years, (b) had a huge post-November 2020 breakout and run into the spring of this year and (c) have basically moved sideways since. Small Caps (IWM) and Mid-Caps (MDY) are two broad examples, and for sectors, financials (XLF, shown below) also look the part. Any breakout on the upside by these in the next sustained rally should be fruitful.

- Finally, as for growth stocks, the good news is that I still see many names that lifted from multi-month bases in August, had good initial runs and are so far pulling back normally—if they’re pulling in at all.

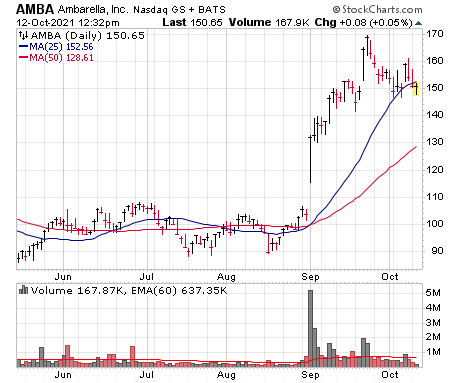

- Chip stocks look iffy, but Ambarella (AMBA) looks great—after a massive-volume breakout and follow through, it’s pulled back about 20 points, but looks healthy and is still hanging around its 25-day line. Earnings estimates are massive and the firm’s new computer vision chips are catching on quick with auto and security camera clients.

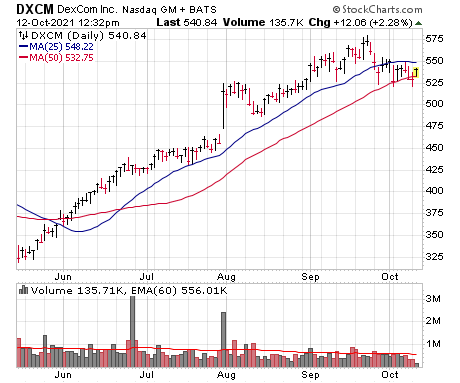

- Dexcom (DXCM) has a history of doing nothing for a year or so and then embarking on another run, and that run started in late July after earnings. It’s not your fastest horse, but the current three-week retrenchment to its 50-day line looks fine—another week or so of seasoning would be nice.

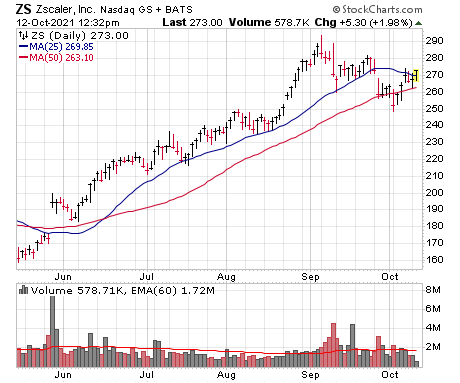

- Zscaler (ZS) did suffer a string of heavy-volume selling at its highs, and that might mean it needs more time to rest. But this six-week dip is orderly and the stock has generally found support near its 50-day line.

There are other names, of course, my favorites of which you’ll find in my Cabot Growth Investor and Cabot Top Ten Trader investment advisories– whether it’s in the next few days or another few weeks, there should be a bunch of newer merchandise that leads the next leg up.

What are your thoughts on the market today? What stocks do you like? Are you bullish or bearish?

[author_ad]