Last month, I wrote about two stock market numbers to keep an eye on: 2,786 and 2,581 in the S&P 500. The former is the benchmark U.S. index’s high water mark since the market correction began in earnest in early February; the latter number was the S&P’s low, reached in early April. While the market came perilously close to topping 2,786 last week, alas, it’s still stuck in that post-correction trading range.

Months-Long Trading Range Intact

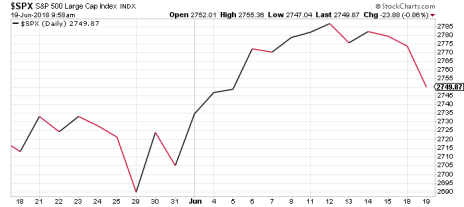

The S&P got oh-so-close to a fresh high last week, closing at 2,786.85 on June 12. Here’s what that close call looked like on a chart:

But for the third time in four months, it met resistance, and has since sunk back a bit on the latest escalation from President Trump in the tariff war with China. Stocks have made a ton of headway since bottoming at 2,581 on April 2, shooting up 6.5% even after this week’s mini-pullback. That said, the post-correction trading range remains intact, and the S&P is still 4.6% off its January highs. For the year, the index is up less than 3%.

[text_ad]

Given how far stocks have come since that early April bottom, it feels like a breakout has already occurred. In reality, however, things are no better now than they were three months ago—and worse than they were five months ago.

Growth stocks are behaving much better—the Nasdaq broke through to new highs at the beginning of the month, and is up 9% in 2018. But even the Nasdaq is showing signs of weakness, tumbling more than 100 points in the last three trading days. Whether it’s due to Trump vs. China or normal consolidation, the market waters are suddenly choppy again, as evidenced by Tuesday morning’s 15% spike in the VIX.

What to Do Now

What should you do about the reemerging volatility as an investor? For that, I’ll defer to Mike Cintolo, our resident growth investing expert and stock market historian. Here’s what Mike wrote to readers of his Cabot Top Ten Trader advisory earlier this week:

“We have a few main thoughts when it comes to the market. First, of course, the intermediate-term trend remains up, and most stocks are acting well, thus we continue to advise a bullish stance.

“Second, though, divergent action is still in evidence, with small caps and growth stocks racing up the charts, while many sectors and indexes (the NYSE Composite is down 1% this year!) are stuck in the mud.

“And third, we’ve seen a bit of froth emerge, with some IPOs and other growth names going vertical, whether it’s on news or not. Like we said, we remain bullish—it’s hard not to be when the leading indexes (Nasdaq, S&P 600 SmallCap) and stocks are acting well. That said, given some of the froth we see out there, be sure to keep your feet on the ground, looking for decent entry points and taking some partial profits on the way up.”

My two cents? Like I wrote last month, until the S&P 500 breaks out of its post-correction trading range, I’d at least keep some cash on the sidelines—or, your “feet on the ground,” as Mike puts it. If and when the index finally breaks above 2,786, the rest of the market could take off the way growth stocks have in recent weeks.

[author_ad]