To help celebrate America’s independence, today I want to give you what I think are two of the top stocks to buy for a diversified portfolio. But first, let me tell you what I will not be doing this Fourth of July…

What The Fourth of July Means to Me

For more than 30 years, my July Fourth celebration included marching in the local parade while playing my clarinet in Wilson’s Band, a ragtag group of some 30 volunteer musicians of varying ages and skill levels. But two years ago, facing the sad truth that my skill level was declining toward an embarrassingly low level, I retired from the band.

No longer do I march around the neighborhood playing the same three songs.

[text_ad]

No longer do I drink a Budweiser at the halfway mark while the rest of the parade catches up to the band.

And no longer do I march alongside my high school girlfriend, who flies up from Texas for the weekend to see family and friends.

But I still celebrate the holiday, and I hope you do, too, because freedom is the bedrock of our country.

For starters, there are the five freedoms guaranteed by the First Amendment.

Our Five Freedoms

Freedom of Religion

Freedom of Speech

Freedom of the Press (that’s my business)

Freedom to Assemble Peaceably

Freedom to Petition the Government for Redress of Grievance

Subsequent Amendments guarantee us the right to bear arms, the right to not quarter soldiers, the right to equal justice, the right to own private property and more, but it’s that right to own private property that I want address today.

Your Right to Invest

The constitution does not specifically give us the right to invest. But it does give us the right to own private property, and it’s under that umbrella that investing activity (or inactivity) takes place.

Investing, of course, is the practice of buying something with the expectation that it will be worth more in the future.

Most Americans do it when they buy a house; history has taught us that houses generally appreciate over time (ignoring the costs of maintenance, which are generally more than offset by the benefit of having a place to live).

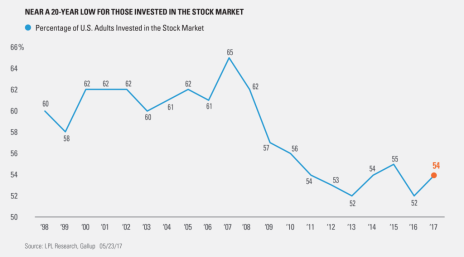

But many Americans never get to experience the thrill of investing in stocks. In fact, according to a Gallup poll done a year ago, just 54% of Americans said they had money invested in the stock market.

That’s down from 65% at the market’s 2007 pre-crash peak.

And why is this?

One factor is wealth inequality (as opposed to income inequality). With 85% of the country’s wealth in the hands of the top 20% of the population, the lower 80% have precious little to invest.

Another factor is wealth accessibility—if most of your equity is in your house, as is the case with many people, it’s hard to turn that into investible cash.

And another factor is that Americans are losing confidence in the future—and who can blame them? Between our deeply polarized government and the fissures opening across Europe, western civilization appears to be on the ropes.

But I’m not discouraged. I’ve always subscribed to the theory that it’s darkest just before the dawn, and that in the long run, the trend remains up for the stock market and for our standard of living.

So one of my goals at Cabot is to get people to see that there are oodles of opportunities for investment, if only they will open their eyes!

There are plenty of top stocks to buy right now. To me, the following two stand out—for very different reasons.

Top Stocks to Buy #1: Walt Disney (DIS)

On the conservative side, there are high-yielding blue chip stocks. A basket of five or more of these, acquired over time, can provide a solid core to any portfolio.

But if you’re wise, you’ll buy them when they’re low, and not when they’re high.

For example, right now, Roy Ward, Cabot’s value investing guru, is recommending Walt Disney (DIS), a stock that’s made no progress in two years, mainly because its cable network ESPN continues to lose viewers to streaming services.

But the company is doing great on the movie side (Star Wars VIII is coming soon) and its new Shanghai Disney Resort is starting to pay off, too. Plus, you get a 1.5% dividend. Roy says the stock is cheap here.

For more information on how you can get started with Roy’s Cabot Benjamin Graham Value Investor, click here.

Top Stocks to Buy #2: Autohome (ATHM)

On the aggressive side, there are a slew of opportunities in technology, from biotech to chips to internet security, all of which are booming today. But in my mind, the greatest opportunities lie in China, simply because of the country’s robust economic growth.

Combining the twin themes of technology and China, one stock that I like is Autohome (ATHM), the number-one source of online information about cars in China. It’s the first place Chinese consumers go when they want to research cars. And, of course, the revenues come from car dealers who advertise there.

Revenues at Autohome were $914 million in the past year and the company is growing fast, with revenues up 62% last year. Autohome was recommended by our China expert, Paul Goodwin, in early June, and readers’ profits are just beginning to grow. But it’s not too late for you to join them!

For more details on Paul’s Cabot Global Stocks Explorer, click here.

Investing is your right, and the more we exercise that right, the better!

Note: Four years ago, I concluded a similar column on Independence Day by recommending Tesla (TSLA), which was then a stock trading at the elevated level of 115.

Today it’s at 370.

So readers who bought then have done pretty well.

But I’m always looking forward, and there’s no reason the stocks I mentioned above can’t do as well in time.

[author_ad]