Today, I’m going to tell you what I like and don’t like about this ongoing June market rally. But first, let me tell you a little story…

Back in 1999, there was a kid that was just getting out of college who wanted to come work at Cabot—I remember he was a pretty good writer for his age, and while he was a bit of a goofball and idealistic, he was very passionate about stocks and market timing.

In fact, he had been reading Cabot Growth Investor (then called Cabot Market Letter) for a few years, as his Dad subscribed to the newsletter on a whim back as the late-1990s bull market was just getting underway, so he was familiar with Cabot’s growth methodology. He even wrote his own little market report for a few dozen friends and family.

He emailed and otherwise hounded Tim Lutts, Cabot’s chief investment strategist, then and now, about stocks from college, and as luck would have it, just as he was graduating, Cabot was starting a new advisory (Internet Stock of the Week) to take advantage of the boom that was underway. He came in for an interview with a suit and tie and did well enough to land a job for the luxurious salary of $15 per hour and no health insurance.

[text_ad]

That kid was me, and I happily accepted the role. And this weekend will mark my 20th anniversary at Cabot—the only “real” job I’ve ever had.

To say that the past 20 years have been an adventure, both personally and professionally, would be an understatement—and that’s been a good thing. I always joke that I got a major, long-term bear market out of the way (2000-2013) early in my career, so the rest should be a cakewalk. But, while there have been challenges, and there surely will be more, I wouldn’t change a thing.

Anyway, this little tidbit isn’t meant to go too far down memory lane. You can read history books for that, and besides, this book is still being written. I simply wanted to say thanks to all of you out there who have been with me along the way—subscribers, supporters, even the occasional critic, you’ve all helped.

It’s been a fun journey to this point, and while no job is perfect (sorry, Tim!), I still get up every weekday excited to see what the market has in store. With that said, let’s get to the current environment.

June Market Rally: Real or Not?

After a very sharp five-week decline that took more than 7% off the S&P 500 and more than 10% off the Nasdaq, stocks have staged a nice rally during the past week and a half. The question on everyone’s mind is whether this June market rally is the real McCoy, or whether the worries of the past few weeks (trade war, economy) will lead to another leg lower.

Today, I’ll relay a couple of things I like about this rally attempt, two things I’m not a big fan of, and when it comes to individual stocks, one principle to keep in mind.

First, the positives.

June Market Rally: What I Like

Investor Sentiment Took a Big Hit in May

While everyone talks about the fundamental reasons for a market correction, I like to think of them in student-of-the-market terms: Corrections serve to dampen enthusiasm, punish late buyers and shake out the weak hands. That’s exactly what the sharp May decline did.

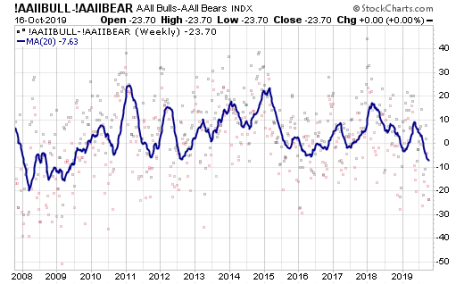

There are a bunch of examples, but here’s a good one: Shown below is a chart of the four-week moving average of the bull/bear spread in the AAII survey. (The weekly readings move around a lot, hence the use of a moving average.) You can see that, as of last week, the average had dipped to -14%—one of the lowest levels of the past few years! It’s a secondary indicator, but this survey has a nice history of moving to extremes near market bottoms, and is a good sign many threw in the towel after a month of bad headlines and pain.

Participation was Excellent on the Initial Rally

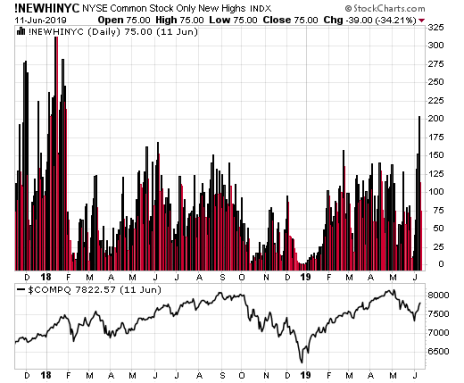

While the gains in leading growth stocks were excellent right off the bottom, one of the most impressive things I saw came from looking at some broad market measures. Shown below is an 18-month chart of the number of common stocks on the NYSE hitting new highs every day. Last Friday, that figure spiked to more than 200, the largest level since January 2018!

The Nasdaq wasn’t quite as impressive, but still saw its greatest number of new highs since last September, and the NYSE advance-decline line hit a new high this week. It’s a good sign that much of the market is ready to move higher if the sellers are truly out of ammo.

So it’s all good, right? Well, not quite. Two things that are far from ideal are:

June Market Rally: What I Don’t Like

Small Caps Remain in the Doghouse

The S&P 600 SmallCap Index actually peaked back in late February, etched a double top in early May and then went on the toboggan slide like everything else—from high to low, the index slid 10.6%. And while it has bounced back, it remains far weaker than the big-cap indexes—the S&P 600 recouped a max of 45% of its May correction, compared to 70% to 80% for the S&P 500 and Nasdaq.

Defensive Stocks are Leading the Way

Yes, some growth stocks have gone nuts, which is great to see. But it’s also true that a ton of money is pouring into defensive names—in fact, you can see in this chart of the Consumer Staples Fund (XLP) that it’s decisively moved out to new highs well ahead of the overall market! Yes, I know some of that is due to expectations of lower interest rates (and maybe a lower U.S. dollar), but to me, it is what it is.

So where does it all leave us? To me, I’m a fan of going slowly—I do think the pieces are in place for a resumption of the post-December uptrend, and the initial wave of buying is an encouraging sign that we have a bottom that we can work off of. But it’s also true that not everything is in gear, a lot of money is flowing into safe stocks, and small-cap stocks (which often lead the early part of rallies) are having trouble moving.

Overall, I’m still optimistic longer term, but like I said, I’m comfortable going slowly and waiting for the intermediate-term trend to turn up and for some of the wild action we’re seeing among individual stocks to subside.

It also means that, when buying, to keep your feet on the ground and look for advantageous entry points and “under control” action.

For instance, take a look at Beyond Meat (BYND), the white-hot recent IPO that went ballistic after earnings late last week.

Is it exciting? Sure! And I’ll have you know I actually grilled two of their burgers over the weekend for some research (ahem). They weren’t bad at all and were far, far tastier than any veggie or bean burger I’ve had.

But look at the stock. It’s all over the place! If you own some, maybe you book partial profits and try to hold the rest. But for new buyers, there’s no edge here in my view, at least not right now.

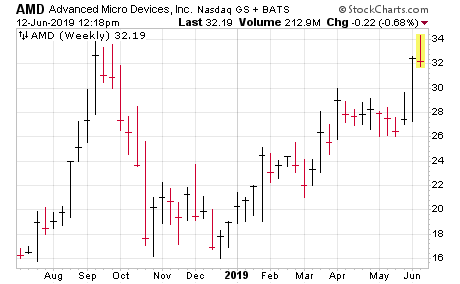

Instead, look for a stock that has some structure to it. Take Advanced Micro Devices (AMD)—it built a huge, deep base from September of last year through early April of this year. And then, despite a complete meltdown in chip stocks and the market correction, shares basically went sideways, effectively tightening up even as things were falling apart. Then, last week, the stock exploded to new highs on big volume as soon as the market perked up!

Obviously, if the market’s rally fails, all bets are off, and the weak chip sector is still a risk. But if you’re going to do some buying, picking up a few shares of one of the first growth stocks to hit new highs is a sound idea.

To get more information on additional stocks that are hitting new highs that are recommended in Cabot Growth Investor, click here.

[author_ad]