The U.S.-China Trade War has Reached Another Fever Pitch. How to Play It? We Asked Our Market Expert.

Well, we usually only do Q&A sessions with one of Cabot’s Chief Analysts on rare occasions, but given what’s transpired lately with the new trade war/currency controversy/interest-rate tensions, we’re tallying up another one this week with Mike Cintolo, head of our Cabot Growth Investor and Cabot Top Ten Trader advisories, as well as VP of Investments for Cabot as a whole.

Let’s get to it.

[text_ad use_post='129627']

What to Do Amid the Trade War and Market Selloff

Q: Hi Mike—We just did one of the Q&As in mid-May when the last trade war reverberations were knocking the market around. And your outlook was basically spot-on, thinking the major indexes were likely to fall mid- to upper-single digits before a new move up. But that was then and this is now—what do you think of August’s plunge so far?

A: Hi Chris. Well, the May downturn was a bit “easier” to talk about as the market’s first pullback after a persistent run almost always resolves to the upside. This one is more ominous in my view, mostly because (a) many leaders stalled out/lost momentum for a few weeks, (b) we’ve seen some decisive breakdowns after huge runs and (c) the ferocity of the decline off the top.

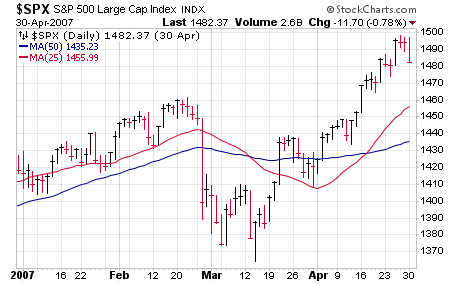

I see two scenarios from here. The first is that this is similar to a Brexit (summer 2016) or Shanghai Shakeout (February 2007—chart shown below) situation, where high-profile, obvious, much-ballyhooed bad news causes a quick mini-crash. But then the market bottoms out relatively quickly (two to six weeks) and gets going.

The other scenario is that this correction lasts longer—something where we see three legs down, taking two to four months, allowing many stocks to build new launching pads. I’m not predicting that necessarily, but it’s possible.

Q: Two follow-up questions to that. First, what about the chances of a late-2018 style collapse?

A: Well, I never say never—remember I’m a trend follower, so I try not to predict exactly what’s going to happen. But I would simply say the majority of longer-term evidence still says that, yes, this is a bull market. There are a couple of yellow flags (non-confirmation by small-cap indexes, etc.), but longer-term trends of the indexes, leading stocks (even the ones that have broken down look intermediate-term weak—but longer-term intact) and other secondary measures (tame sentiment, recent peaks in advance-decline lines) point toward higher prices down the road.

Q: OK, that sounds better. And then the second follow-up is, which of those two scenarios do you see as more likely?

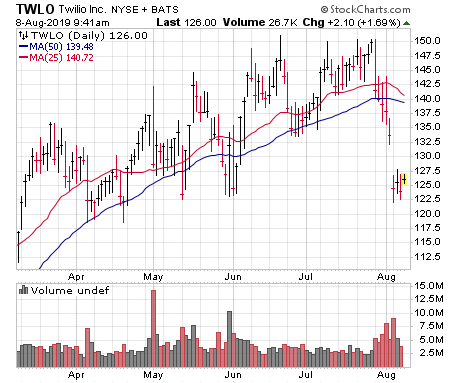

A: At this point I am favoring the one that says we’re going to need some time, but I don’t have a strong opinion on that, to be honest. On one hand, when I look at some of the leading stocks that had steady runs for the first few months of the year and just broke down (Twilio (TWLO) is a good example—see below), I think these stocks are going to need many weeks to consolidate and get going again.

However, even as the indexes have plunged in recent days, I have to say I am very impressed with the number of positive earnings gaps and overall resilience among “fresher” growth leaders. I wouldn’t expect to see that sort of action if the market was ready to tank for another few weeks.

Thus, really, I’m cautious here—we’re 30% cash in Cabot Growth Investor’s Model Portfolio (click here to subscribe) and have most stocks rated Hold. But I’m taking it day to day and keeping an open mind. That’s always good advice, anyway.

Q: Since you brought it up, what are some examples of those resilient and earnings-gapping growth stocks?

A: Oh heck, just since last Friday, I’ve seen Pinterest (PINS), Match Group (MTCH), Guardant Health (GH), Invitae (NVTA), Insulet (PODD) and others surge on their reports and, so far, hold their gains.

I’m seeing some fresher leaders like Anaplan (PLAN) basically hold their 50-day lines during this maelstrom.

And, impressively, I’ve even seen some stocks that have had huge, huge runs remain composed as well—Shopify (SHOP), Alteryx (AYX) and even Okta (OKTA) are examples.

To be clear, I’m not saying people should run out and buy these names. Good stocks can go bad in a hurry in a bad market, so as the downturn continues, many of these could give up the ghost. But to this point, there’s no question that it’s not all risk-off appetite, despite the headlines.

Q: That’s great stuff. So I know you’re mostly a student of the market, but I’m sure you’ll get asked this at next week’s Cabot Wealth Summit: What do you make of the trade war and the currency shenanigans?

A: Yeah, I try not to overanalyze that stuff. That doesn’t mean I think the news is worthless or that I’m downplaying the real-world effects. In fact, I told Tim Lutts the other day that, in 50 years, there will be books written about these days—for instance, on how trillions of dollars of debt had a negative interest rate. It’s crazy.

Honestly, my biggest thought on these topics isn’t fundamental, per se, but sentiment-wise: The news is very, very obvious at this point, with everyone aware that the U.S.-China trade war is getting more intense. The currency and interest rate stuff is also beginning to hit the mainstream as well. That doesn’t mean these factors can’t cause the market to go down for a while, but usually, trouble comes from where you least expect it—not what everyone’s been focusing on for a while.

Q: Makes sense. I know you’re busy prepping for the Summit so just two more and I’ll let you go. First, on the buy side, and I know you said you wouldn’t be doing too much buying here given the market environment, but how would you advise someone who does want to put some money to work here?

A: To be clear, I’m not hardcore against any buying at all. But the few things I’d make sure of, at least if you’re talking about growth stocks: First, make sure you’re focusing on a real leader with a good story, numbers and a relatively resilient chart. Now’s not the time to dabble in pipe dreams.

Second, I would tend to keep new positions small and use a loose stop or loss limit. If you normally buy $10,000 of a stock, keep it to $5,000 or $6,000 in this environment. And if you normally use a 10% loss limit (to pick a number out of thin air), make it more like 15% to 20% so you can withstand the increased volatility that we’re seeing.

And third, do some buying only if you already have built up some cash. In other words, if you’ve tossed out a bunch of stocks recently, sure, nibbling here or there is fine. But if you’re still basically fully invested, you should focus more on managing your portfolio. With the intermediate-term trend pointed down, we’re playing defense first here.

Q: Last one: I know this is subject to change, but what stock is at the top of your watch list right now?

A: We do have a “Top Stock Picks” panel at next week’s Summit, so I won’t give away my pick here. But one of the recent IPOs that I mentioned earlier looks great to me: Pinterest (PINS) has the feel of a new-age social media company with a lot of growth ahead of it. With Facebook (FB) already having had its major run, I like Pinterest, which I think of almost as a visual search platform, allowing users to get and share great ideas, whether it’s recipes, room layouts, clothes, tattoos (seriously), vacation resorts arts and crafts or more.

The firm ended June with 300 million active users, most of which are outside the U.S., though revenues from domestic and international sources are nearly equal. And revenues are growing fast, up 62% in Q2 (mostly advertising from companies that are trying to visually sell their goods). Earnings are in the red, though EBITDA (a measure of cash flow) should approach breakeven this year. Big picture, I see the company having a very unique offering.

And as for the stock—as opposed to some super-hot recent IPOs, PINS dipped and built a reasonable launching pad for a couple of months before bursting back toward its highs on earnings last week.

Again, it could easily pull in if the market remains weak, but the longer it can hold up relatively well, the greater the chance it’s ready for primetime when the next uptrend gets underway.

[author_ad]