The first four months of 2019 were about as smooth as can be, with stocks staging a stunning, persistent rebound following the wipeout late last year. But May has brought a change in character, with the trade war with China hitting another gear, causing a quick, sharp selloff in the major indexes and most stocks.

With all the uncertainties and questions, I thought now would be a good time for a simple Q&A with our market timing and growth stock expert Mike Cintolo, chief analyst of our Cabot Growth Investor and Cabot Top Ten Trader investment advisories, to get his views of the market, thoughts on what comes next and anything else that he’s keeping an eye on. Enjoy!

What to Do Amid the Trade War and Market Selloff

Q: Hi Mike. Interesting past week and a half, so let’s get right to it: What do you think of the market?

[text_ad]

A: Hey Chris, good to talk with you. I always go with the evidence, and right now my market timing indicators are telling me that we’re still in an overall bull phase that likely kicked off last December, but that the market has likely begun the first “real” correction of this bull move. Obviously, there are no sure things, but that’s what the odds strongly favor at this point.

Q: So, a couple of follow-ups on that. First, and I know you’re not big on price targets or predictions, but when you say “real correction” are you thinking anything size-wise? 10%? 15%? Back toward last year’s lows?

A: Again, there is no surety when it comes to these things, but I would say a drop that large would be historically rare. In new bull phases that have featured some blastoff indicators flashing green, the first market correction is usually contained to 4% to 7% on the S&P 500. But that comes with two caveats: first, these corrections tend to last a few weeks, not just days, and second, individual stocks can obviously fall a bunch more. We’ll see how it goes.

(Note: The blastoff indicators Mike’s referring to are the 2-to-1 and 90% indicators that flashed in January and February, respectively, both of which have a great track record of forecasting higher prices for nine to 12 months down the road.)

Q: The S&P 500 already fell 5% from its high—do you think that could be enough?

A: So, I’m open to anything, including the fact that this high-profile tariff battle could cause a short, sharp, scary shakeout, followed by an immediate snapback. But my guess, and it’s only a guess, is that after four months of advances without much in the way of any real decline, it likely will take more than just a few days for psychology to change and stocks to consolidate their gains.

Q: Before getting back to the market, since you mentioned tariffs, do you have any thoughts on the U.S.-China trade war?

A: No, not really. That’s not to say it’s not a real issue or that it can’t cause a steep correction. But, first, what happens is impossible to predict, and second, I’ve found that, over the years, it’s much better to focus not on the news but on the market’s reaction to the news. So that’s what I clue off of.

I know people are starting to write articles about how either the trade war isn’t that big of a deal, or conversely, that it could cause things to melt down. I’ll let others figure that out. My job isn’t to dive into the policy arena but to make and keep money in the market, and the best way to do that is simply to follow the evidence.

Q: That’s fair. As for the bigger picture, are you concerned at all that the major indexes stalled out at their prior October peaks? And what do you think of the “sell in May and go away” tactic—does the sharp selloff this month mean that adage is going to be true this year?

A: Well, I’m always worried about everything in a sense, so sure, the chart action alone hints at a “double top.” But that’s just one piece of evidence—our longer-term trend model, called Cabot Trend Lines, remains positive, the bullish track record of the blastoff indicators from earlier this year can’t be ignored and we really haven’t seen any classic signs of a stock market top—sentiment, while it grew complacent, never came close to being euphoric, and breadth in the market was solid right through April. Taken together, the odds favor the market being nicely higher when looking six to nine months ahead.

As for the calendar thing, I prefer to just use our indicators that measure what the market is doing in real time. Ancillary, simple things like the calendar have some truth over time, for sure, but I prefer to just go with what I see. Heck, November and December are usually very strong, but last year, the market tanked during those months. So I go with what I see.

Q: Looking ahead, assuming the odds play out, what will you be looking for to give you an “all clear” that the selling is over and the bull market is resuming?

A: Right now, I’m looking for the major indexes to rise decisively back above their 50-day lines; such a move in the days ahead would lend credence that this was one big shakeout. Going along with that would be some bullish action from leading growth stocks, with some new breakouts and others hitting new highs.

Q: Besides strength, is there anything else you’re keying off of?

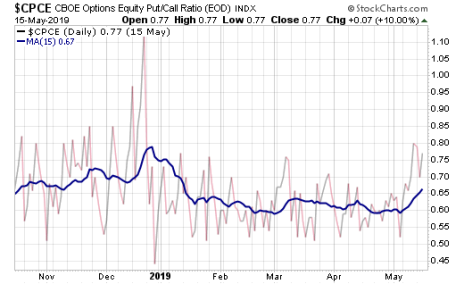

A: I wouldn’t say I would trade off this, but when things get hairy I do keep a closer eye on certain sentiment measures for signs that some investors are throwing in the towel. There are many of them out there but I like to keep an eye on the 15-day moving average of the equity put-call ratio. You can see that ratio has picked up a bit, which is good, but could easily have room to run before I’d think there’s some real worry.

Honestly, a few weeks of choppy action with the put-call ratio and other sentiment measures picking up could produce a real nice buying opportunity going forward. We’ll have to see.

Q: Okay, moving on to stocks, what advice are you giving subscribers? Specifically, how do you determine which stocks to hold, and which ones to sell?

A: My process usually involves looking at (a) my biggest positions, (b) my losers and (c) my laggards, which at this point I would define as any stock that didn’t make a decisive new high during March and April. If I’m going to cut, that’s where I’d do it—either trimming large positions (which are usually my bigger winners) or throwing up tight stops in names that are showing me a loss and/or have stalled out for a while.

Meanwhile, I tend to give my winners and better actors more rope, at least at this point in the market cycle. Given that I think it’s still a bull market, my thought is that some of the real leaders likely have much farther to run over time. Thus, I want to give them a chance to correct and consolidate, though I’ll occasionally take partial profits in these names in an attempt to have my cake (taking some profit) and eat it too (still have the chance for huge gains with my remaining shares).

Q: What about going more heavily in cash—waiting out the storm in a big cash position and then re-buying once things turn up?

A: If you’re a shorter-term investor or trader, sure, I could see moving more quickly to cash. But in my experience, for every time it pays to bail out of most things quickly, there are four or five times when bailing out wholesale bites you, as the market and many stocks snap back and you often chase your tail a bit.

Bigger picture, I like to look through two- or three-year weekly charts of past winners every now and then to remind me that the big money is usually made in the big swing—by owning a leader in a new bull phase and holding on to all or most of your shares for a sustained run. That’s another reason I try to hold onto most of my shares in my top performers if the evidence suggests a correction (not a punishing bear phase) is likely.

Q: What about buying?

A: I’m not opposed to some buying here or there, but I have been telling people to either keep positions small or be very selective and use tight stops. Unless you’re hugely in cash, I think now’s a time to watch and see how most stocks consolidate going forward. I prefer to look for stocks that have some structure to them on the chart, not just ones that are zigzagging up and down.

Q: Any names you’re stalking closely right now?

A: There are a few, sure. One I’ve mentioned before is Qualcomm (QCOM), which I think has morphed into a liquid leader in the wake of the Apple settlement, with big earnings estimates next year and the potential to be the “go-to” 5G stock for big institutions. While it’s pulled back recently, the dip has come on light trading volume and pales in comparison to the prior run. It’s in position to do well once the market comes out of its funk.

Another is Coupa Software (COUP), which looks like a leading cloud software stock and has a story that I really like—its platform is the best in business-spend management, which is about as pervasive as can be. The stock showed signs of being an early leader by hitting new highs in January, and after a flat consolidation, nosed out to new highs last month. And it’s held up well so far despite the market’s plunge.

The third is Shopify (SHOP), which I’m half-kicking myself for not buying weeks ago when I was looking at it. I think it’s a real leader of this advance, though I don’t see it near a good entry point. Still, I’m willing to wait for either a few weeks of consolidation and/or a pullback toward support.

Q: Thanks for this, Mike. I’ll let you get back to analyzing the Patriots’ 2019 depth chart work.

A: Good talking to you, Chris. Next time let’s do an interview when the market is skyrocketing and/or the Bills are in the playoffs ... though we should probably do another one within the next decade, right?

*Note: If you’d like more stock picks and market advice from Mike Cintolo, you can subscribe to Cabot Growth Investor by clicking here.

[author_ad]